Spread widening breaks longest ever run of UCITS cat bond fund gains

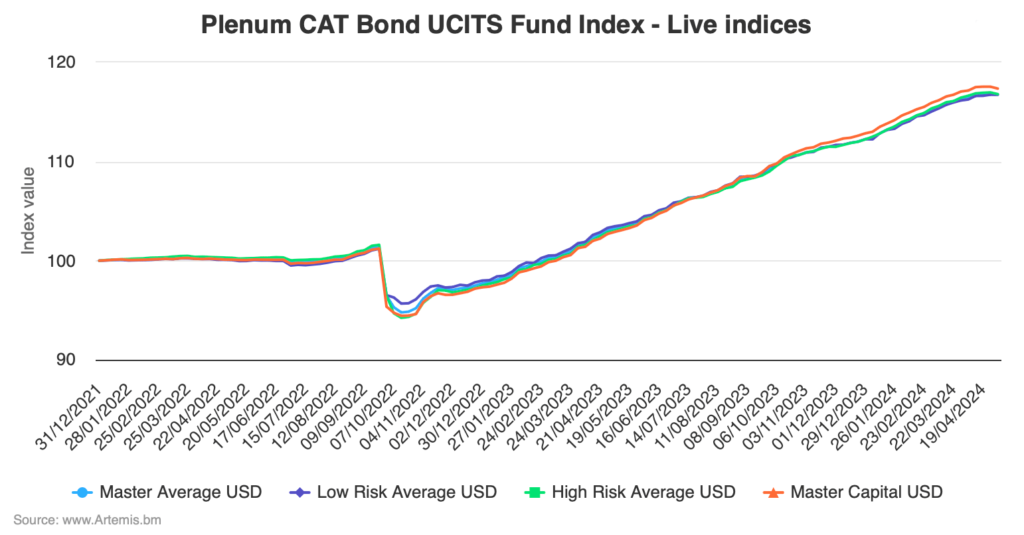

As spread widening in the catastrophe bond market accelerated in recent weeks, the Plenum CAT Bond UCITS Fund Indices recorded their first negative week since back in December 2022, ending a 73 week long-run of positive average returns across the tracked cat bond funds.

The catastrophe bond market had experienced spread tightening in 2024, through much of the year so far, as supply-demand dynamics drove pricing across the primary and secondary market.

The narrowing of catastrophe bond spreads was seen as both evidence of abundant investor demand for the cat bond asset class, as well as a signal that supply and demand were not balanced in the market, something that was expected to become more stable as supply of new cat bonds increased.

In recent weeks though, as we’ve been reporting, the tightening trend has reversed and this has now become evident in the results of catastrophe bond funds structured in the UCITS format.

The Plenum Investments Index that tracks the returns of catastrophe bond funds in the UCITS format, the Plenum CAT Bond UCITS Fund Indices, had been rising strongly through 2024 although slowed in recent weeks as widening effects impacted cat bond values.

As we reported last week, while spread widening has been seen through most of April and into the first week of May 2024, alongside more balanced supply and demand in the market, some are attributing at least part of the widening trend to the latest hurricane risk model update from Moody’s RMS.

Now, with the latest data from the Plenum CAT Bond UCITS Fund Index, we can see the effects of spread widening in the first negative week of performance from this Index since late 2022.

Analyse cat bond fund performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format and provides a broad benchmark for the performance of cat bond investment strategies. Click the chart below for an interactive version and index development by week.

The last time the UCITS cat bond fund Index experienced a negative week was right back at the end of November into the first days of December 2022, when the catastrophe bond market was still digesting the ramifications and potential for losses (that failed to materialise to any significant degree) from hurricane Ian.

Since then, the Index has risen across a stunning 73 week streak, which we believe to be the longest run of gains that UCITS cat bond funds have ever seen.

Over that period of consistent gains, the Master Average UCITS cat bond fund Index rose by an impressive 20.5%.

It’s important to note that it may not be every UCITS cat bond fund that experienced negative performance in the last week, as this is the Index performance, so averaged across the group of all funds tracked.

At 0.37%, the average UCITS cat bond fund return for April 2024 is one of the lowest months of performance for some time.

Spread tightening had been driving down the total yield of the catastrophe bond market, but the widening trend that emerged in recent weeks drove a small recovery in April, as we reported last week.

As we’ve explained, while secondary trading was the first place that widening became evident, it is now being seen in the primary issuance market for cat bonds, where investors have recently begun demanding higher returns than where price guidance has often indicated deals were targeted to settle at.

While supply of catastrophe bonds and demand or capital available to support them adjusts, we’re likely to see some ongoing fluctuation and perhaps a period of less impressive cat bond fund returns for a time.

But this is just the market finding an equilibrium, with supply of capital and investment opportunities adjusting.

Once through the busy issuance period before the mid-year reinsurance renewals and the Atlantic hurricane season begins, we should start to see a more typical pattern for a time.

How much of an influence new hurricane risk metrics from the Moody’s RMS model update really are remains to be seen, but even if that is a significant consideration for cat bond fund managers, they will quickly remodel their portfolios and understand what the new expected loss metrics mean to them, so that effect is not expected to be persistent.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using our new chart.