SGIC achieves record-breaking growth

SGIC achieves record-breaking growth | Insurance Business Asia

Insurance News

SGIC achieves record-breaking growth

Insurance boss outlines company’s goals

Insurance News

By

Roxanne Libatique

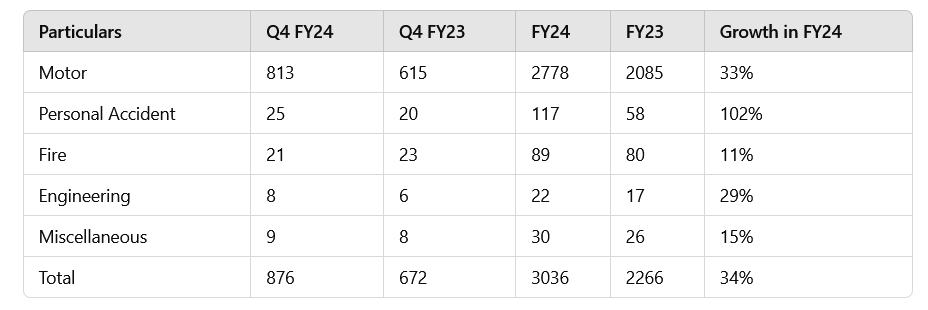

Shriram General Insurance Company (SGIC) has reported a significant 30% increase in gross written premium (GWP) for the fourth quarter of FY24, reaching Rs 876 crore.

For the fiscal year ending March 2024, the company saw a 34% rise in GWP, totalling Rs 3036 crore, marking its highest growth since the company’s inception. The insurer’s net profit for FY24 rose by 22% to Rs 455 crore.

Policies issued by Shriram General Insurance Company

The company issued 1,474,981 policies in Q4 FY24, which represents a 6% increase year-on-year.

As of March 31, 2024, SGIC’s assets under management (AUM) grew by 7.10% to Rs 12,064 crore, while its solvency ratio stood at 4.02.

The total number of live policies increased from 52.95 lakh in FY23 to 62.58 lakh in FY24.

Segment-wise GWP of Shriram General Insurance Company (in Rs crore)

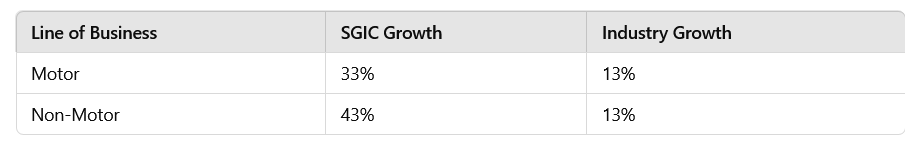

Shriram General Insurance Company’s business line growth versus industry in Q4 FY24

Shriram General Insurance Company’s CEO forecasts growth

Anil Aggarwal, managing director and CEO of SGIC, said the year marked a milestone for the company, with a 34% GWP growth rate that surpassed the industry average of 12.8%. He projected approximately 30% growth for the fiscal year 2025, attributing this to ongoing expansion efforts.

“Our focus last year was on expansion,” he said. “We opened 43 new branches, and our manpower has increased from 3705 to 4015. We are working to increase our non – motor portfolio that has gone up from 8% last year to 8.5%. In the next 5 years, we will be increasing our non-motor folio to 15%.We are hiring aggressively. We currently have 69,000 agents, and planning to recruit 20,000 agents this year and further increase it to 2 lakhs agents in the coming years . We will also add 25 more branches this year.”

The company announced a final dividend proposal of 39%, bringing the total to 122.5% for FY24, compared to 100% in FY23, pending shareholder approval.

Lead insurer for Odisha

Appointed by the Insurance Regulatory and Development Authority (IRDA) as the lead insurer for Odisha, SGIC is tasked with increasing insurance penetration to achieve the vision of “Insurance for All by 2047.” The company will deploy agents at Gram Panchayats to advance this initiative.

Shriram General Insurance Company’s SME segment

SGIC aims to grow its non-motor business through the SME sector.

Aggarwal acknowledged the challenges but emphasised the potential of this segment.

“This is a challenging area but an attractive one; we need a lot of manpower and strategies to sell products in this segment. We are working with various industry associations to help in reaching businesses in this segment. This will help us increase our non-motor growth, definitely,” he said.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!