Reinsurer underlying ROE’s still trail rising cost of capital: Gallagher Re

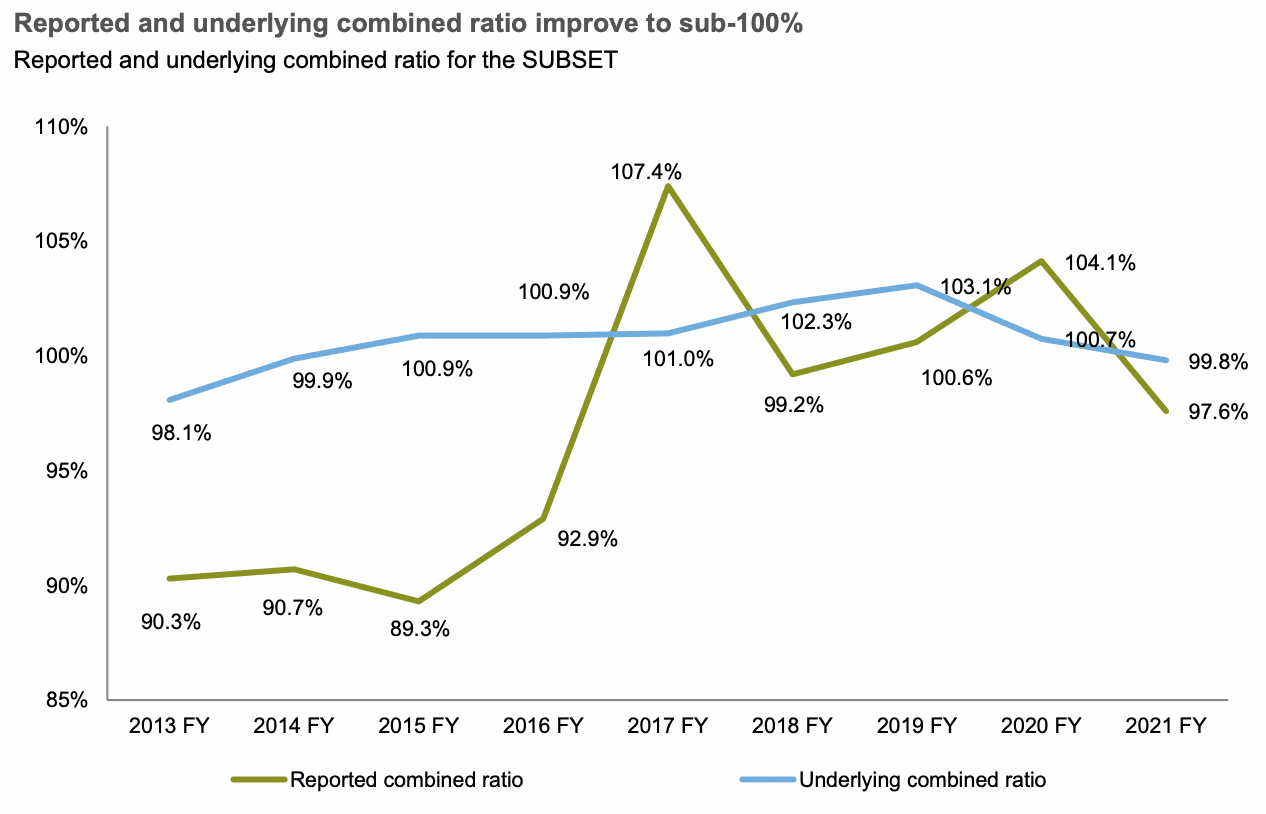

There has been further improvement in the underwriting performance of the cohort of reinsurance firms tracked by Gallagher Re, but while their underlying combined ratio has fallen below 100 for the first time since 2014, their underlying returns on equity remain depressed.

The Gallagher Re team have been tracking reinsurance performance and results in their regular reports for some years now, formerly under the Willis Re brand.

Two key metrics we tend to watch as signals for reinsurance market underwriting profitability, as well as the efficiency and comparability of traditional reinsurance to other lower-cost capital sources, are the underlying combined ratios and return-on-equity (ROE) of the subset of reinsurers the broker gets full data disclosure from.

Gallagher Re explained that, “Reinsurers’ weighted average reported combined ratio was 97.6%, a sharp improvement from the COVID-19-impacted 104.1% in 2020. While COVID-19 continued to impact daily lives last year, it barely registered in terms of reinsured losses due to prudent reserving undertaken by companies in the prior year. The sector did absorb a heavy load of natural catastrophe losses, although these were no worse than the latest five-year average.

“Reinsurers’ underlying combined ratio, excluding prior year development and normalising for natural catastrophe losses, improved from 100.7% to 99.8%, the first time it has been sub-100% since 2014. While inflation is a growing concern, to date rate increases have outstripped claim trends. This drove down loss ratios and the strong premium growth also improved expense ratios.”

On the combined ratio side, Gallagher Re notes the concern that inflation is raising in the industry, but said that, “To date rate increases have outstripped claim trends. This drove down the ex-nat cat accident year loss ratio last year and a lower expense ratio also helped.”

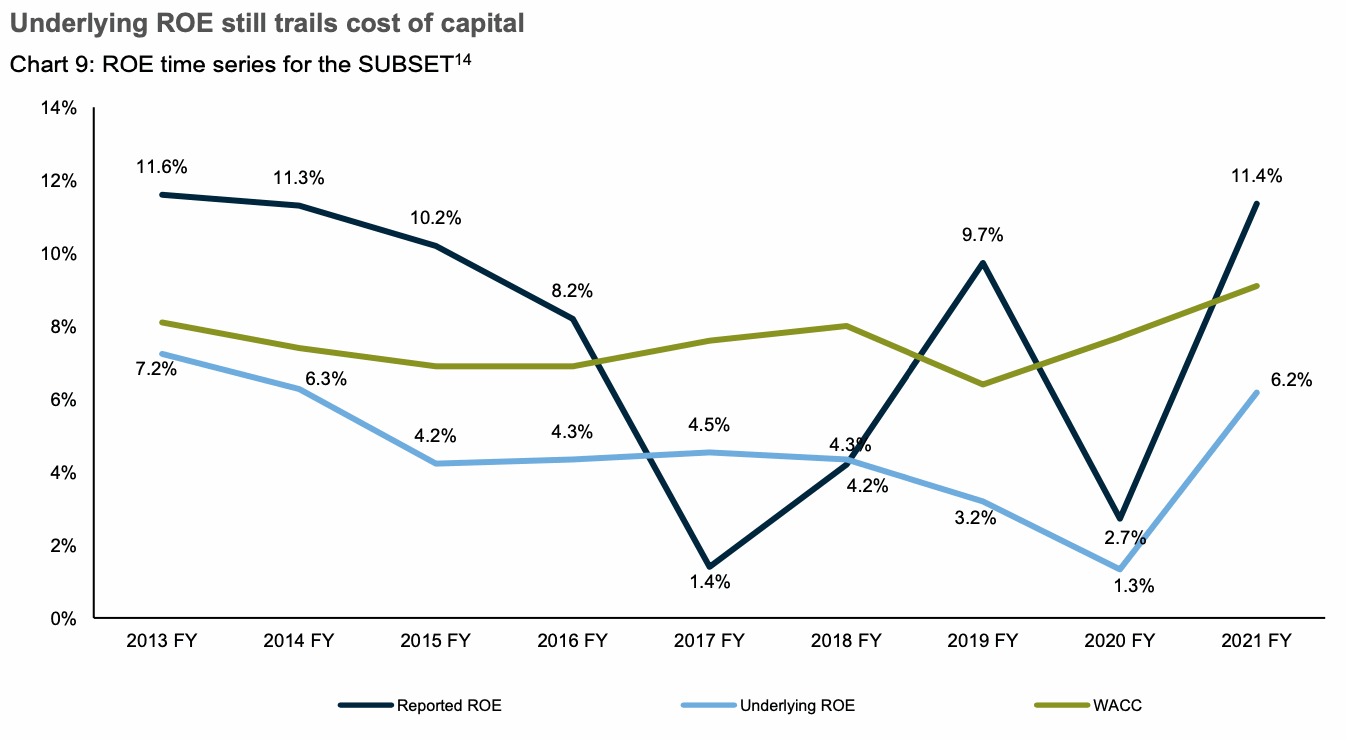

At the same time, the average return on equity (ROE) saw a marked improvement as well in 2021, leaping from from 2.7% to 11.4% on a reported basis, and from 1.3% to 6.2% on an underlying basis.

“That said, the industry’s underlying RoE does not yet meet its cost of capital, which exceeded 8% in 2021,” Gallagher Re said.

The drivers of ROE improvement were an increased return on investments and a decrease in pandemic-related losses, Gallagher Re said, so we shouldn’t get too excited that this is an underwriting driven improvement in reinsurance returns.

But, each component of the ROE did actually improve in the last year, which includes underwriting margins, which we’d imagine was largely driven by rate gains.

Interestingly though, the weighted average cost of capital, as measured by S&P, is now at a high in the chart above, which Gallagher Re notes is due to higher equity and credit risk premiums.

Given the increased use of alternative capital sources, the general access to capital improving and its fungibility always on the rise, plus the modernisation and digitalisation efforts that should drive efficiency, you would be forgiven for thinking the cost of capital of the reinsurance industry might have steadily fallen over recent years.

Premium expansion has brought down the expense ratio across the subset of companies Gallagher Re tracks, to 29.7% for 2021.

But as reinsurers continue to fail to meet their cost-of-capital, on an underlying basis, it’s perhaps increasingly likely they will continue to find ways to utiltise lower-cost capital sources to help them manage volatility on their balance-sheets.

James Kent, Global CEO, Gallagher Re, commented, “The 2021 result is good news for reinsurers and insurers alike. Reinsurers faced another year of significant natural catastrophe losses, yet still came out with a robust and improved performance across their overall portfolios. Insurers in turn benefited from the strong capitalisation and resilient performance of the reinsurance sector.”

Also read: Alternative reinsurance capital grew 4% to $94bn in 2021: Gallagher Re.