Social Security Could Look 'Completely Different' for Younger Clients: Jeff Bush

The appropriation bills are a more straightforward opportunity for Republicans to push for spending cuts. The debt ceiling imposes spending caps for two years and suggests continued caps for subsequent years. But caps are ceilings, not floors, and I expect the House Republicans will champion actual spending cuts during the appropriations process.

The government will shut down if Congress does not complete the appropriations process by fiscal year-end, Sept. 30, or pass a continuing resolution (CR).

My best guess, at this point, will be a CR until later in the calendar year. Both parties are vested in looking like they are holding firm heading into an election year, with Republicans demanding spending cuts and Democrats holding their ground on social spending. This face-off and possible shutdown have, in the past, created market volatility. Given interest rates and economists’ opinions, higher market volatility could push us closer to recession.

As a way of setting up the 2024 elections, members of both parties will debate other legislative issues, but by and large, appropriations will be the big story for the rest of this year. Other topics include immigration, Ukraine funding, tax tweaks and others.

Are there any broader issues advisors should be concerned about?

Absolutely. I do not know how to say this more plainly — both parties are failing the country by not addressing our country’s fiscal realities.

Our growing debt-to-GDP ratio is out of hand and only getting worse. It’s projected to cross $50 trillion in 10 years. I don’t care how low interest rates are; servicing that debt is mathematically unsustainable. Most elected officials are unwilling to admit this publicly.

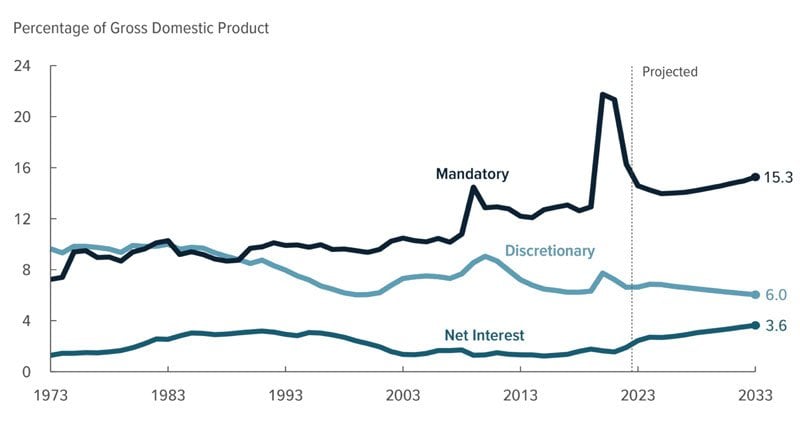

Our spending is growing, and our revenues are flat as a percentage of GDP.

Source: CBO: The Budget and Economic Outlook, Feb 15, 2023

The largest share of spending growth vs. GDP comes from the mandatory portion of the budget (Social Security, Medicare and Medicaid) and the cost of servicing the debt.

Discretionary spending (Defense, National Parks, Federal courts, general government) are shrinking. Sadly, I often joke that the United States is becoming a healthcare provider and pension fund with a military.

CBO: The Budget and Economic Outlook, Feb 15, 2023

CBO: The Budget and Economic Outlook, Feb 15, 2023

The bottom line, the country will only be on a sound fiscal footing once Congress addresses both mandatory spending and additional revenue.

What does this mean for advisors?

Advisors need to help clients plan for inevitable changes in their retirement landscape. They need to assume that Social Security will change. The cost-of-living factor may change for all retirees. But for younger clients, Social Security could be significantly different.

Congress tends not to act until a forcing event necessitates their action.

If this axiom holds, I do not anticipate a serious attempt at Social Security reform until after the 2028 election, with one caveat: Should either party sweep the White House, Senate and House in 2024, I predict an effort by that party to address Social Security and tax reform in 2025.

Regardless of when Congress takes up Social Security reform, we will know when they are finally serious when they are willing to address all the variables of the Social Security formula simultaneously. Meaning adjustments to the full retirement age, early retirement age, tax rate, tax cap, and means testing. I do not anticipate Congress applying these changes to anyone within 10 years of their full retirement Social Security age.

Advisors must be fluent in Medicare programs and more assertive in presenting long-term care solutions to clients. Life insurance is unlike any other solution for wealthier retirees and, in my mind, falls into three categories.

Significant wealth — traditional estate planning uses with an appreciation that the estate exemption may well drop significantly.

Middle wealth — Hedging LTC expenses and rebuilding an estate after living on an appropriate percentage of their wealth. Many clients live too conservatively.

Mass wealth — Solving for LTC needs or creating an inheritance for the next generation.

I’m referring to quality-of-life strategies for current and future clients.

Pictured: Jeff Bush of The Washington Update.