Small Business Health Insurance Cost UK (June 2022 Prices)

What is small business health insurance?

Small business health insurance is a policy taken out by an employer to provide employees access to private healthcare services in the UK. While there are differing levels of cover to choose from, broadly speaking, these policies allow employees to be diagnosed and treated faster than they might be via the NHS.

Is private healthcare worth it?

It’s well documented that the NHS is suffering from a record-breaking backlog, and even critical services like cancer care are struggling. It’s not just hospitals that are feeling the strain; getting GP appointments and access to services such as physiotherapy, talking therapies and more has become difficult.

Private health insurance enables those with policies to access private healthcare treatment options in the UK. In most cases, they’ve seen and treated faster. Here are some of the core benefits of small business health insurance from both an employee’s and employer’s perspective

Benefits of health insurance for employees

Avoid NHS waiting lists and be treated soonerAccess to drugs and treatments not routinely available on the NHSChoice over when and where treatment takes place24/7 virtual private GP services (most insurers)Physiotherapy and other complementary therapies (comprehensive policies)Mental health support and talking therapies (comprehensive policies)Cover for family members (if the employer wishes to)A private room while they’re in hospitalDiscounts on things such as gym membership

Benefits of health insurance for employers

Ensure employees stay fit and well and return to work as quickly as they can after illnessStand out in the employment market and attract employeesRetain your employees by demonstrating your commitment to their wellnessGreater flexibility with medical appointments with doctors available 24/7There are numerous benefits of health insurance for small companies in the UK

What does health insurance cover?

All health insurance policies, both for businesses and individuals, are designed to cover the costs of treatment relating to acute medical conditions, meaning those that can generally be cured. Chronic conditions, i.e. those that can’t be cured and perhaps need monitoring and management, aren’t typically covered.

It’s difficult always to know what is and isn’t covered as, for example, a mental health issue or cancer may not be curable but would still be covered, assuming you have opted to have them covered. Therefore, it’s always wise to review your policy terms in detail and speak to a health insurance broker to ensure that you fully understand what to expect.

Cover levels

Later in this article, we look at the current average cost of small business health insurance and those costs are based on three differing covering levels. We won’t dwell on this too much, but here is how we’ve defined each group for which we’ve provided example pricing.

Key cover

Key cover includes inpatient treatment at a network of private hospitals across the UK. It also includes some outpatient cover, meaning costs relating to pre-treatment diagnostic tests will be covered only up to a maximum level (typically £1,000). Key cover doesn’t include things like physiotherapy or mental health cover.

Enhanced cover

Enhanced cover includes everything Key cover does, but the outpatient cover limit is £1,500. In addition, it also includes therapies cover, so physiotherapy and other alternate therapies are included.

Comprehensive cover

Finally, Comprehensive cover includes unlimited outpatient cover, therapies, and mental health support.

Other options

None of the cover types we’ve provided pricing for include routine dental and optical cover, nor do they include travel cover, all of which are available as optional add-ons.

What’s excluded?

All health insurance policies will typically exclude the following:

Pre-existing conditionsEmergency treatmentCosmetic surgeryChildbirth and infertilityTreatment for chronic conditionsSelf-harm, alcohol and drug abuseTreatment is required due to taking part in high-risk activities “I recently got a family health insurance policy through myTribe and the service was excellent from start to finish. The adviser that I spoke to was very patient and took time to explain all of the intricacies to me so that I felt confident and informed when making a decision. The fact that they compare the market for you makes the process really quick and easy and I think I came away with not only the best policy for me but a much better understanding of how private health insurance works.”

“I recently got a family health insurance policy through myTribe and the service was excellent from start to finish. The adviser that I spoke to was very patient and took time to explain all of the intricacies to me so that I felt confident and informed when making a decision. The fact that they compare the market for you makes the process really quick and easy and I think I came away with not only the best policy for me but a much better understanding of how private health insurance works.”

by Chris Stratton – 12th May 2022

Compare Health Insurance Policies

Tax implications of a group health insurance policy

Health insurance is seen as a P11D benefit in kind, meaning that by providing it to employees, they will need to pay PAYE and National Insurance contributions to the value of the benefit. While this is a relatively small amount in most cases, older employees or those with family members who also have cover will see a more significant increase in their tax bills.

From a company’s perspective, health insurance is a tax-deductible business expense; therefore, the policy’s cost will be deducted from your profit at your year-end.

Small business health insurance cost

In this section, we explain what affects the cost of a small business health insurance policy along with providing you with some example quotes. Please remember that the quotes we’ve provided are based on many factors, and the price you pay will be different.

What affects the cost of small business health insurance?

While not an exhaustive list, you can generally expect all of the following to affect the cost of your policy:

Number of employeesAge of employeesLevel of cover selectedWhether you cover employees’ family membersWhere your company is basedCost of private healthcare treatments at the timeIndustry your business works inYour employees’ medical histories (in some cases)The type of underwriting chosen

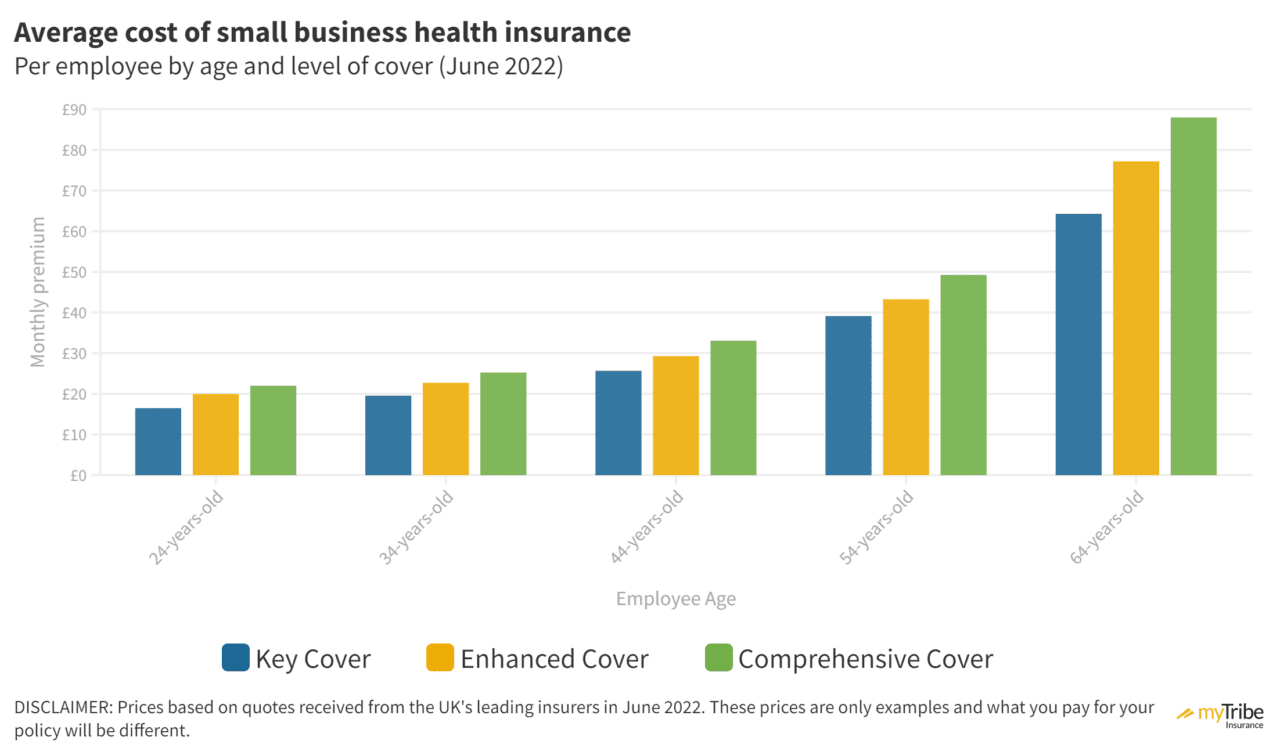

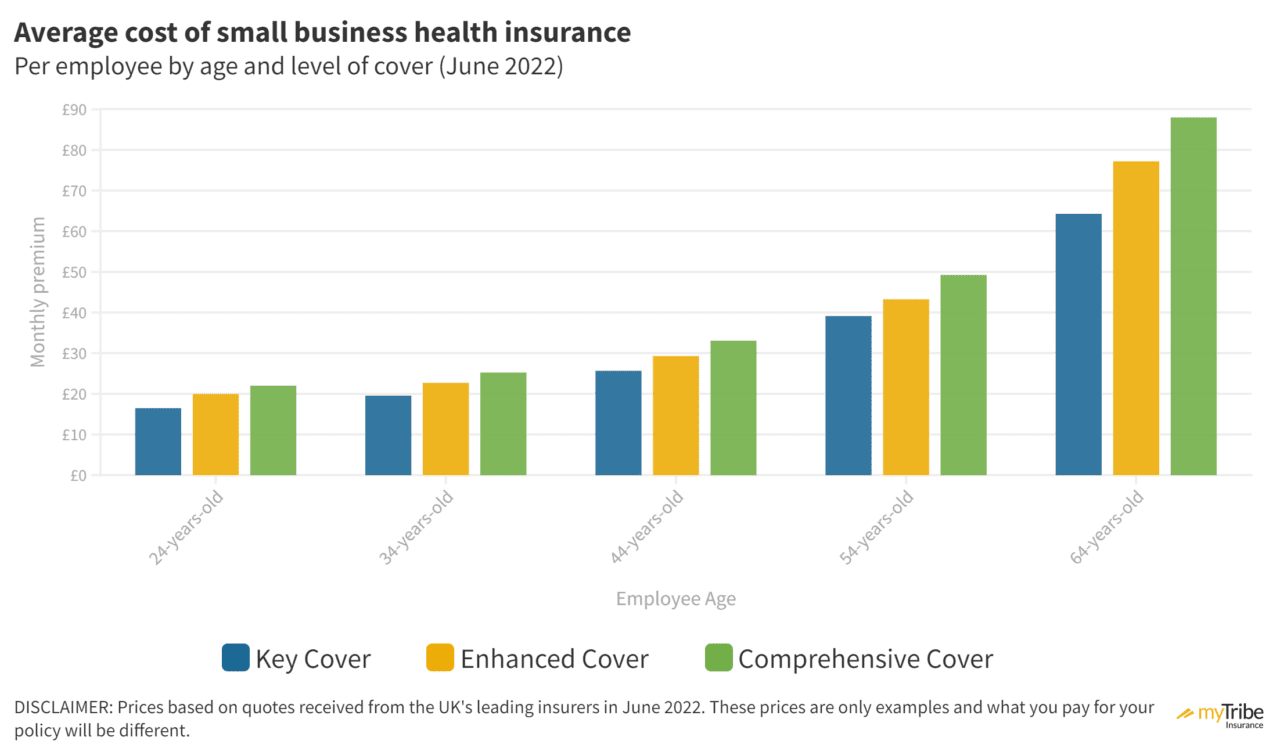

Small business health insurance costs in 2022

The pricing below is based on quotations from several leading insurers; we obtained those quotes in June 2022.

Employee Age

Key Cover

Enhanced Cover

Comprehensive Cover

24-years-old

£16.48 per month

£19.96 per month

£22.00 per month

34-years-old

£19.55 per month

£22.70 per month

£25.24 per month

44-years-old

£25.67 per month

£29.30 per month

£33.04 per month

54-years-old

£39.14 per month

£43.27 per month

£49.24 per month

64-years-old

£64.29 per month

£77.21 per month

£87.99 per month

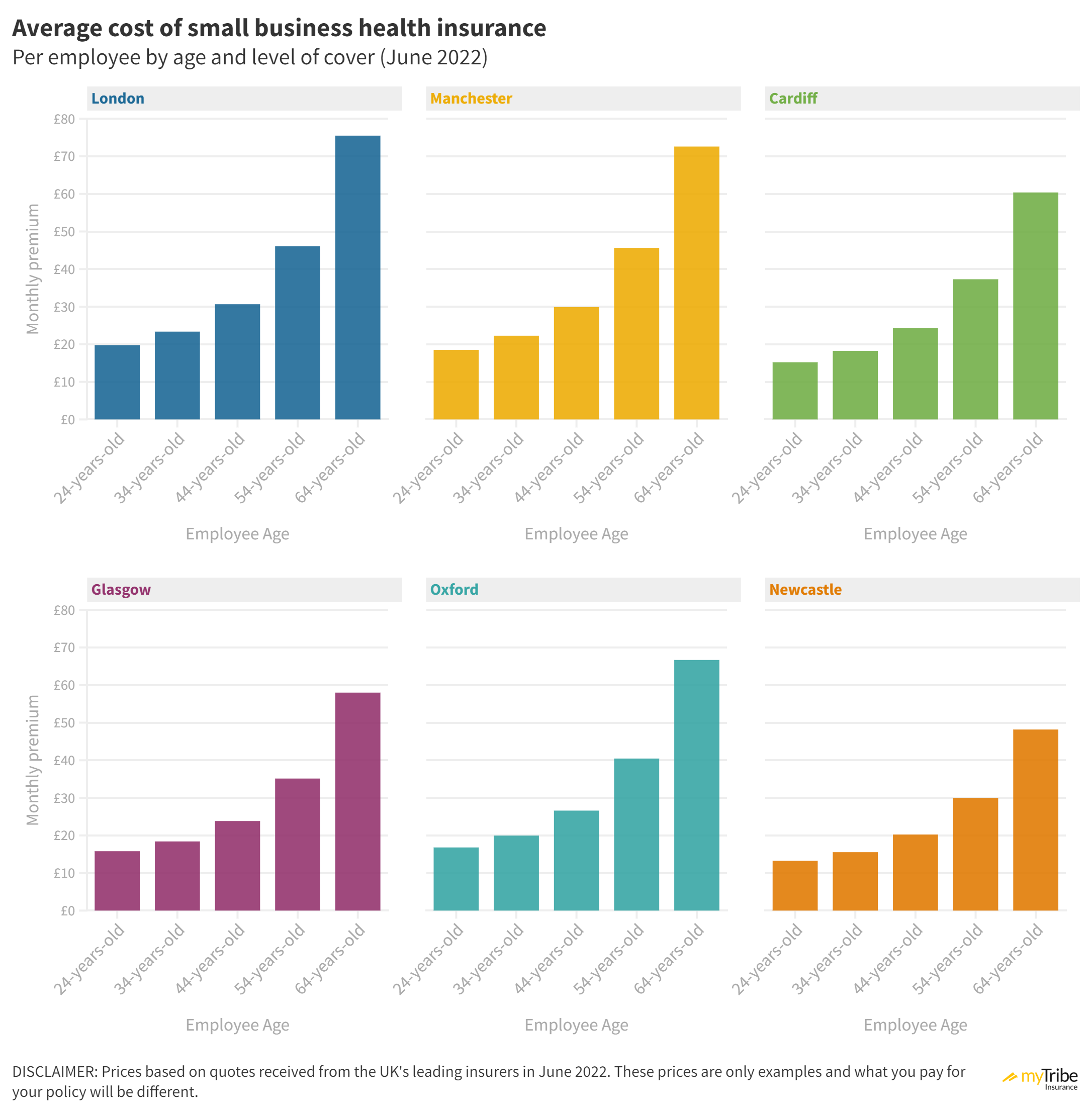

How your postcode affects the cost of your small business health insurance

While the most significant factors in the cost of your small business health insurance plan will be the number of employees you have, their ages and the level of cover you opt for, your location also has a large impact. In this part of our article, we look at the average cost of health insurance based on where your business is located.

The average cost of business health insurance based on location

This chart shows the cost small businesses can expect to pay for health insurance in towns and cities across the UK.

Where your business is based plays a significant role in the cost of your health insurance

Where your business is based plays a significant role in the cost of your health insurance

Health insurance for small business owners

You can typically need three or more employees to set up a group health insurance policy. Therefore if you are a small business owner with less than that number, you’d need to take out a personal policy instead. Thankfully, providers such as WPA offer discounts for self-employed individuals and professionals, so you may end up paying less by doing it personally anyway.

How to compare quotes and get the best price and policy

Comparing small business health insurance isn’t straightforward, and there isn’t an online tool that’ll allow you to do it. The only way to compare prices easily is by speaking to an independent health insurance broker. The service they provide is free of charge, and they will do the leg work and provide you with a summary of what each of the leading providers’ charges and offers. Not only that, but they will be able to answer any questions you might have and ensure that you understand what it is you are buying.

Frequently asked questions

As a company owner, is it better to buy health insurance through my company or personally?

You can only get health insurance through your business if you have three or more employees on the policy. If you are a small business owner that would like to cover for yourself and your family, it may be best to take out a policy personally.

Why should I offer health insurance to my employees?

There are numerous benefits of providing medical insurance to your employees, but perhaps most importantly, it ensures that should they become unwell, they get the treatment they need promptly and are back to work as soon as they can.

Can I take our business health insurance with two employees?

Not usually, most group health insurance schemes start at three employees.