Severe weather events drive US insurers to record losses

Severe weather events drive US insurers to record losses | Insurance Business America

Catastrophe & Flood

Severe weather events drive US insurers to record losses

New report highlights increasing impact of weather risks

Catastrophe & Flood

By

Mika Pangilinan

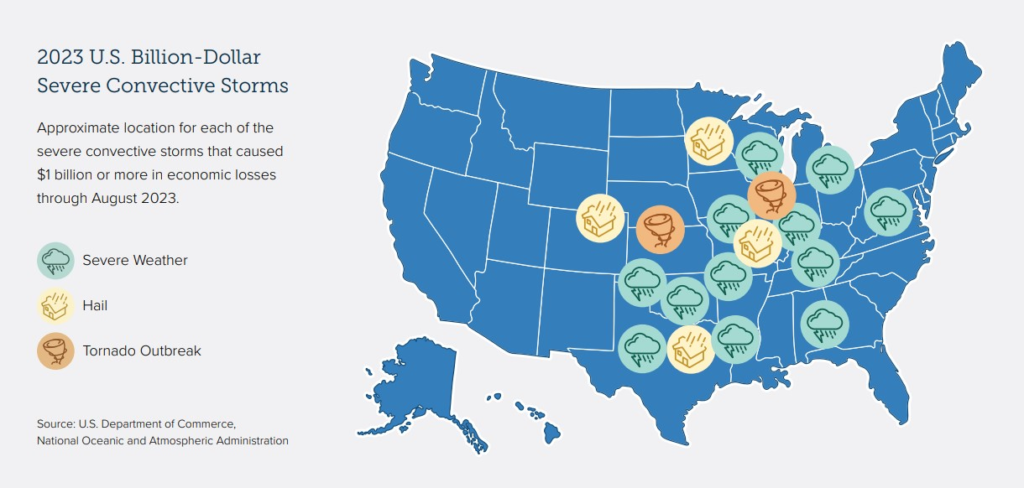

The United States is currently grappling with its costliest year on record for severe convective storms, with insured losses already surpassing $50 billion by the end of September, according to a report released by the Insurance Information Institute (Triple-I).

Severe convective storms encompass a range of natural disasters, including thunderstorms with lightning, hail, tornadoes, and derechos.

As noted in in Triple-I’s latest issues brief, tornadoes ravaged Arkansas, Illinois, and Mississippi during the first half of 2023, resulting in significant loss of life and property damage. These events were closely followed by a series of intense hailstorms that hit Colorado, Minnesota, and several other states during the summer months.

“This $50 billion loss due to a single peril is a substantial issue,” said Steve Bowen, chief science officer at Gallagher Re, who collaborated with Triple-I on the report. “In fact, there have been only six years since 2010 when the combined annual catastrophe losses did not reach this threshold.”

This year’s record-breaking losses can be attributed in part to the fact that these storms had hit densely populated areas where residences and commercial buildings are expensive to repair and replace, the Triple-I report noted, citing a study by Swiss Re.

Swiss Re’s analysis pointed to the impact of inflation and said the effect of high prices has increased the nominal values of insurable assets like buildings and vehicles, which in turn has been pushing up insurance claims for “damage caused by Mother Nature.”

Considering the increasing risk posed by severe weather, The Triple-I brief highlighted the importance of mitigation and resilience. It made recommendations focused on securing property during storms, as well as evolving insurance approaches like parametric policies.

What are your thoughts on this story? Feel free to comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!