Sick Leave & Sick Pay

Sarah is 33 and works as an accountant in a firm in the city centre.

She’s mostly on time – though last week she was late because her cat vomited on the floor.

Sarah suspects that Jim, the cat in question, took one look at the hardwood flooring in the hallway and thought,

Nah, the carpet is a way better shout.

Little fecker.

Sarah’s a great employee; she’s even started contributing to her employer’s pension scheme.

But then Sarah gets sick.

She’s out of work for a week because of cramps.

The company she works for are decent and pay her ten sick days a year.

Sarah’s not worried.

But then the cramps don’t go away, and she finds out she’s got stomach cancer, and she’s about to face a long medical battle, and God knows how long out of work.

Those ten paid sick days are all the company offers.

So, what happens next?

And what if something like that were to happen to you?

How do Sick Leave and Sick Pay Work in Ireland?

Stories like Sarah’s happen all the time.

Life happens – and sometimes it happens hard.

Most of us don’t consider insuring our salary in the event of illness – it’s not on top of our minds when negotiating a new job or a revised contract.

We’re probably too busy finagling over the dollar bills we’re making.

But sick pay is important – hopefully, you’ve got a caring employer willing to cough up for more than a few days.

Because here’s the thing: an employee in Ireland (that’s you) is legally entitled to just three days of sick pay per year (and that’s only since Jan 1 2023!)

Three days, let’s count them.

Your company doesn’t owe you a cent.

It doesn’t matter whether you’re toiling at your desk long past office hours or taking the mick with extremely extended lunch breaks – we all have the same statutory rights when it comes to sick pay – three measly days.

Other than those three days, the amount of sick you get is up to your employer, though most businesses settle for that measly three days – which, in the grand scheme of an entire working year, isn’t a whole lot.

Especially as you get older and end up with hangovers that last longer than those three days.

Remember that one particular session when you were keeled over your desk until the Tuesday, outrunning The Fear, considering selling all your worldly possessions and living out of the back of a van while you travel around Europe. Your kids could go live with their gran for a while, surely.

In all seriousness, get familiar with your company’s sick pay policy – including how many days you’ll get.

Also, find out how soon your employer requires a medical certificate – it’s usually after two or three consecutive days off and should say when you’ll be able to return to work.

PRO TIP: if you’re on annual leave and you’re ill and get a cert to prove it, you should get the day back and can take it off later.

How Can You Survive Financially if you Take More Than Three Days off?

Deep breaths, sonny, because we’re about to look at the cold, hard facts of being long-term out of work.

It ain’t pretty.

So, depending on your exact circumstances, you’ll be looking at various options – all of which have terrifying names.

The options are:

Illness Benefit – a short-term (one to two years) payment if you can’t return to work. You should apply within six weeks of getting sick. You don’t get any payment for the first six days of your illness, but you’re covered for one to two years after that.

Invalidity Pension – this kicks in if you can’t return to work. To qualify, you have to be unable to go back to work either permanently (yes, I know it’s scary, but these are the cold, hard facts I mentioned earlier) or if you’re out sick for 12 months and can prove you’ll be out sick for at least 12 more. Self-employed people get this; they don’t get illness benefit.

Partial Capacity Benefit – this scheme applies if you’ve been on Illness Benefit or Invalidity Pension for six months and want to ease your way back into work.

Disability Allowance – this is a weekly allowance paid to people who haven’t worked in 12 months due to a disability.

Occupational Injuries Benefit Scheme – paid if you get an illness or injury at work or travelling for work.

Supplementary Welfare Allowance – if you’re out sick and have no income, you can apply for this.

Injury benefit – a weekly payment from the good folks at the Department of Employment Affairs and Social Protection if you can’t work due to an accident at work. (Doesn’t every government department sound like it should be a Harry Potter book? Harry Potter and the Department of Employment Affairs and Social Protection sounds like a riot, doesn’t it?)

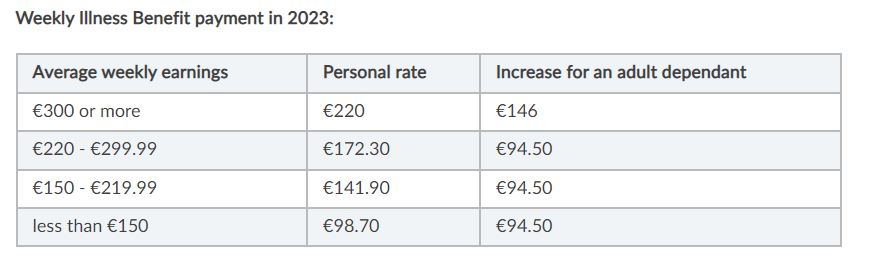

Your next question, no doubt, is how much those benefits pay.

I’m not going to go through an exhaustive list right now as it’s on a case-by-case basis, but to give you an idea, we’ll look at Illness Benefits, which Sarah will get for a year while she recovers.

Sarah isn’t married and doesn’t have any kids.

It’s just her and her pukey cat.

Sarah would be looking at a personal rate of €220 a week – or €953 a month.

If Sarah is lucky, the accountancy firm she works for will also cover a certain amount of her wages, but that’s rare.

Could you live on €953 a month?

I couldn’t.

And that’d just be me – we’re not even factoring in Hannah and the kids.

Life is expensive.

So is being sick, especially long-term.

Yes, it’s crap, but it’s even worse if you’re unprepared.

When it comes down to it, you have two options to insure yourself should you take a considerable amount of time out of work.

Those two options are Serious Illness Cover and Income Protection.

Serious Illness Cover has several different names because the insurers thought, “yes, let’s make this even more complicated.”

Like Sarah’s cat, the insurers are annoying shits.

It’s usually known as Serious Illness Cover or Critical Illness Cover.

You get a tax-free lump sum if you get a serious or critical illness covered by your policy.

Most Serious Illness Cover payouts are for cancer, heart attack, or stroke.

I go in-depth in my ultimate guide to Serious Illness Cover here, but in brief, what I’ll say is this: Serious Illness Cover is good if you can’t get income protection.

But it’s not a patch on Income Protection.

Income Protection: How does it Work, and do you need it?

Income Protection (also known as Permanent Health Insurance / Salary Protection / Income Continuance) can pay you up to 75 per cent of your before-tax income (minus the state Illness Benefit) if you cannot work.

If you’re working full-time or are self-employed, this could make a big difference in your life.

Let’s say you earn €80,000 per annum. You can insure up to 75 per cent of this, less the state Illness Benefit of €11,440 per year.

If you’re self-employed, you’re not entitled to any Illness Benefit, so you can insure 75 per cent of your pre-tax income.

75% x €80,000 (minus €11,440 = €48,560

So you can insure €48,560 using Income Protection.

If you cannot work, you get €48,560 from the insurer and €11,440 from the state, giving you a total replacement income of €60,000.

This replacement income lets you concentrate on getting better without constantly worrying about how you’ll keep your head above water.

By the way, some employers offer a group income protection scheme wherein they’ll cover you under the terms of their policy.

If your workplace is scabby and doesn’t offer Income Protection, you can buy your own policy.

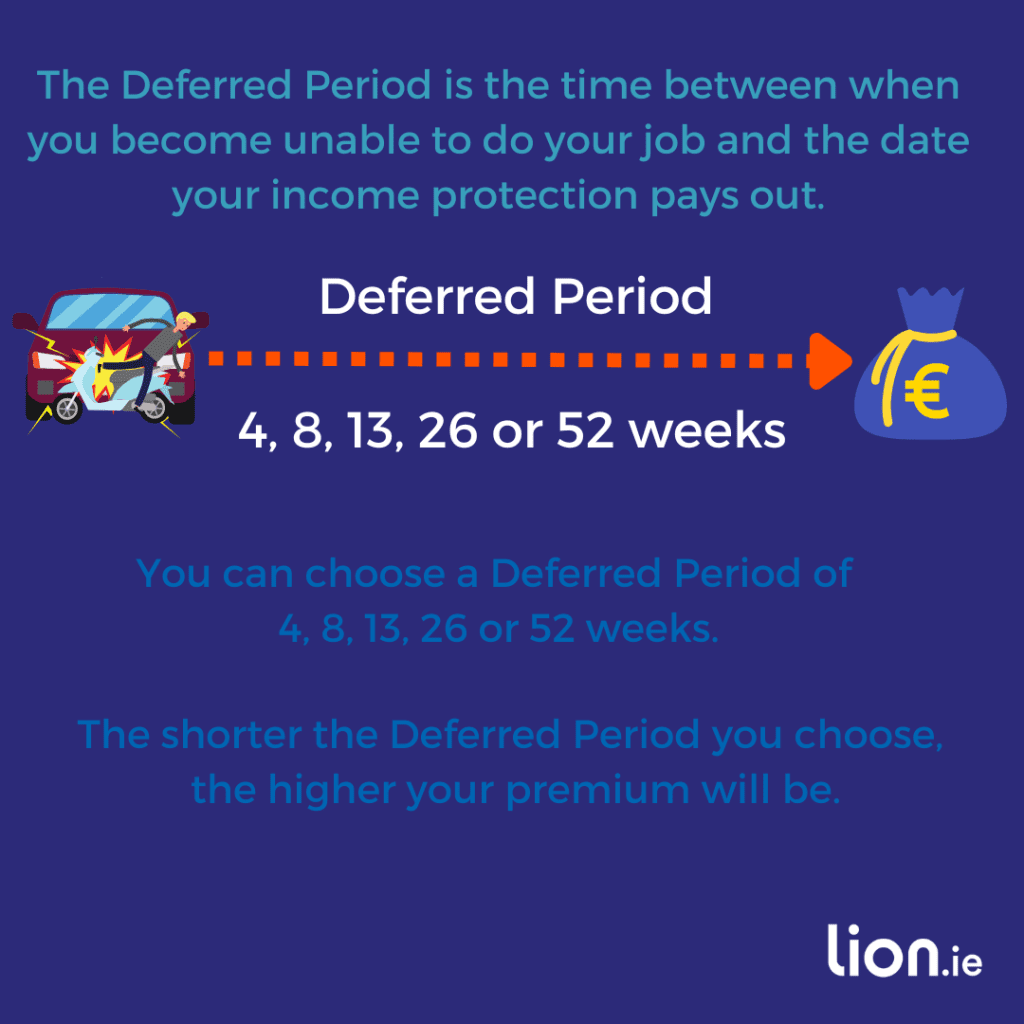

What’s a Deferred Period?

The deferred period (also known as the waiting period) is important: it’s how long you have to be unable to do your job before you can claim on your policy.

You can choose a deferred period of 4, 8, 13, 26, or 52 weeks.

Your cover will be cheaper if you have a longer deferred period – but is the few extra quid a month really worth surviving for a whole year on the government’s measly Illness Benefit?

Is Income Protection Expensive?

Let’s look at an example real quick: Jane, a 26-year-old chemist on €45,000.

She wants to see how much she might pay with various deferral periods for 75 per cent cover until she’s 55.

A 4-week deferral period will set her back €36 per month after tax relief

A 13-week deferral period will set her back €17 per month

If she chooses a 52-week deferred period, she will pay just €11 per month

As you can see, there’s a significant difference between the pricing at four weeks versus 52 – but could you afford to wait that long?

In this instance, Jane picks the 13-week deferral period because work will pay her for the first three months if she can’t work.

She can easily afford the €28 payment, especially as it’s actually only costing her €17 once she claims back 40% tax relief.

If you’re curious about how to claim tax relief on income protection / permanent health insurance, I’ve covered that here.

Factors like your age, health, medical history and lifestyle will impact the cost of your cover.

(Smoking is a divil for all types of insurance.)

Your occupation may cause increases too – and I don’t mean if you do something bananas like working as a bullfighter.

Occupations fall into categories from Class 1 to Class 4.

Class 1 is your fairly standard office worker, who’ll be sitting at the desk all day, while Class 4 is more dangerous and includes people doing a lot of physical work, like tradesfolk.

The Hard Truth

If you’re young, single, footloose, and fancy-free, you could probably survive without Income Protection.

Worst comes to worst; you could move home for a year or two and get by.

It’d be grim, but you could do it.

However, the state’s Illness Benefit won’t cut it if you have kids or a mortgage or loved ones to look after.

You could probably muddle through for a few weeks, but do you want to be stressed about finances while trying to get better?

You’re going to feel awful already, and the financial stuff’s stress definitely won’t help.

If you’re not sure it’s worth it, why not give our Income Protection quote calculator a whirl and take it from there?

I’ve described Income Protection as the big daddy of insurance, and I will tell you why right now.

You go to work to make money.

That money funds your lifestyle.

If that money dries up, you’re in big, big trouble.

So what if you could back up that money?

Insure it, if you will.

One more case study for ya!

Let’s look at the cat lady Sarah again.

Let’s say she took out a policy a year before she got ill.

She was earning €60,000 as an accountant and wanted to insure the full 75 per cent of that (less social welfare, she can insure €33,560), with a deferral period of 13 weeks (how long she’d have to be out before the policy kicks in).

Tax relief applies to Income Protection, so for €42.32 every month, Sarah would receive 75 per cent of her salary (less social welfare!) until she’s back to work.

And all for less than a tenner per week.

It’s worth considering (especially if you’re an accountant)

Over to you…

Crappy sick pay?

Reckon you’d struggle to live on Illness Benefits of €220 a week?

Make the smart decision and protect yourself.

You’ll never be younger; premiums will never be cheaper.

Take the plunge.

There is a chance that future you may look back on today as the most important day of your life.

Give me a call on (01) 693 3382, and let’s get it sorted or complete this short questionnaire to get the ball rolling.

Thanks for reading

Nick

lion.ie | Protection Broker of The Year 🏆