“Rich supply curves” can drive successful allocations for reinsurers: Tremor

Submitting “rich supply curves” for reinsurance capacity can result in a more successful allocation for a reinsurer, according to Tremor Technologies, the insurtech operator of a programmatic risk transfer marketplace.

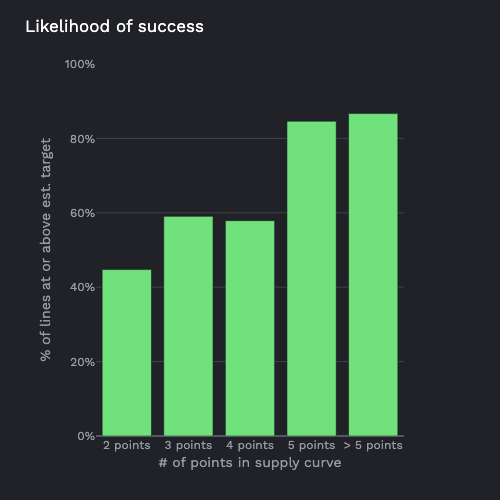

Tremor Technologies has analysed data from its marketplace on the reinsurance capacity supply curves submitted by reinsurers, finding that there is a “strong correlation between the likelihood of a successful allocation and the number of points in a reinsurer’s supply curve.”

Tremor believes that “reinsurers who provide richer supply curves are more likely to hit their target” when it comes to deploying their capacity.

The company explains that, “Rich supply curves as part of the anonymized aggregate supply that the cedent sees are more likely to be realistic and influence the cedent’s final pricing.”

Which Tremor says, can lead to “a successful allocation for the reinsurer.”

We’ve written before that the ability to fine tune deployments of reinsurance capital, by expressing preferences that dictate a reinsurer appetite to deploy and at what price, can be a very effective way to more dynamically build portfolios.

At the same time, buyers of protection should also be able to express their preferences as to how they want to buy, and their appetite for cost of coverage as well.

Sean Bourgeois, Tremor CEO explained, “Why is this important? Reinsurers are portfolio managers – they have different pricing strategies that vary with quantity, peril, region and more.

Sean Bourgeois, Tremor CEO explained, “Why is this important? Reinsurers are portfolio managers – they have different pricing strategies that vary with quantity, peril, region and more.

“Only Tremor offers reinsurers the opportunity to express their precise and complete strategy per placement in confidence – which allows us to deliver transparent, competitive market clearing prices for cedents every time.”

Using technology, reinsurers can set different preferences for the supply of their capacity, such as being willing to increase line sizes at certain rates and pricing.

In essence, the likelihood of success increases with more points added to a supply curve, meaning those reinsurers that think about how their capacity can be dynamically deployed, while their pricing can attract cedents, could stand to benefit.

The company has provided some data to help explain how these supply curves work and how they can be used to influence the success of allocations.

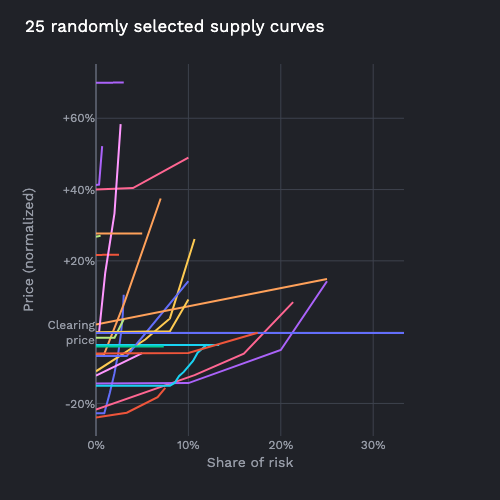

“Each normalized supply curve below represents a reinsurer’s authorization for a specific placement: the y-axis is reinsurer’s price relative to the clearing price, the x-axis is the line size as a share of the risk. The curves effectively represent different strategies. Some are flat and connect two points, but the majority use sloping segments to indicate line sizes increase with price at different rates,” Tremor explained.

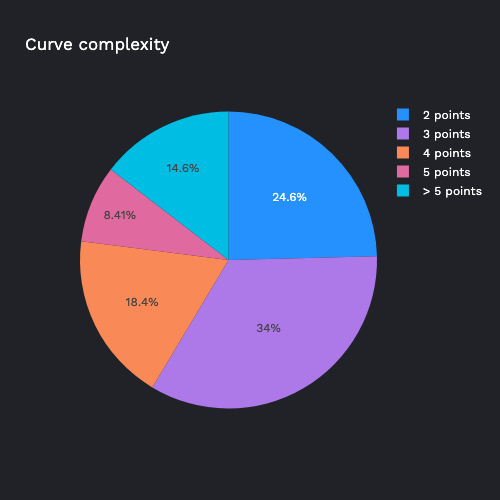

Continuing to say, “As for the whole population, the number of points in a supply curve is an important metric that captures the overall complexity of the reinsurer’s authorization. As the number of points increases, so too does the allocative precision that the reinsurer will get; reinsurers with more points in their supply curve tune their line based on the final price chosen by the cedent.

“The chart below breaks this down for real curves, more than 40% of Tremor supply curves include at least 4 points.”

Tremor CEO Bourgeois further explained, “Insurers and reinsurers have just experienced a historically challenging renewal season where the negotiation process was painful and extensive, nobody ended up with what they wanted and price discovery was almost non-existent.

“The common process this year of re-issuing FOTs and short placements said it all – the prices were wrong and there was no visibility to understand incremental cost in real time.

“Tremor offers the reinsurance market tools so that both sides can avoid this pain, delivering true market clearing prices with real time incremental cost analysis – this is all possible because we are able to capture reinsurer’s unique strategies and risk appetites in a way that only Tremor’s modern market tech and confidentiality rules can.”

This is all about making capital work harder and more efficiently, while helping to ensure cedents have a greater chance to fill their program needs, while making sure reinsurers risk appetites are met and adhered to.