Rising Stars 2022

Jump to winners | Jump to methodology

Tomorrow’s industry heavyweights

The tables have turned in the Australian labour market over the past 30 years. Throughout the 1990s, unemployment ranged from 6% to 11%. It fluctuated from 4% to 6% from 2000 to 2020, and was 3.5% in August 2022.

“In the past, an employee was lucky to have a job, and the general thought pattern these days is the business is lucky to have the employees,” says David Hooker, the national manager of insurance for Australia at Hooker & Heijden.

A group of employees the industry is particularly lucky to have is the current crop of Insurance Business’ Rising Stars. Aged 35 and under, these young achievers have distinguished themselves in an industry notoriously tough for newcomers.

“I don’t really consider myself a salesperson. I just let my product knowledge and attention to customers speak for itself. I think clients appreciate that”

Aaron Scutts, Shielded Insurance Brokers

Winner Aaron Scutts, the 31-year-old head of renewals at Shielded Insurance Brokers, attributes his success to a natural approach. He explains, “I don’t really consider myself a salesperson. I just let my product knowledge and attention to customers speak for itself. I think clients appreciate that. They just need someone who’s attentive, knowledgeable, listens to them, and finds a solution.”

Meanwhile, a fellow Rising Star reveals how he’s thrown himself into the industry to become a well-rounded operator. “Despite having limited hours in a day, I never turn down an opportunity to volunteer for panels, action groups or project teams,” says Fraser Gow, 34, of CHU Underwriting Agencies. “It’s allowed me to greatly increase my knowledge of different parts of my organisation and provided great insight into the potential successes or failings from wider business strategies.”

And he highlights how important it is for the younger generation to be able to grow professionally. “From an organisational point of view, it’s really easy to blame young people for their lack of development. But some of the onus needs to go on the organization as well. There need to be focused development programs that offer employees clear pathways to development and to an end career goal,” Gow says.

Of his Rising Star recognition, he adds, “It would be remiss of me to claim that I’ve managed it alone. I would not have achieved nearly as much without the support of the CHU executive team who make it a priority to cultivate development and talent.”

Oshan de Silva of Ensure Recruitment is continually impressed by the mindset of the industry’s new talent and reiterates how supportive environments enable them to flourish. “Especially looking at rising stars and who are coming up in the industry, the one common thing I see across them is that they’re very adaptable to change, they keep growing their career by adapting to what’s around them. They are the people who grow,” he says. “Most of the younger candidates I speak with have an industry mentor who they look up to and guide them in their career.”

Another Rising Star puts her recognition down to one quality. “Curiosity,” reveals Yijing Vicky Zhang, a marine underwriter at NTI. “I am always curious around how technology continues to shape the world we live in.”

All agree that being prepared for the industry is key and underscored the importance of educating young people on the expectations, opportunities and advancement potential of insurance careers before they enter the market, so they can mirror them and rise to success.

Rob Harris, who owns RH Insurance Recruitment, echoes the Rising Stars’ sentiment. “Insurance doesn’t really advertise itself enough to schools and universities as to the potential career you can have in insurance,” he says.

“Despite having limited hours in a day, I never turn down an opportunity to volunteer for panels, action groups or project teams”

Fraser Gow, CHU Underwriting Agencies

Right skills, right attitude, right work ethic

It’s been a whirlwind progression for Gow, head of customer service for CHU. He was a customer service team leader two years ago worked his way up to become national customer service manager before taking on his current role, all while studying for his MBA and without any prior industry experience.

“It isn’t Fraser’s tenacity, infectious enthusiasm or even popularity that makes him worthy of being listed in Rising Stars for 2022, it is his unwavering commitment to customers,” says the firm’s CEO Kimberley Jonsson. “Fraser is absolutely dogged about improving the customer experience and challenges every person to make decisions with the customer in mind. He is a credit to our industry in the times we are experiencing.”

In the past 12 months, Gow initiated and led an efficiency review of the company’s GSSC (QBE’s Group Shared Services Centre). Based on the results, he initiated a six-month bootcamp for 20 processors. As a result of this, average handle time dropped to 8.5 minutes per item, a 40% decrease. He also spearheaded an operational review of CHU’s insurer binding process – with the project set to free up 25% of their offshore processing time and save the business over $150,000. In addition, he launched LiveChat for customers to communicate to increase satisfaction and also deliver a higher conversion rate in the direct customer space.

Gow himself attributes his own and the company’s success to maintaining excellent broker relationships. And, in the face of 15% to 25% premium increases, disbursing funds when necessary.

“The more we pay out, the more our premiums go up,” he explains. “While that’s difficult for some who have never had a claim, it shows how much as an industry we’re paying out in successful claims.”

Scutts had a similar lack of previous industry experience but joined an innovative insurance company in 2019, Shielded Insurance Brokers, and has since risen to managing renewals for a vast book of clients and overseeing a staff of approximately 10.

He’s used his own personal experience as a model for hiring new recruits. “Instead of seeking those with previous broker experience for the role, we’ve had a lot more success with hiring those just with a client or strong client service background,” says Scutts. “Being able to start with a good base and then building knowledge from there.”

Shielded Insurance Brokers has more than 4,000 5-star reviews, while Scutts maintains a portfolio of over $30m gross premiums.

The firm’s director Douglas Strong adds, “Aaron immerses himself in improving his knowledge by meeting with underwriters, asking hard-hitting questions to insurers to learn more. Where change can be tough, Aaron embraces change and relays that to his team for a seamless transition.”

And then there’s Zhang, who started fresh out of university in a data processing role and has established herself over a five-year period as a successful marine underwriter.

“There’s always a shortage of talent and labour in the insurance industry,” she says. “There’s still a lot of opportunities, but it’s for people who have the right skills, right attitude, right work ethic, and who want to take on challenges and responsibilities.”

“There’s always a shortage of talent and labour in the insurance industry. There’s still a lot of opportunities, but it’s for people who have the right skills, right attitude, right work ethic, and who want to take on challenges and responsibilities”

Yijing Vicky Zhang, NTI

The great technological divide

One of the traditional ways to get new young people in the door – quickly earning their salt while building basic skills – was hiring them to do data processing work, explains Gow.

“Now, with the increases in technology and AI, that’s not really needed anymore,” he says. “So, we’re in a difficult position where we need to hire young people to do more advanced roles that the technology can’t really provide us.”

Zhang concurs, adding: “There’s a big gap. Young people are expected to jump into more difficult tasks.”

Technology is also leveling the playing field between young hires and older veterans. In the past, insurance professionals were often seen as “old” for a reason.

“They were old because they needed to be so experienced,” Gow continues. “They needed 30 years of risk analysis experience under their belts to correctly understand the risk involved.”

Now, however, that work can be done with the assistance of technology that can pinpoint property locations and identify risk down to a particular square footage of a suburb.

“The industry is ever changing and evolving,” says Scutts. “If you can build a strong knowledge base – keep on top of those changes, trends, client needs – you’re going to succeed.”

For example, he says, some might not know much about marketing but if they know how to use Google Trends – an online tool for assessing search queries – they can get their organization to the top of the search results quickly. It’s hesitance to “rock the boat” that makes the industry seem dull.

“As a young person, you might feel like you have no experience or haven’t paid your dues,” adds Scutts. “I just feel like that makes the industry stagnate. We want it to innovate, evolve, use technology.”

Regardless, there’s still a lot to be said for the old-school way of doing things. Harris, a broker many years ago, waxes nostalgic for the days before email communications when the norm was meeting with underwriters face to face.

“Underwriters have become very much data inputters,” he says. “I spoke with someone the other day, and they were interviewing a senior underwriter and they gave them an overview of a risk and said, ‘How would you want to write this risk?’ And the underwriter’s response was well, ‘Have you got a laptop so I can put all the information into the laptop to see what the quote is?’ It’s not just underwriting anymore, and I feel sorry for them because they’re not being trained to underwrite.”

However, technology is more likely to trump tradition in the near future. Zhang, who won an award for an essay on artificial intelligence and its impact on the insurance industry, says, “Some have the mindset that they don’t want to change, but they do want more opportunity.”

Adam Sloan

Head of Sales and Blended Broking

Ausure

Alexandra Slimming

Head of Global Benefits

Honan Insurance Group

Ali Taleb

Account Executive

Marsh

Andrew Clark

Senior Claims Adjuster

Berkley Insurance Australia

Austin Rosier

Assistant Account Executive

Omnisure

Ben Mcinnes

Managing Director

MHIA Insurance

Ben Van Der Merwe

Director

Omnisure

Ben Willis

Account Executive

Gallagher

Benjamin Robinson

Placement Manager – Professional and Executive Risk

Honan Insurance Group

Bianca Parussolo

Claims Team Leader

ProRisk

Binith Gyawali

Customer Value Manager

BizCover

Brooke Millett

Domestic Broker

Runacres Insurance

Callan Roderick

Assistant Underwriter

ProRisk

Christie Brooks

Senior Underwriter/Relationship Manager

DUAL Australia

Clare McParland

Sales Team Leader

BizCover

Emma Laurent

Project Manager

Youi Insurance

Georgia Rowley

Client Executive

Aon

James Wilson

Director

Delmont Insurance Group

Jessica Derek

Senior Underwriter

QUS – Strata Insurance

Jessica Waldron

Account Executive

allinsure

Jordan Stewart

Proposition Manager

QBE Insurance

Joseph Cuzzocrea

Broker

Maxton Insurance Brokers

Josh Meyer

Chief Executive Officer

Avatar Brokers

Matthew Price

Commercial Underwriter – Motor Fleet

QBE – Business

Matthew Spann

Account Director

National Credit Insurance (Brokers)

Michael Dalla Pria

Account Executive

Matrix Insurance Group

Mithrah Baskaran

Solicitor

Holman Webb Lawyers

Persia Navidi

Partner – General Insurance

Hicksons Lawyers

Pooja Khushalani

Senior Claims Executive – Financial Lines

Gallagher

Ross Chambers

Manager – Northern Region

Solution Underwriting Agency

Ryan Menezes

Account Executive

Elliott Insurance Brokers

Sam Fox

Senior Underwriter

Berkley Insurance Company

Sylvia Quang

Partner

HWL Ebsworth Lawyers (Insurance)

President, NSW Young Insurance Professionals Australasia and New Zealand

Taylor Burstow

Head of Business Development

ShieldCover

Teighan Carr

Head of Client Services – Strata and Real Estate

Honan Insurance Group

Will Bird

Account Executive/ Team Leader

Insure 247

William Thompson

Director and Account Manager

Thompson Insurance

Yijing Vicky Zhang

Marine Underwriter

NTI

Yuvi Singh

Director

Global Insurance Solutions

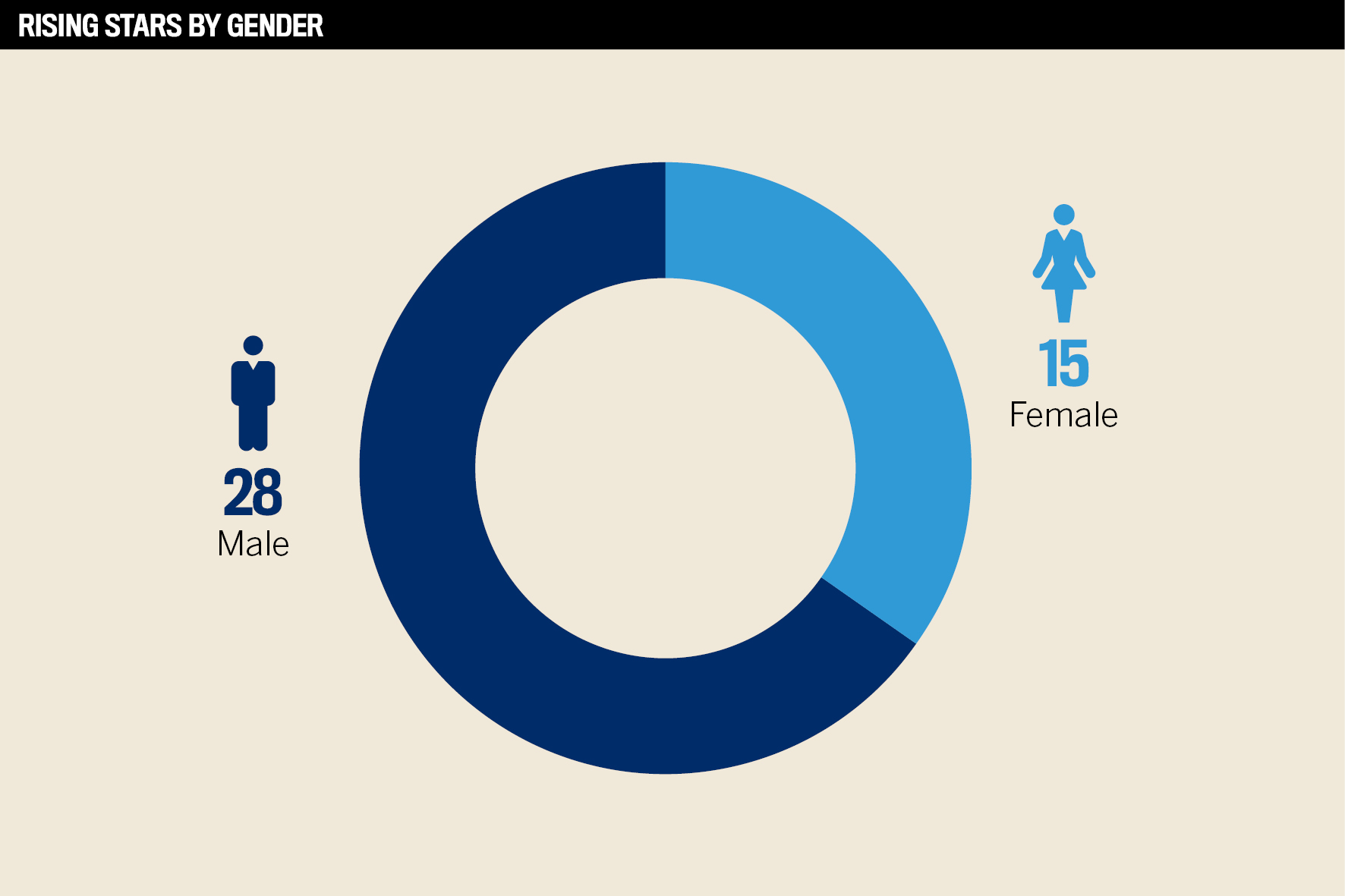

In June, Insurance Business invited professionals from across the Australian insurance sector to nominate their most exceptional young talent for the annual Rising Stars list. Nominees had to be age 35 or under (as of 31 May 2022) and working in a role that related to, interacted with, or impacted the general insurance industry. Nominees must have committed to a career in insurance with a clear passion for the industry.

Nominees were asked about their current role, key achievements, career goals, and contributions to the shaping of the industry. Recommendations from managers and senior industry professionals were also considered. The Insurance Business team reviewed all nominations, narrowing the list down to 43 of the sector’s most outstanding young professionals.