Reinsurance prices to rise by mid-single digits in 2024: Moody’s survey

Moody’s Investors Service has surveyed reinsurance buyers and found that more than 70% of respondents expect reinsurance prices to continue to rise into 2024.

The overall sentiment is that rate firming in reinsurance will continue and remember this is the sentiment of the buy-side, not the sellers of protection.

Moody’s said that, “The majority also believe prices will continue to increase beyond 2024 across both casualty (82%) and property (70%) lines, we believe this is likely as a result of climate related uncertainty and the inflationary environment.”

Moody’s surveyed 42 global property and casualty (P&C) reinsurance buyers to secure the data, and highlighted that “anticipated price increases reflect ongoing claims inflation, particularly in property lines, and somewhat more limited reinsurance capacity.”

But the rating agency added that, “However, most respondents do not intend to purchase more reinsurance protection in 2024, suggesting that primary insurers will absorb a greater share of future losses.”

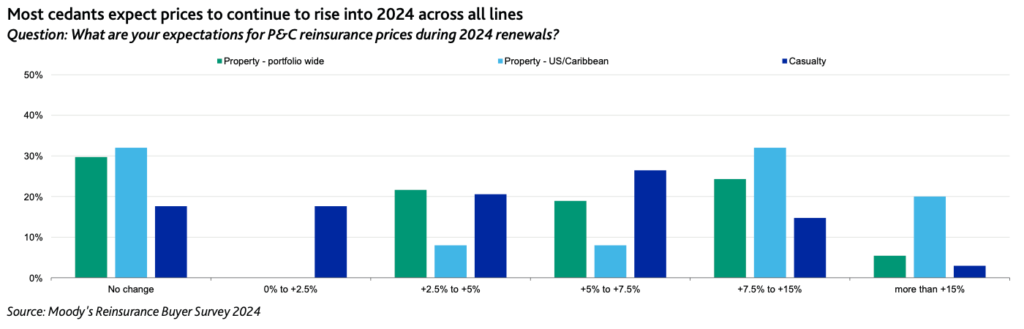

Roughly 44% of respondents expect casualty reinsurance price rises of more than 5%, which Moody’s noted is similar to 2023.

Around 40% foresee mid-single digit increases in property reinsurance costs, Moody’s said.

But there are differences, depending on region.

For US and Caribbean property reinsurance renewals, over 30% of respondents are anticipating rate increases of +7.5% to +15%, the data shows.

While 20% expect property reinsurance rates will increase by more than 20% in 2024.

Almost all of the responding cedants see claims inflation as the key driver of price rises, while more than 60% also cited lower reinsurance capacity being available as a contributing factor, Moody’s said.

Moody’s also noted that “climate related uncertainty” is believed to be another factor that will drive reinsurance prices further along their upwards trajectory.

It’s interesting that some 30% of respondents said that they expect no change in property reinsurance prices in 2024, but Moody’s does not break down price expectations by region of respondent, which may explain the spread.

Moody’s also noted that, “A small minority believe property prices could even start to fall if the 2023 hurricane season is benign, and capacity continues to return to the market.”

Conversely, “Cedants forecast the strongest price increases in catastrophe-exposed property lines, particularly in the US and Caribbean market, with 52% expecting price rises of more than 7.5%, only slightly below 56% last year,” Moody’s explained.