Reinsurers (and ILS) can absorb any hurricane Helene losses within earnings: S&P

While the majority of industry losses from hurricane Helene are expected to fall below primary insurers reinsurance attachment points, any that do flow to reinsurers should be able to be absorbed within earnings thanks to the structural changes of the reinsurance reset, S&P Global Ratings has said.

S&P said that, “Early insured loss estimates of Hurricane Helene are in the mid-single to low-double-digit billions of dollars.”

Adding, “We think the losses will be an earnings event, rather than a capital event, for the primary U.S. property/casualty insurers we rate.”

Despite hurricane Helene, S&P Global Ratings believes that, “Full-year 2024 losses from natural catastrophes for most insurers should remain within their budgeted expectations.”

The rating agency went on to say, “If the early insured loss estimates hold up, S&P Global Ratings thinks the losses will reduce full-year earnings for some of the U.S. property/casualty (P/C) insurers we rate but should not result in a loss of capital.”

S&P highlighted that a catastrophe industry loss in the $5 billion to $15 billion range is not material to the market, relative to the re/insurance sector capital base and surplus base of $1.1 trillion as of June 30th 2024.

The impact on individual insurers will vary, especially for small and regionally focused carriers, S&P noted, adding that it anticipates primary insurers will retain the majority of the hurricane Helene loss.

“Total losses will, in most cases, fall below the attachment points of primary insurers’ property catastrophe excess-of-loss reinsurance programs,” S&P explained.

Adding that, “Insurers have been increasing their retentions to help offset the higher cost of reinsurance,” which means the majority will be retained rather than be passed through to sources of reinsurance capital.

Where losses from hurricane Helene do flow to reinsurance and also insurance-linked securities (ILS) capital, as there will be some, S&P is not expecting them to trouble any reinsurance capital providers.

Given portfolios are diversified and constructed of shares of reinsurance layers from across the market, no single reinsurance provider is likely to be particularly badly hit.

In addition, S&P said that losses should be able to be absorbed within the earnings of reinsurers.

That goes for ILS funds and investors too, as any losses from Helene to flow to the ILS market are unlikely to be sufficient to erode even second-half returns, let alone the returns earned for full-year 2024.

Here, the reinsurance reset experienced over the last two years, as attachments moved higher, terms were tightened and pricing raised, helps to insulate reinsurance capital.

Were hurricane Helene’s industry losses to end in the double-digit billions, five years back that would still have resulted in reinsurers and ILS capital taking a reasonable share of the loss. Now, it is expected to be minimal, for a catastrophe loss at that level.

S&P said, “Given the structural changes in the reinsurance market since 2023 and the strategic actions reinsurers took during the renewals, we believe their potential losses from Hurricane Helene are manageable and absorbable within their earnings. Some of the key reinsurance industry structural changes include increasing attachment points, tightening terms and conditions, not offering aggregate covers, and repricing property catastrophe risk.

“In addition, the reinsurance sector is bolstered by robust capitalization, supported by strong operating earnings in the first half of 2024, positioning it well to handle potential catastrophe claims.”

S&P further explains that the NFIP will also take a significant claims burden from hurricane Helene.

As we’ve reported before, our sources are suggesting the NFIP loss could be in the $3 billion to $5 billion range at this time, which would be below the levels required to attach reinsurance or catastrophe bonds.

Also read:

– Hurricane Helene private/public insured losses likely at least in higher single-digit billions: Aon.

– Some nerves evident as Helene’s Florida claims outpace Idalia, State Farm’s outpace Ian, & on NFIP.

– Hurricane Helene insurance industry loss estimated close to $6.4bn by KCC.

– Direct cat bond losses still seen unlikely from Helene, but NFIP bonds monitored: Twelve Capital.

– Hurricane Helene floods over 100k buildings, at least 10k to over 5 feet: ICEYE.

– Hurricane Helene insured losses anywhere from mid-single to even double-digit billions: RBC.

– Florida reinsurance dependency in focus after Helene, with $5bn+ loss expected: AM Best.

– FEMA’s NFIP reinsurance & cat bonds in focus after catastrophic flooding from Helene.

– Hurricane Helene private insurance loss seen mid-to-high single-digit billions: Bowen, Gallagher Re.

– Hurricane Helene economic loss in $20bn – $34bn range: Moody’s Analytics.

– Hurricane Helene insured wind/surge property loss in Florida/Georgia initially said $3bn – $5bn: CoreLogic.

– Losses to per-occurrence cat bonds from hurricane Helene currently seen as unlikely: Twelve Capital.

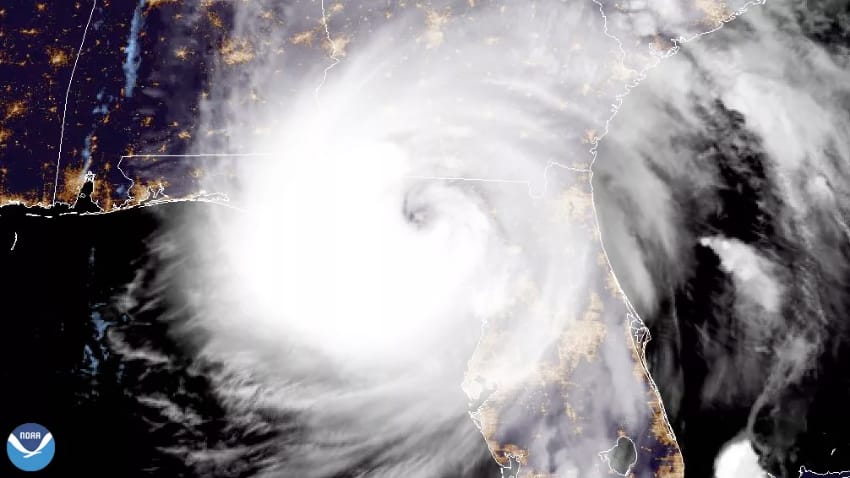

– Hurricane Helene landfall at Cat 4 140mph winds, Tampa Bay sees historic surge flooding.

– Hurricane Helene industry loss seen $3bn to $6bn if Tampa avoided: Gallagher Re.

– Minimal to no cat bond impact expected from hurricane Helene if track unchanged: Plenum.