Renters Insurance: The Important Things College Students Need to Know

As a college student, we know there’s a lot on your mind as the school year approaches. From meeting new friends and gaining independence to writing research papers and eating (sometimes questionable) food in the dining hall, the last thing you want to worry about is insurance.

We’re here to help you understand how renters insurance works when you go off to college, so you can focus on the exciting parts of this stage of life.

Let’s start by answering one fundamental question.

Do you need renters insurance when you move away to college?

The answer is yes! Whether you live in an on-campus dorm or an apartment or house off campus, you need a renters insurance policy so your belongings are covered in case they are damaged or stolen.

Although burglaries, pipe bursts, smoke damage and vandalism are unexpected, they can happen and before they do, it’s important for you to know that your personal possessions are covered.

Let’s take your laptop for example; its value goes beyond the price tag. Your laptop stores important assignments and papers that you’ve worked on for hours. No matter where you are on campus – your dorm, the library, the dining hall – if your laptop is damaged or stolen by a covered peril, it would likely be covered by your renters policy. While it won’t re-write your six-page paper on the Neolithic age, a renters insurance policy could lessen the emotional distress you might feel in the event of a damaged or stolen laptop.

Now, you might be wondering if you are covered by your parents’ policy or if you need to buy your own?

This depends on your age and enrollment status. If you are younger than 24 years and enrolled as a full-time student, you might qualify for coverage by your parents’ policy. This should happen automatically but you should always feel free to contact your insurance agent to confirm. If you are older than 24 years and enrolled as a part-time or full-time student, you do not qualify for parental coverage. If you don’t qualify, this is a great opportunity to gain even more independence by purchasing your own renters insurance policy.

For more details on whether or not you will be covered by your parents insurance, it is a good idea to reach out to their current insurance carrier and ask.

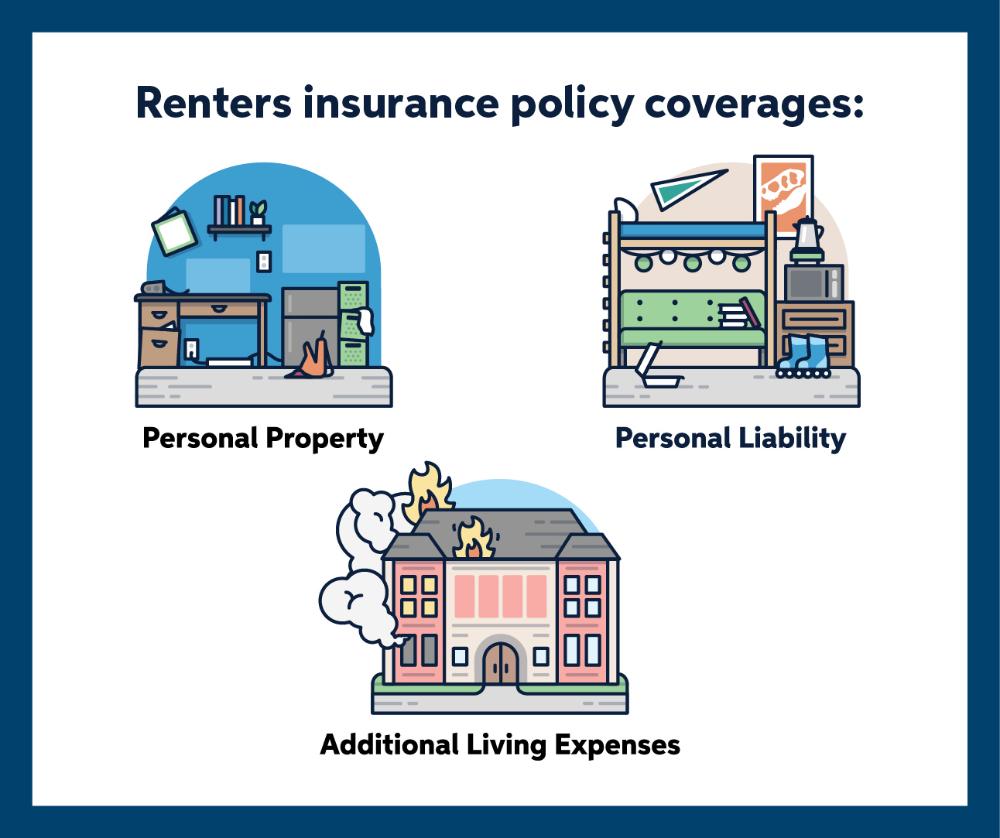

A renters insurance policy includes the following coverages:

Personal Property: Covers your personal property in the event of a loss caused by common perils

including fire, smoke, theft, water damage, vandalism and more

Additional Living Expense: Covers your living expenses, over your usual expenses, when your home/dorm is uninhabitable because of a covered loss

Personal Liability: Covers you against lawsuits arising from bodily injury and property damage as well as the cost of legal defense

We also offer optional additional coverages to help further your feeling of peace of mind. For more information or to get a quote, reach out to a local, Bolder Insurance advisor.

Disclaimer: This article is not expert advice. The analysis of coverage is in general terms and is superseded in all respects by the Insuring Agreements, Endorsements, Exclusions, Terms and Conditions of the Policy. Some of the coverage mentioned in this material may not be applicable in all states or may have to be modified to conform to applicable state law. Some coverages may have been eliminated or modified since the publishing of this material. Discounts may not be available in all states. Limitations and conditions may apply. Premiums will be based on benefits chosen. Please check with your local Independent Bolder Insurance Advisor for details.

This article provided by Auto-Owners Insurance, a Bolder Insurance partner.