Rising home insurance rates predicted in 2024

Rising home insurance rates predicted in 2024 | Insurance Business America

Guides

Rising home insurance rates predicted in 2024

Home insurance rates are rising across the country. Which states are experiencing the highest premium hikes? Read on and find out

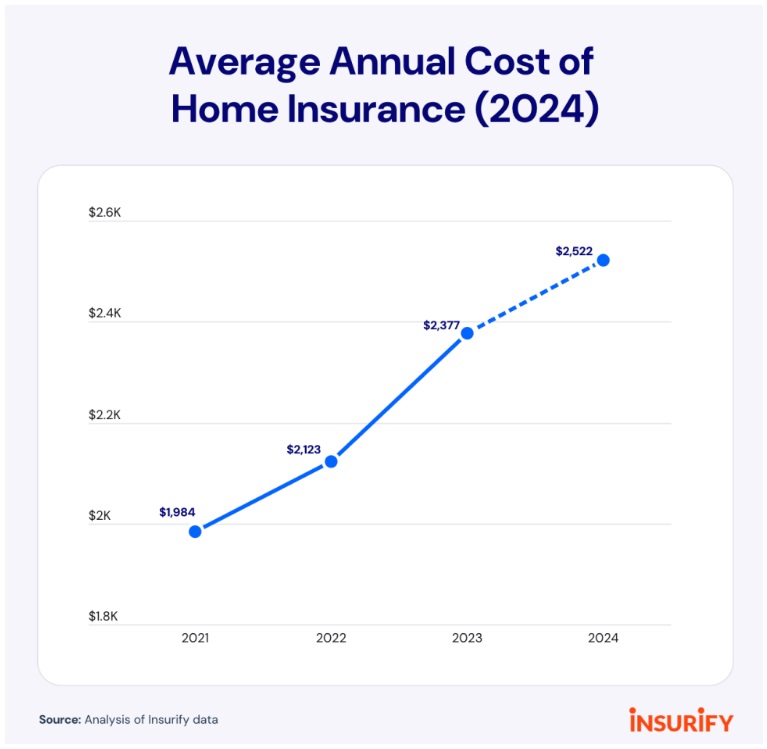

Soaring premiums have been one of the biggest challenges facing homeowners across the US. Between 2021 and 2023 alone, home insurance rates have risen almost 20%, new data gathered by Insurify has shown.

Still, the price increases aren’t showing signs of letting up. Analysis by the online insurance marketplace predicts a 6% jump in premiums this year. Worsening weather conditions brought by climate change can push up the rates even higher next year.

So, where will home insurance rates increase the most? Insurance Business digs deeper into Insurify’s data to find out.

The firm’s Home Insurance Projection Report foresees a 6% rise in annual premiums in 2024. The increase will put the national average at $2,522 at the end of the year. With climate experts expecting a devastating hurricane season, home insurance costs are forecasted to surge even higher in 2025.

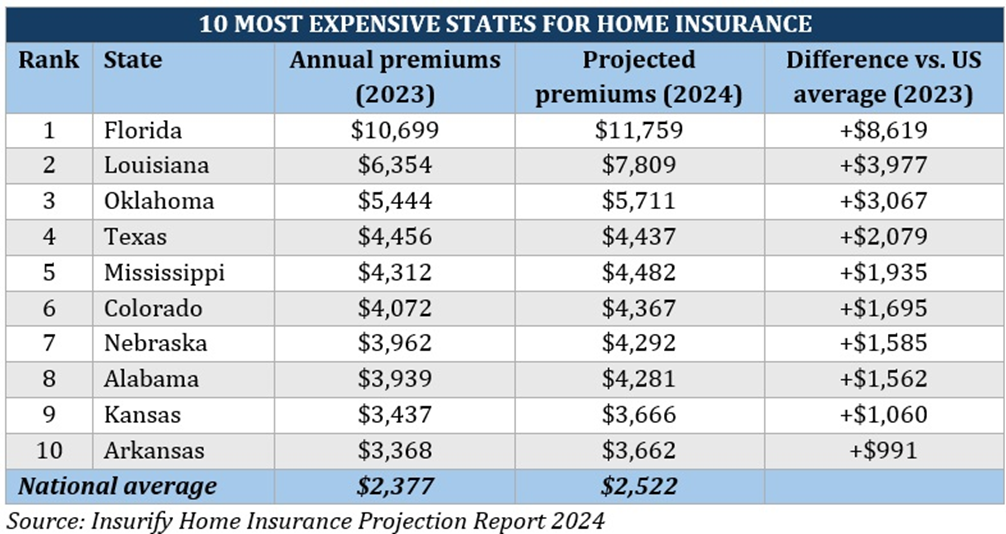

Rate hikes are predicted to be the highest in states prone to extreme weather. These include most central and southern states, where premiums can soar up to 23%.

These are the 10 most expensive states for home insurance based on the figures Insurify gathered.

The top 10 states with the highest home insurance rates share one thing in common: they are prone to extreme weather events.

Among the states on the list, Arkansas, Florida, Louisiana, Mississippi, and Texas are situated along the path of many destructive hurricanes. Kansas, Nebraska, Oklahoma, and Texas, meanwhile, are in the Tornado Alley. Nebraska and Texas, along with Colorado, also face growing wildfire risk.

Unsurprisingly, six of the 10 costliest cities for home insurance are in South Florida, with yearly rates exceeding $11,000. Five of these cities are at a “very high risk” of natural hazards based on Federal Emergency Management Agency’s (FEMA) National Risk Index.

The rest of the top 10 consist of three Louisiana cities, ranging from “relatively moderate” to “relatively high” risk, and Ocean Springs in Mississippi.

Here’s a summary of how much home insurance costs are in these cities:

Homeowners in some states, however, are feeling the burden of surging costs more than others. Here are 10 states where home premiums are rising the fastest, according to the report.

1. Louisiana

Average annual home insurance rate: $6,354

Projected annual home insurance rate: $7,809

Projected increase: 23%

% of insurers with rate increases: 24%

Louisiana home insurance rates are almost three times the national average but can climb by 23% by the end of the year. Severe weather risks brought by climate change have impacted home premiums in the state. These weather-related exposures are pushing nearly a quarter of insurers there to increase rates.

2. Maine

Average annual home insurance rate: $1,322

Projected annual home insurance rate: $1,571

Projected increase: 19%

% of insurers with rate increases: 27%

Although it is one of the cheapest states for home insurance, Maine is expected to have the second largest rise in premiums this year. The effects of global warming are catching up with the state. According to the Maine Climate Council, a 1.5-foot relative sea level rise (SLR) is expected within the state by 2050. For context, just one foot of SLR can intensify the impact of coastal storms tenfold. More than a quarter of home insurers in Maine are projected to increase home insurance rates in 2024.

3. Michigan

Average annual home insurance rate: $1,840

Projected annual home insurance rate: $2,095

Projected increase: 14%

% of insurers with rate increases: 48%

Homeowners in Michigan face a range of risks, including windstorms, hail, snow, and flooding. Apart from this, building repair costs are increasing. These factors are expected to push up home insurance rates in the state. The report forecasts that almost half of home insurance companies in the Great Lakes State will increase premiums this year.

4. Utah

Average annual home insurance rate: $1,369

Projected annual home insurance rate: $1,541

Projected increase: 13%

% of insurers with rate increases: 38%

Home insurance rates in Utah are expected to climb by 13% in 2024, with more than a third of insurers increasing premiums. The Beehive State is prone to wildfires, earthquakes, and floods. Homeowners must consider these risks when choosing coverage. On average, Utah home insurance is among the cheapest in the country.

5. Montana

Average annual home insurance rate: $1,778

Projected annual home insurance rate: $1,997

Projected increase: 12%

% of insurers with rate increases: 31%

Montana’s diverse terrain results in varied climate patterns across the state. Because of this, homes there are exposed to different levels of risk. The eastern part of the state tends to face harsher winters and hotter summers. This raises the risk of natural disasters. The report predicts that nearly a third of home insurance providers in Montana will increase rates this year.

6. South Carolina

Average annual home insurance rate: $3,082

Projected annual home insurance rate: $3,410

Projected increase: 11%

% of insurers with rate increases: 35%

Homes in South Carolina have an 86% chance of being impacted by tropical storms, according to the latest data from the state’s Department of Natural Resources. This means a higher risk of storm surges, coastal flooding, and water damage, which can lead to home insurance rate hikes. Premiums in South Carolina are already among the nation’s most expensive.

7. North Carolina

Average annual home insurance rate: $2,110

Projected annual home insurance rate: $2,327

Projected increase: 10%

% of insurers with rate increases: 19%

Just like its neighbor on the south, North Carolina experiences many tropical storms throughout the year. This raises home premiums in the state, especially for those living in coastal and flood-prone areas. Last year, more than 20 storms and hurricanes hit the state, according to data from the North Carolina State Climate Office. Insurify’s report foresees nearly a fifth of home insurers increasing rates in 2024.

8. Illinois

Average annual home insurance rate: $2,050

Projected annual home insurance rate: $2,245

Projected increase: 10%

% of insurers with rate increases: 45%

Located within the Tornado Alley, Illinois experiences an average of 50 tornadoes each year. These have a significant impact on home insurance rates. Home premiums there are slightly lower than the national average but are projected to jump by a tenth this year. Nearly half of insurers are expected to raise rates.

9. Connecticut

Average annual home insurance rate: $1,764

Projected annual home insurance rate: $1,972

Projected increase: 9%

% of insurers with rate increases: 50%

Home insurance rates in Connecticut are relatively affordable compared to most states, but premiums are increasing fast. Half of home insurers in the state are expected to increase rates by the end of the year. This can lead to homeowners paying around a tenth more for coverage. Some of the biggest property risks in the state include hurricanes, snow, storms, and flooding.

10. Nevada

Average annual home insurance rate: $1,224

Projected annual home insurance rate: $1,336

Projected increase: 9%

% of insurers with rate increases: 46%

Nevada has one of the cheapest home insurance premiums in the US, even with the projected 9% increase this year. Earthquakes, floods, and wildfires are among the biggest risks homeowners face. Some areas also have high crime rates. Nearly half of home insurers in Nevada plan to increase premiums in 2024.

Here’s a summary of the top 10 states where home insurance rates are increasing the fastest based on Insurify’s report.

Severe weather is the biggest factor driving up home insurance rate hikes, according to Insurify’s analysis.

Citing the Environment Protection Agency (EPA), the report states that climate change has increased the frequency and intensity of weather-related events. Extreme weather has resulted in costly damage and reduced the affordability of home coverage.

Data gathered by Insurify revealed that Texas incurred $400 billion in damages in 2023, the highest among all states. The Lone Star State also ranked fourth in home insurance costs.

Florida experienced slightly less damage at $390 billion but has the most expensive premiums.

Louisiana registered $310 billion in damages, the third largest, and has the second highest home insurance rates.

Forecasting firm Weather Bell predicts a “hurricane season from hell” in 2024. It expects six to eight major hurricanes, out of the 14 to 16 total, to hit the US by the end of the year.

“A ‘hurricane season from hell’ could pile up crisis upon crisis,” explains Betsy Stella, vice-president of carrier management and operations at Insurify. “The financial insolvency of all insurance companies will be tested.

“Perhaps especially newer providers who have stepped into the market recently. Citizens – Florida’s insurer of last resort – too, will be tested.”

Stella adds, however, that policyholders won’t see the rate changes immediately.

“Insurance companies reassess rates based on anticipated payouts, file for increases, and get the necessary approval from state regulators before raising premiums. Since most homeowners policies have a 12-month term, policyholders may not see price hikes for as long as 18 to 24 months.”

Unfortunately, home insurance rates will continue to soar in 2024, according to Insurify’s analysis. Annual home premiums are expected to jump by an average of 6% nationally, from $2,377 to $2,522. The rate hikes are projected to reach as high as 23% in some states.

Worsening natural calamities brought by global warming is the biggest factor driving up rates. Inflation, however, also plays a major role in the premium increases, leaving homeowners uncertain about their future expenses.

Almost all 50 US states are predicted to experience a rise in home premiums. Missouri, North Dakota, South Dakota, Texas, and Washington are the only states anticipating a slight drop in home insurance rates.

Home insurance, however, has lots of moving parts. Premiums can rise or dip depending on different factors, that’s why keeping abreast of the latest trends is important. You can do so by visiting and bookmarking our Property News Section. Here, you can find breaking news and the latest industry developments. Don’t forget to click subscribe to receive our free e-newsletters.

Have home insurance rates increased in your area? What do you think are the reasons for the hike? Do you expect home premiums to drop soon? Share your thoughts below.

Keep up with the latest news and events

Join our mailing list, it’s free!