Retro rates can rise further, but usage to reduce amid higher pricing: S&P

With pricing for retrocessional reinsurance having soared over the last couple of years and global reinsurance firms reducing their appetites for natural catastrophe risk, S&P Global Ratings believes this could drive a reduction in the use of retro protection.

A new report states that the catastrophe risk appetite of global reinsurance firms varies at the moment, with some eager to assume more, others much less.

Still further differences are evident in the appetite for risk, with many reinsurers shifting their appetites towards the mid and higher layers of property catastrophe reinsurance towers.

S&P explained that, “More than half of the top 20 global reinsurers maintained or reduced their natural catastrophe exposures during the January 2023 renewals, despite the improved pricing terms and conditions and rising demand.”

But in its latest report S&P also states that retrocession use could drop, given the changes in appetite being seen, meaning less catastrophe risk assumed at the more volatile layers, while pricing and rates for retro protection are so much higher.

“We expect the top 20 global reinsurers to deploy more capital toward catastrophe risk in 2023 and 2024, because of continued strong demand from cedents, while higher retrocession cost could lead reinsurers to ceding less of their risk,” S&P Global Ratings credit analyst Charles-Marie Delpuech explained.

Since the start of 2023, capacity available for retrocession has been somewhat constrained, S&P said, including the use of third-party capital.

The rating agency says that, based on data at January 1 2023, “Reinsurers have tended to reduce their use of retrocession for tail risk in 2023 as a result.”

The rating agency continued to explain that, “We expect that rates in the retrocession market will continue to increase.

“This means reinsurers may have to cede proportionally less of the risk if it becomes too expensive. ”

Given the constraints on capacity for retrocession, as well as the fact retro protections have generally moved higher up, in terms of attachment, while aggregate retrocession is much less available and collateralized reinsurance sidecars generally shrunken for many, it seems natural to imagine the price could increase, if the demand was there to drive it higher.

But the demand for protection may not be so abundant, especially as traditional reinsurers also move their focus higher up the reinsurance tower.

S&P said that there could be more appetite to deploy capacity to catastrophe risks through the end of 2023 and into 2024, but this may not translate into more use of retrocession.

“We think those reinsurers that will aim to deploy more capital in 2023 and 2024 may decide to rely less on retrocession,” the rating agency said.

However, the rating agency noted that, “The top 20 reinsurers remain large users of retrocession, and it will remain a key risk management tool.”

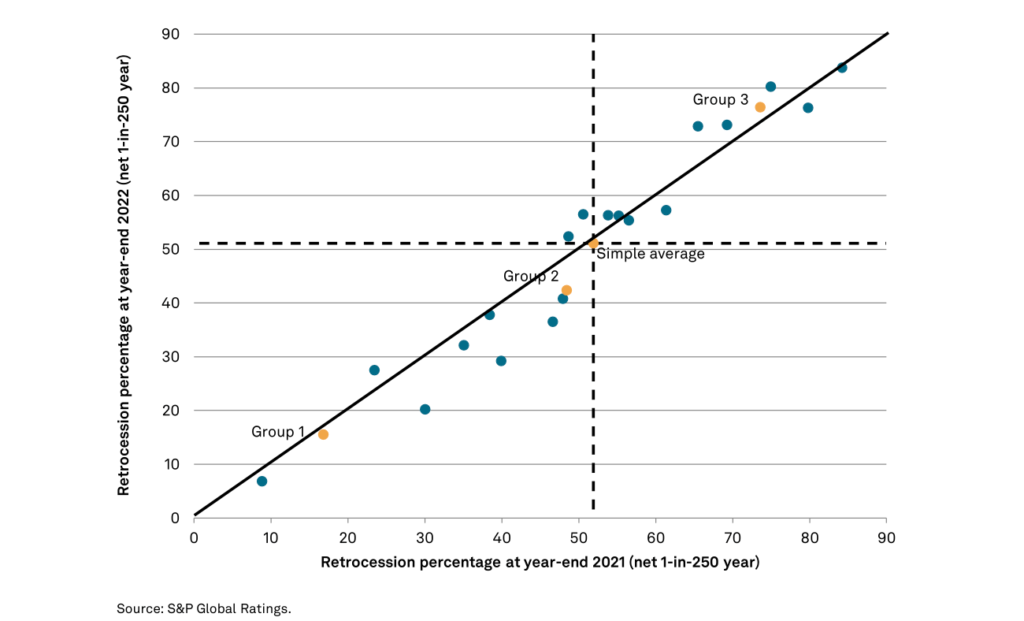

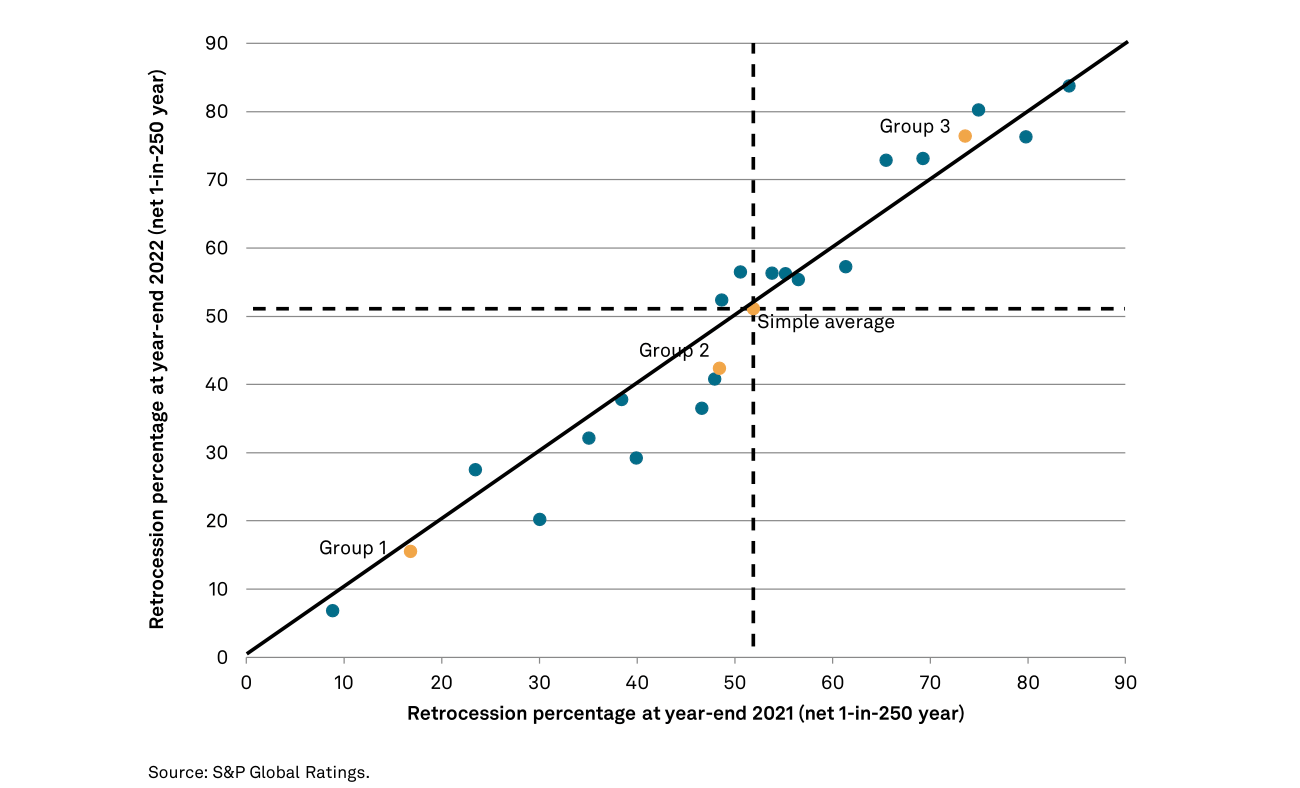

“As of Jan. 1, 2023, reinsurers ceded slightly over half of their 1-in-250 exposure, on a simple average basis. However, average utilization ratios mask a wide range of coverage. Large global reinsurers typically retrocede less risk, for example,” S&P explained.

Retrocession use still varies wildly across the cohort of top reinsurance firms, as the chart seen to the right here shows.

Retrocession use still varies wildly across the cohort of top reinsurance firms, as the chart seen to the right here shows.

What does now appear to be the case, is that the days of running a reinsurer on the back of cheap retrocession are behind us and it will not be possible to mask poor underwriting performance by ceding losses to retrocessionaires and third-party capital providers.

Some reinsurers have built their businesses on the back of retro and going forwards it seems likely that will prove a costly strategy, at least as a pure buyer.

It’s possible leveraging capital provider appetite for retrocessional risk through partnership structures, sidecars and other joint ventures, would remain a viable way to grow a reinsurance business.

But even there, the margin benefits are not where they once were, when the retro proved so cheap there was a margin override to be earned on the inwards business.

While nat cat appetites adjust and reinsurers find a new equilibrium, in terms of their inwards cat appetites versus availability of retro protection, some retro strategies may shrink further, it seems.

But there remain some major reinsurers for who retrocession programs are absolutely key partnership strategies, Hannover Re for one, and here the retro side is likely to keep expanding, as these reinsurers grow as well.

One area that retro capacity has proven more abundant is the catastrophe bond market, with a reasonable amount of activity in the industry loss trigger cat bond space, which are largely providers of retrocession for reinsurers.

The cat bond market has proven a cost-effective source of retrocession through the first-half of 2023, and it will be interesting to see if that continues and whether the cat bond market can benefit from any reduction in retro capacity via other collateralized and traditional writers.