Safe to say hurricane Milton likely a $20bn+ insurance market event: Siffert, BMS

In his latest update yesterday evening, Andrew Siffert, Senior Meteorologist at broker BMS Group, explained that he feels it is safe to say that hurricane Milton is likely to be at least a $20 billion insurance market loss event, while even a best possible scenario of a wind shear impacted Milton going into Tampa Bay could be over $25 billion.

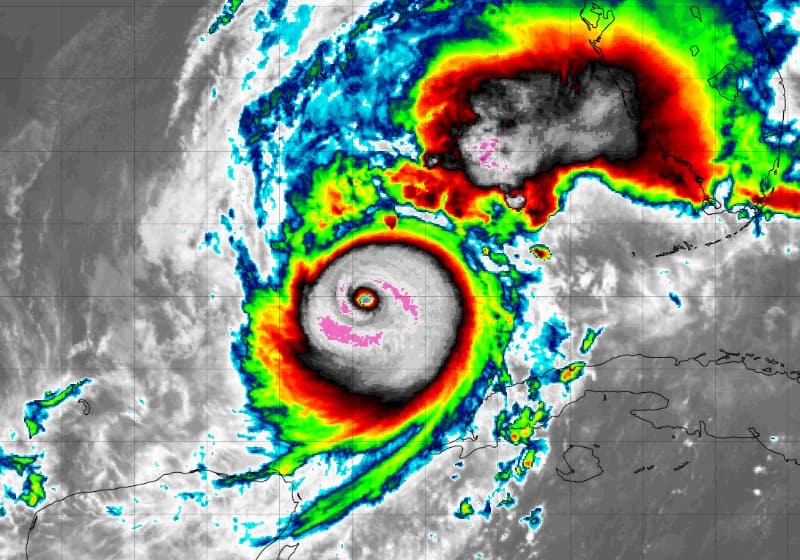

Siffert again highlights continued uncertainty over hurricane Milton’s path, landfall location and eventual intensity, but said that, “The Sarasota and Tampa areas are bracing for what could be one of the top ten most destructive weather events in U.S. history.”

“If a direct landfall on Tampa of Category 4 winds and surge occur, current losses could rival the 1926 Miami hurricane or the 1928 Lake Okeechobee hurricane and Katrina in 2005,” Siffert explained.

Adding, “This will all depend on track and intensity at landfall, which is starting to narrow, but right now, it is likely that insurance losses will be at least $25B in the best possible forecast scenario if Milton falls apart due to shear and dry air before landfall.”

Siffert further said, “It is still entirely too early to pinpoint an accurate insurance loss range. A storm making landfall in Tampa Bay would be a historic loss for the insurance industry and likely change the insurance market for years.

“The landfall along Sarasota is much more manageable for the industry and similar to Ian. Yet at this point, it is safe to say this will likely be at least a $20B dollar event.

“This is solely based on a review of the low end of the catastrophic modeling guidance and some of the historical analogs like the 1921 Tarpon Spring / Tampa Bay Hurricane that today would cause over $25B in insurance industry losses.”

All of which ties in with the still relatively wide-range of loss estimates being seen, with our sources continuing to suggest something close to Tampa Bay and without much loss of intensity could be a $50 billion plus industry loss event for insurance, reinsurance and catastrophe bond or insurance-linked securities (ILS) markets.

Siffert provides some details on the narrowing of focus on specific landfall locations and the fact that as time passes, the chances of track error also narrow.

He noted that, “We can refine the expected landfall area and intensity, with the average error for a 36-hour forecast being around 36 miles and an intensity error of about 8.5 mph. It is important to remember not to focus solely on the storm’s category, but rather on the full range of potential impacts Hurricane Milton could bring.”

Going on to say, “An increase in vertical wind shear will likely cause some weakening before the hurricane reaches Florida, but there is high confidence that Milton will be a much different storm. Landfall is still expected at the Longboat Key, FL. But a swath up or down the coastline from Clearwater, FL, or Venice, FL, is still possible.”

Siffert also highlighted the potential for damage further inland to occur.

As we explained yesterday, hurricane warnings extend across the entire Florida Peninsula and forecasts suggest hurricane Milton will sustain its hurricane status right the way across the state.

Siffert said, “While much of the focus is on the Tampa Bay region’s landfall, which is still recovering from Hurricane Helene ten days ago, it should be noted that the entire I-4 corridor is highly populated, and impacts could be felt well inland into Orlando. The Northeast coast of Florida will also see damage as onshore flow and storm surge impact areas alone as the storm continues to expand in size after landfall.”

He also provided some insight into specifics such as the state of construction and building quality in the regions likely to be affected by hurricane Milton.

“The overall wind gust is essential for wind damage, but the building stock is more important. Pinellas County has the highest concentration of old construction in the Tampa Bay Area,” he explained.

Siffert explains that newer building stock is built to stricter codes, so should be expected to withstand hurricane wind gusts far better. Meaning landfall location and eventual path are critical with this storm, as is always the case.

Storm surge levels in the vulnerable Tampa Bay remain uncertain and a slight shift in landfall location can make all the difference there between historic levels that flood down town Tampa, or a lower level such as seen with recent hurricane Helene.

Wherever Milton landfalls, Tampa Bay could see another surge of at least equivalent to Helene anyway, while the further south scenarios would see significant effects in other areas with lower but still relatively high exposure concentrations.

So, with hurricane Helene loss estimates coming out around the $11 billion level, for the private market, it’s easy to think Milton is likely to be $20 billion plus.

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.

Also read:

– Hurricane wind speeds forecast across entire Florida Peninsula as Milton approaches.

– Mexico’s catastrophe bond presumed safe from hurricane Milton.

– Stone Ridge leads managers cutting mutual cat bond or ILS fund NAVs on hurricane Milton.

– Hurricane Milton could be a huge test for the entire (re)insurance market: Evercore ISI.

– Hurricane Milton losses could amount to tens of billions, but uncertainty high: BMS’ Siffert.

– As hurricane Milton intensifies, Mexico’s catastrophe bond comes into focus.

– Material hurricane Milton losses could change 2025 property reinsurance price trajectory: KBW.

– Cat bond & ILS managers explore options to free cash, as hurricane Milton approaches.

– Hurricane Milton: First Tampa Bay storm surge indications 8 to 12 feet.

– Hurricane Milton is biggest potential ILS market threat since Ian in 2022: Steiger, Icosa.

– Hurricane Milton forecast for costly Florida landfall. Cat bond & ILS market on watch.