Shutdown Threat Looms Over U.S. Flood Insurance

Even as the 2023 Atlantic hurricane season proves to be more intense than originally predicted, federal funding for the National Flood Insurance Program (NFIP) is threatened by a potential government shutdown. Funding for NFIP will expire after September 30 if lawmakers don’t reach a deal.

Claims on existing policies would still get paid if NFIP isn’t reauthorized. But the program would be unable to issue new policies and would face other funding constraints. If it can’t issue new policies, thousands of real estate transactions requiring flood coverage could be derailed.

Insured losses from hurricanes have risen over just the past 15 years. When adjusted for inflation, nine of the 10 costliest hurricanes in U.S. history have struck since 2005. This is due in large part to the fact that more people have been moving into harm’s way since the 1940s, and Census Bureau data show that homes being built are bigger and more expensive than before. Bigger homes filled with more valuables means bigger claims when a flood occurs – a situation exacerbated by continuing replacement cost inflation.

Flooding isn’t just a problem for East and Gulf Coast communities. Inland flooding also is on the rise. In August 2021, Hurricane Ida brought heavy flooding to the Louisiana coast before delivering so much water to the northeast that Philadelphia and New York City saw flooded subway stations days after the storm passed. Floods in Eastern Kentucky in 2022 further underscored the need for more comprehensive planning on how to deal with these disasters and reduce the nationwide flood protection gap. California and the Pacific Northwest have been hit in recent years by drenching “atmospheric rivers” and, most recently, Hurricane Hilary, which slammed Southern California and neighboring Nevada, where it turned the Burning Man festival in the state’s northern desert into a dangerous mess of foot-deep mud and limited supplies.

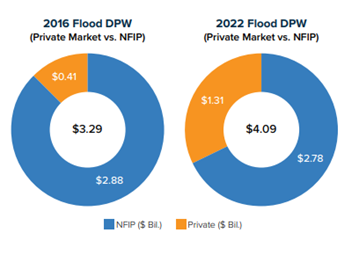

Flood insurance is provided by NFIP and a small but growing number of private insurers, who have become increasingly comfortable writing the coverage since the advent of sophisticated modeling and analytical tools. Between 2016 and 2022, the total flood market grew 24 percent – from $3.29 billion in direct premiums written (DPW) to $4.09 billion – with 77 private companies writing 32.1 percent of the business.

Flood risk was long considered untouchable by private insurers, which is a large part of the reason the federally run NFIP exists. While private participation in the flood market is growing, NFIP remains a critical source of protection for this growing and underinsured peril.

Learn More:

FEMA Incentive Program Helps Communities Reduce Flood Insurance Rates for Their Citizens

More Private Insurers Writing Flood Coverage; Consumer Demand Continues to Lag

Stemming a Rising Tide: How Insurers Can Close the Flood Protection Gap

Kentucky Flood Woes Highlight Inland Protection Gap

Inland Flooding Adds a Wrinkle to Protection Gap

State of the Risk Issues Brief: Flood

State of the Risk Issues Brief: Hurricanes