Right Place, Right Price: Unlocking SMB Commercial Property, Workers Comp, and Cyber Insurance Markets

Published on

November 9, 2023

Your marketing team has just handed you SMB buyer personas that they have created for your review and input. You think back to a similar exercise that the executive team did six or seven years ago and you dig it up just to compare. Here they are…side by side. How has the SMB buyer changed? How has the risk changed? How has the market changed? How have your commercial product offerings changed? Where does the new buyer fit in your planning? Where do you fit into theirs? These are the important questions that must be asked.

Right price.

First, you notice some similarities. SMB decision-makers are still value-driven. One of their priorities is shopping their business around. They are still concerned about getting a fair price. Then and now, SMB decision-makers take their time when researching options. They are no-nonsense. They don’t buy into marketing fluff. They want what is necessary. They evaluate based on real information. If they make an emotional decision, it’s because their analysis has triggered an emotion based on a current pain point or risk need.

Convenience and seeking recommendations were also key indicators of purchase patterns. Were the products easy to buy, easy to use, and was the claims process simple when it was needed? These traits are still in effect as well, but something has changed. SMB buyers want even more convenience and they need to feel that their insurer truly understands them — not just their industry — including the details behind their business risks. SMB decision-makers are growing more and more comfortable with sharing corporate/telematic/private data if it contributes to better prices, improved services, or greater protection. SMB buyers appreciate transparency in the relationship.

Right place.

When you look at the 2023 and the 2016 personas side by side, the glaring difference relates to business pressures. SMB decision-makers may have felt pressure in 2016, but it’s nothing like today’s concerns. SMBs are facing dozens of new challenges, including inflation, supply chain issues, rising interest rates, rising risk, and low unemployment. Today’s insurers can win the market by helping SMBs survive and thrive addressing these challenges, some the same and some new. But the real key to capturing a greater level of market share is making sure the offerings are placed where the SMB buyer is looking.

To help insurers where and how to meet the new SMB buyers as they navigate today’s compounding issues, Majesco published an SMB survey report entitled, Resiliency in Times of Change: Rethinking Insurance to Help SMBs Thrive. It covers SMB customer sentiment and SMB decision-maker demographics that identify options where to place new products and services, and how to position those products and services to optimize their impact. In today’s blog, we look specifically at Commercial Property and Business Owners Policies, as well as Workers Compensation insurance and Cyber insurance.

Commercial Property and BOP for SMBs

Today, we are seeing increasing environmental, societal, and technological risks that have the potential to intersect and significantly disrupt people’s lives. Increased extreme weather events and natural disasters have a growing unprecedented and increasingly significant impact. As a result, the cost of insurance is increasing, putting financial pressure on SMBs.

Some regions and properties are seeing significant increases due to claims from catastrophic events such as wildfires, hail, and flooding. Risk Management magazine reports that wind and flood losses were high prior to Hurricane Ian, and that event alone is expected to cost the industry more than $50 billion with some experts estimating it as high as $100 billion. Flood premiums could rise by 25% or more. At the same time, the replacement value of most properties has increased significantly due to inflation, which will drive higher replacement cost values and insurance costs.[i]

What can help to lower Commercial Property and BOP premiums?

Personalized Pricing with Data

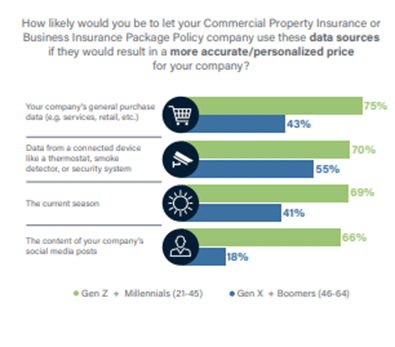

Gen Z and Millennial SMBs are highly interested (66% to 75%) in using data from several new, non-traditional sources if it results in more accurate, personalized prices for commercial property or BOP insurance (see Figure 1). In contrast, Gen X and Boomer SMBs’ interest is much lower with gaps of 22% to 48% as compared to the younger generation.

For both generations, the use of connected devices in a property is strong and offers an opportunity for insurers to develop new products that leverage such devices to not only help price but also monitor and reduce the risk for properties. Insurers offering products that provide monitoring and personalized pricing could help SMBs reduce risk and, potentially, insurance premiums, which addresses the financial top-of-mind issue.

Figure 1: Interest in new data sources for commercial property/BOP insurance pricing

Demand for Value-Added Services

There is a much closer alignment between the generations regarding value-added services for commercial property or BOP, with an average gap of only 14% (see Figure 2).

There is very high interest by both generational SMB respondents in promoting safety, risk resilience, and peace of mind through security monitoring with smart devices. These services can be packaged along with current commercial or business insurance policies, or they can be presented as value-added service options. Either way, monitoring services can use sensors and alerts for smoke/CO2, water leaks, equipment failure, and severe weather. These services have among the highest levels of interest for both segments. Gen Z and Millennials’ demand for services to help make their lives easier is once again reflected in their very high interest in digital property self-assessment tools (87%) automatic claims FNOLs based on severe weather and location data (75%), on-demand single-item insurance (73%), and concierge service for repairs and preventative maintenance (68%).

For SMBs, this becomes a real value with all the pressures they face daily — including the time it takes to simply manage and operate the business. Protective measures, just like insurance, should operate in the background and take very little time to set up or maintain, but provide risk resilience that ensures their business is safe and secure.

Price-conscious SMB decision-makers are also interested in protecting their property, machinery, and capital investments. The idea of risk resilience with preventive services should be top-of-mind for insurers as a way to provide more value for SMB premiums. Preventive services may, of course, serve as policy add-ons that could generate revenue on their own, depending on how they are constructed.

Insurers need to look to new products that leverage IoT devices and digital loss control options to give “power” to SMBs to assess and manage their property and associated risks. Majesco’s Loss Control, Property Intelligence[DG1] , and Intelligent Core for P&C[DG2] are tightly integrated and can help insurers incorporate loss control, property, and other data to use for risk assessment, underwriting and new services within or alongside existing or new products.

Figure 2: Interest in value-added services with commercial property/BOP insurance

Improving Product Placement Through Expanded, Relevant Channel Options

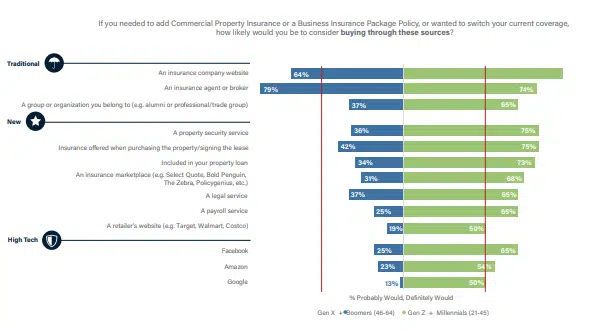

The Majesco SMB survey also uncovered real opportunities for improved product placement. Even though Agents/brokers and insurance company websites remain the preferred methods for purchasing commercial property or BOP insurance (as seen in Figure 3), the generational segments flip in their preferences for these two traditional channels, with Gen X and Boomers preferring agents/brokers by 15% and Gen Z and Millennials preferring insurance company websites by 12%.

Gen X and Boomers SMBs have less interest in all other channel options except for the soft embedded option of purchasing insurance when buying the property or signing the lease (42%). In contrast, Gen Z and Millennial SMBs are interested in all the channels – consistent with their expectations of a multi-channel world. In particular, their interest is exceptionally strong for the embedded options of buying the property/signing the lease (75%), including the property loan (73%) and from a property security service (75%). And once again, the High-Tech channels do very well with Gen Z and Millennials, reaching 50% interest or higher. This means that finding the right placement for insurance products is now an imperative issue AND a real opportunity.

Figure 3: Interest in channel options for commercial property/BOP insurance

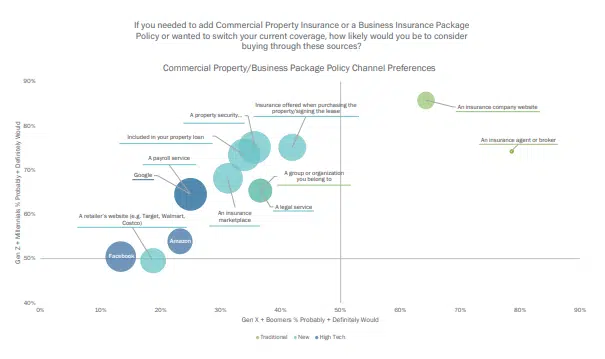

In another view of this data, Figure 4 emphasizes the dominance of the two traditional channels (agents/brokers and insurance company websites) in the upper right-hand quadrant in terms of interest. The larger bubble for insurance company websites indicates Gen Z and Millennial SMBs’ greater preference for this channel as compared to the older generation.

Because of the lower interest by the older generation and large gaps between the two generational groups, the other channels are represented by larger bubble sizes – highlighting market opportunities for the younger generation for insurers.

Figure 4: Generational alignment on interest in channel options for commercial property/BOP insurance

The new and growing spectrum of channel options, especially the exciting opportunities for embedded insurance, will give innovative insurers and their partners tremendous opportunities for growth, with new markets, new offerings, satisfied and loyal customers. Majesco’s Digital Customer360 for P&C and Digital Agent360 for P&C[DG3] , with new and growing AI tools, will place Commercial and BOP insurers in a position to capitalize on their Right Place, Right Price approach.

Workers Compensation and Cyber Insurance

As businesses continue to adapt to the impacts of the pandemic, low unemployment, new work options, and inflation, they are adjusting their operational models to meet employee needs and expectations, which, in turn, has implications for workers compensation. As companies look to emerging trends and risks such as marijuana legalization, remote working, mental health and wellness, and increased use of Gig workers, the impact on SMBs and workers compensation insurance will drive insurers to rethink their approach.

In addition, cyber will continue to rise to the top as SMBs accelerate the digitalization of their business. According to a report by Gallagher, “After three years of hardening conditions, the cyber insurance market has finally begun to show signs of stabilization and from a premium perspective, cyber insurance buyers are seeing smaller rate increases and, in some cases, even flat renewals.”[ii]

Managing and minimizing these risks will become ever more crucial to SMBs, reflected in the interest in value-added services.

Demand for Value-Added Services

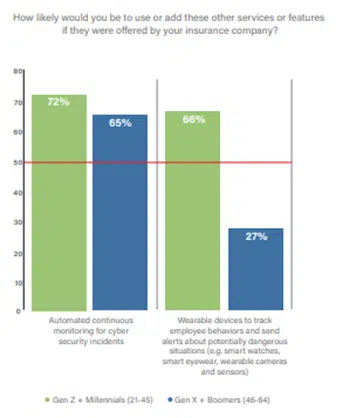

Cyberattacks are on the rise for SMBs, many of whom are ill-equipped to handle or recover from an attack. Consequently, cyber risk/data security is the fifth most important top-of-mind issue for both Gen Z and Millennials (66%) and Gen X and Boomers (63%) as previously noted. As such, it is not surprising there is very high interest by both generational segments in the value-added service of automated, continuous monitoring for cyber security incidents (72%, 65%), as seen in Figure 5. With their increasing digital capabilities, minimizing this risk becomes increasingly important to their ongoing business operations as well as for keeping their customers’ trust. Leading insurers offering cyber insurance are working with their customers to provide these services, differentiating them in the market as well as helping to minimize any losses.

Interest in worker’s compensation value-added services diverge between the two generational groups. Gen Z and Millennials’ strong interest in using wearable devices to monitor employee behaviors for potentially unsafe situations (66%) is in stark contrast to that of Gen X and Boomers, with a gap of 39%.

With the rising interest in wearables by individuals through Fitbit, Apple Watch, and other devices, these devices have the potential to prevent accidents or injuries, streamline the recovery process, reduce claims, and ultimately, improve health and financial outcomes for employees and employers through a speedy recovery. Insurers should take advantage of the interest of the younger generation of SMBs with new, innovative products and value-added services attached to them.

Figure 5: Interest in value-added services with data breach/cyber and workers compensation insurance

Expanding Channel Options

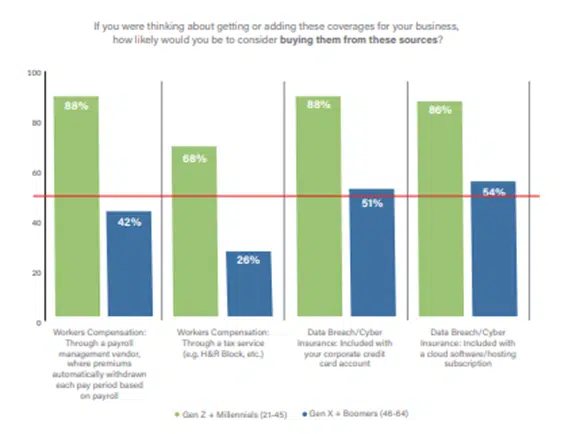

As reflected in Figure 6, Gen Z and Millennials continue their high interest in new channels for both workers comp and data breach/cyber security, ranging from 68% to 88%.

However, a disparity emerges for Gen X and Boomers between these two lines of business. Their interest in two embedded options for cyber insurance exceeds the 50% midpoint, but their interest in new workers comp channels is lower, reaching just 42% for obtaining it through a payroll management vendor and 25% for obtaining it through a tax service. We could speculate that Gen X and Boomers’ views on these two types of coverage could be influenced by their longer experience with workers comp, and the fact that it is often a required coverage.

Both areas are seeing increased or emerging risk for SMBs, leaving many unprepared for the potentially serious consequences. Insurers offering these products should look to other channels to help educate and offer these products, helping SMBs while also growing their business.

Figure 6: Interest in channel options for data breach/cyber and workers compensation insurance

Understanding these pain points for SMBs is the equivalent of understanding the opportunities as an insurer. Every new threat represents a new possibility for insurance to play a role. And each new product and service has the potential to be purchased at a point of sale or use — meaning that digital service and multi-channel strategies are crucial to serving the new SMB cohort.

As an insurer, no matter where you are in the process of product and channel expansion for Commercial and BOP P&C, Worker’s Comp, and Cyber, your organization can take advantage of Majesco’s new, revolutionary Intelligent Core solutions for insurers. Majesco P&C Intelligent Core Suite, Loss Control, Property Intelligence and Digital 360 Solutions are[DG4] designed to be the most flexible and robust system solution available — capable of handling a far wider range of business products and channels than ever before. Majesco’s intelligent core platforms harness the power of microservices, APIs, cloud, AI/ML, generative AI, pre-configured content and best practices, access to new data sources, and an ecosystem of innovative capabilities.

For a clearer picture of how your company can take advantage of all that Majesco offers, be sure to tune into the Majesco webinar, The Dawn of Intelligent Core Insurance Software today.

[i] Cavignac, Jeff, “What to Expect for the Commercial Insurance Market in 2023,” Risk Management, November 21, 2022, https://www.rmmagazine.com/articles/article/2022/11/21/what-to-expect-for-the-commercial-insurance-market-in-2023

[ii] Farley, John, “2023 U.S. Cyber Market Conditions Outlook Report,” Gallagher, January 2023, https://www.ajg.com/us/news-and-insights/2023/jan/2023-us-cyber-market-conditions-outlook-