Should You Cancel your IRA to Buy Life Insurance?

Podcast: Play in new window | Download

There are life insurance agents, motivated by various marketing organizations, telling people that their taxes are going up. Way up. Mostly because Social Security is bankrupt. They even have a super assertive and amazingly authoritative person to reference. David Walker, the former U.S. Comptroller General…he’s been complaining about SSA for years. In fact, he predicted all sorts of doomsday scenarios…most of which had timelines that are already behind us. But hey, no worries, SSA is still bankrupt.

Now, if you understand the U.S. Tax Code, you might know that Social Security benefits are funded through taxes that are collected under FICA (Federal Insurance Contributions Act). These are payroll taxes. They are deducted from wages that you earn, or assessed against business income that you generate. They fund programs like Social Security and Medicare. These taxes are different from the federal income taxes that you pay–most of those dollars go towards defense spending.

But they are different, like really different. Technically speaking, the U.S. collects these taxes for their intended purposes and used them for their intended purpose.

Now current projections suggest Social Security will be completed depleted of any surplus created by tax revenues by 2034. And it’s this discussion about the eventual end of FICA surplus that acts as the key argument behind the soon-to-be massive tax increase American face.

But there’s something else…

Historically Low Taxes?

Supposedly, taxes are low. Like really low right now.

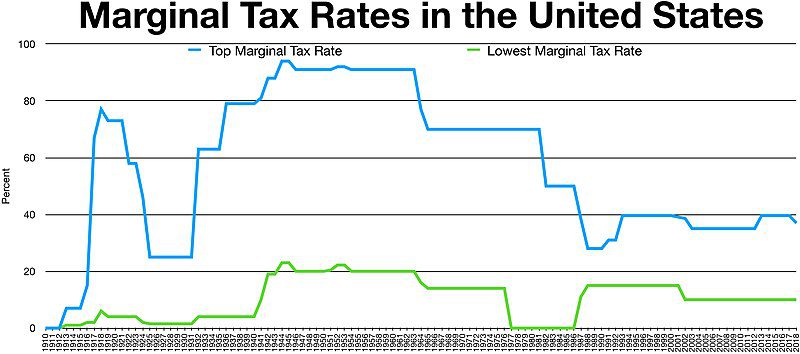

Here’s an often referenced chart that proves the point:

Looking at this chart, it sure does seem like our current tax levels are considerably lower than they once were.

But there’s a problem with this argument. The data shows marginal income tax rate in nominal terms with no context for the tax code’s intricacies that existed throughout history. We see a pretty rapid drop throughout the 1980s. This was a major Reagan initiative. But, what we don’t often see through this data was the cataclysmic shift in the tax code that took place at the same time. Reagan era tax law didn’t so much reduce taxes as it did simplify and reduce marginal income tax rates. This was, surely, beneficial to people whose income fell in stratospheric levels at the time. But the overall move was ultimately neutral in terms of absolute taxing dollars collected. Marginal rates fell, but at the same time, many deductions and credits ceased to exist.

So does this chart prove that we are well below average in terms of tax rates and set for a big hike? No not even remotely, and anyone who claims that is either woefully misinformed or intentionally attempting to mislead you.

But Social Security is a problem, right? One that can only conceivable be fixed with tax increases? That is probably true.

Those tax increases, however, aren’t going to impact retirees. They don’t pay FICA, unless they have a j-o-b in retirement. Your savings aren’t going to incur a FICA tax, not without a massive revision to U.S. Tax Code.

But let’s ignore for a minute the asinine claims made by some insurance marketers and their agents about rising taxes, and lets for a moment focus on the viability of using life insurance by way of raiding your qualified savings (i.e. 401(k) or IRA) and instead putting it into life insurance.

Liquidating your IRA Case Study

Let’s assume a 40-year-old male with $500,000 in an IRA he rolled from a 401(k) with his former employer. Johnny McMorning, a life insurance agent, suggests that he liquidate the IRA over the next 10 years and use that money to fund a life insurance policy. Johnny claims that doing this will save untold sums of taxes, especially after the financial reckoning that will take place due to Social Security insolvency.

McMorning points out that because the life insurance policy builds cash value, that will become a primary source of tax-free income in retirement that will completely ignore all of the tax rate increases coming down the pike.

Looking at some numbers:

Stick with the plan and make $20,000 contributions to the new 401(k), take income of 5% withdrawals against the IRA balance beginning at retirement to create an annual income of $150,488 after taxes

Liquidate IRA per McMorning’s recommendations and as well as redirect planned contributions to a life insurance policy. Because we can’t recommend that someone put all of his/her money into life insurance, we’ll split the planned $20,000 annual contributions between the life insurance policy and a non-qualified general brokerage account. Total after-tax annual income using the whole life policy and a 5% withdrawal amount against the brokerage account is $132,675 after taxes.

Ignore McMorning’s advice, keep the $500,000 in the IRA, and start a new policy funding it with the planned contributions that would have gone into a new 401(k). Withdraw 5% of IRA balance and use whole life policy to create retirement income. Total annual after-tax income is $153,996 after taxes.

But keep in mind that these figures are after-tax figures assuming current tax rates. One of the biggest arguments made in favor of ditching your IRA in favor of life insurance is the fact that we have no idea what tax rates will be in the future. Some like to ask the question “would you borrow money without knowing the terms of the loan?”

In order to have a net income higher with the liquidate IRA plan, taxes must increase on this individual from 26% today to 35% during retirement. That’s a big increase for someone whose income will fall middle of the tax schedule. And remember, we don’t fund Social Security with Federal Income Tax, so we need some other major shift in U.S. Federal Budgeting to necessitate such an increase in income taxes.

The point that we do not know what future tax rates will be is irrefutable. It’s also prudent to take note of this and contemplate a possible strategy change with respect to how we go about saving for the future from this point forward. But we can make estimations on what future tax rates might be and then make reasonable estimates on the risks associated with holding taxable retirement accounts. From the example above, I’d argue the chances of an increase from 26% to 35% is pretty low.

Paying Taxes isn’t the Worst Possible Scenario

I know I’m going to lose some of you with this section, and that’s fine. You can overreact to an emotional subject and harm yourself if you want. But paying taxes isn’t the end of the world. Yes, we’d like to set ourselves up for a situation where fewer dollars are eroded by taxes. If the die has already been cast, however, now it’s a challenge of maximizing what we have with what we’ve done.

Paying taxes isn’t fun. But it’s certainly not something worth avoiding at all costs. In the above example, attempting it will end up forfeiting almost $18,000 in annual income. That’s a lot of money to give up just to say you didn’t have to pay taxes.

Inflating taxes and their impact on retirement savings is one of the last bastions some life insurance agents/marketers feel they have to make life insurance compelling against general investments. I don’t personally think this is true, but many of them do. Much like our recent conversation about over-stating effective tax rates to juice Internal Rate of Return, this too is an attempt to augment what life insurance is capable of producing. It’s fraught with technical half-truths masquerading as the complete picture.