SIAA Insurance vs. Renegade Insurance 2024: Who Offers the Better Perks?

TLTR: This article compares SIAA Insurance with Renegade Insurance (formerly Covered by SAGE) based on their benefits, how they make money, and their reputation.

How Do SIAA and Renegade Insurance Compare?

Founded in 2018, Renegade Insurance was established with the goal of bringing about the necessary changes in the insurance industry for agents, clients, and carrier partners. This insurance agency has access to over 100 carriers, specializes in offering both commercial and personal insurance services, and is licensed to conduct business in 48 states.

SIAA was founded in 1995 with the aim of fostering the expansion and long-term development of independent agency distribution systems. With access to more than 30 insurance companies, SIAA has a solid alliance of 48 master agencies that cover all 50 states. Insurance agents have access to more than 30 reputable national and regional carriers through SIAA, which provide both personal and business lines of insurance.

How Do SIAA and Renegade Insurance Make Money?

Renegade Insurance makes its money through commissions. Renegade does not provide 100% commissions on any lines; instead, their splits vary among policies on every line.

The compensation split for personal lines starts at 90/10 for new businesses and varies based on the premium. There is a 60/40 split between agents and Renegade on the personal lines’ renewal business. The split for commercial lines is also 80/20 for a new business and 50/50 for renewal.

SIAA primarily makes its money through commissions too. Additionally, the agency network has several considerable maintenance costs, as seen by its membership fees, early termination fees, buyout fees, and selling fees. SIAA additionally takes 50% out of agent bonuses, including 5% of annual commissions. The multi-tiered partnership business model of SIAA, with its strategic partner companies, offers established commercial ties, a critical mass of volume, and effective long-term results that are profitable for them as well as the partner companies and member agencies.

Add Your Agency

Listing your business is free and easy.

Your email has been registered. Redirecting…

Your email has been registered. Redirecting…

Renegade Insurance Offering

Renegade provides its agents and agencies with a range of benefits that aid in their progress and efficiency. Independent insurance agents are allowed to operate a virtual agency of their own; Renegade Insurance does not require a retail storefront. Agents can also cross-sell all insurance lines of business by choosing from alternatives provided by Renegade for those who want to sell life or health insurance policies.

Renegade Insurance offers lead sourcing through internal marketing and provides proprietary Lead Management Software and Rater. The agency additionally offers handling of local marketing and a product and sales training center for agents. Renegade also offers assistance with book of business transfers from one carrier to another and client servicing.

SIAA Offering

For individuals eager to become independent agents, SIAA offers an astounding variety of benefits. Earning bonuses through profit sharing and additional commissions with no minimum premium restrictions are some benefits of joining SIAA. Additionally, SIAA permits agents to have their own preferred company contracts, which may include complementary comparative rating software for the first year and a subsidized price after that.

Additionally, the agency assists with placement and quoting for all lines. SIAA agents can also benefit from significant discounts on agency management systems, mentoring and counseling on all facets of agency management, including training with seasoned staff.

Factors to Consider

When choosing an organization that is best for you, the first step is to visit the website of the agencies operating in your area.

Check out their licensing page and their state-wise coverage. Furthermore, you can find out who the agency is appointed with and other similar information. You can also view a list of the agencies they have appointed under their license.

Another line of research will help you locate an agency member online or their website. Talk to the agency’s career representatives; they are excellent at giving the right recommendations.

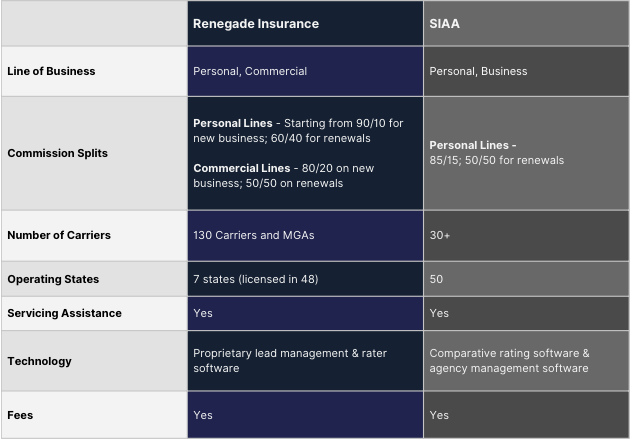

SIAA vs. Renegade Insurance: At a Glance

What is Best for You: SIAA or Renegade Insurance?

Renegade is an agency that offers agents access to numerous lines of business, and SIAA is one of the largest alliances of independent insurance firms in the nation. Both Renegade and SIAA provide:

Their agents with marketing support.Access to tools for generating leads.The ability to more efficiently schedule carrier appointments.

Overall, both agencies assist independent agents by providing great rewards and benefits. If you’re seeking an agency network, SIAA would be ideal for you. If, on the other hand, you want to join an independent insurance agency, Renegade would be the best choice.

Add Your Agency

Listing your business is free and easy.

Your email has been registered. Redirecting…