"Ridiculous" budget process – legislator speaks out on NFIP

“Ridiculous” budget process – legislator speaks out on NFIP | Insurance Business America

Catastrophe & Flood

“Ridiculous” budget process – legislator speaks out on NFIP

The system is tricky, constituents tell Rep. Gottheimer, who says reforms are needed

Catastrophe & Flood

By

Mark Schoeff Jr.

Congress likely will continue to renew federal flood insurance with short-term funding approvals rather than reauthorize it for multiple years, Rep. Josh Gottheimer, D-N.J., told brokers recently.

Congress extended the National Flood Insurance Program through the end of the government fiscal year, Sept. 30, as part of an appropriations bill it approved in March to fund several federal agencies. The legislation ensured the government would avoid a shutdown after lawmakers wrangled for months over spending levels.

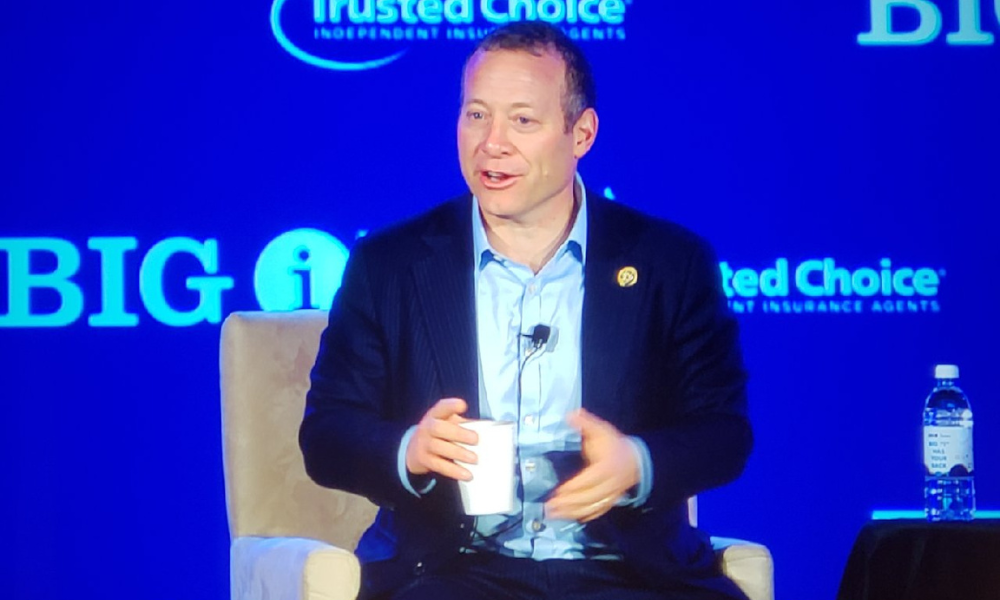

Gottheimer (pictured above) predicted that Congress would again lurch through a series of short-term funding bills in the next appropriations process. That likely would mean a limited extension for the NFIP rather than a reauthorization of several years that could also include reforms that the Big I and other insurance trade associations are seeking.

The razor-thin political margins on Capitol Hill – where Republicans hold a 218-213 majority – will prevent the compromise required for a long-term budget policy, Gottheimer said last Thursday at the Independent Insurance Agents and Brokers of America Legislative Conference in Washington.

“I don’t think that’s going to happen in this Congress,” said Gottheimer, a member of the House Financial Services Committee. “We’re going to keep doing this punt, which is ridiculous. A lot of what we do doesn’t make sense to me, these month-to-month things.”

Big I seeks NFIP reform

In a document given to its members for their Capitol Hill meetings, the Big I advocated for a bill that would give private flood insurance a role in meeting “continuous coverage requirements” and ensure that people who leave the NFIP for private insurers can return to the NFIP without penalty.

The Big I “also opposes any policies that would…undermine the valuable and trusted role that independent agents play in the offering, sale and servicing of flood insurance,” the talking points state.

The NFIP is top of mind for his constituents, Gottheimer said.

“It’s one of the things that people talk to me a lot about at home,” Gottheimer said. “They’re having trouble getting coverage. [They tell him] how tricky the system is. So, I think some of these reforms would actually be really, really helpful.”

Gottheimer spoke to more than 600 Big I members before they set off for talks on Capitol Hill with members of the House and Senate and congressional staff.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!