Reinsurance has a self-healing mechanism, investors may not have realised: Swedroe

Some investors may not have realised that “reinsurance has a self-healing mechanism” causing them to miss out on the record year of returns in 2023, according to Larry Swedroe, Head of Financial and Economic Research at Buckingham Wealth Partners.

Swedroe made these comments in taking a deep-dive on the performance of asset manager Stone Ridge’s largely quota share focused Reinsurance Risk Premium Interval Fund in 2023.

As we’d reported last year, by early November investors in Stone Ridge Asset Management’s interval ILS fund strategy were already up by 40%.

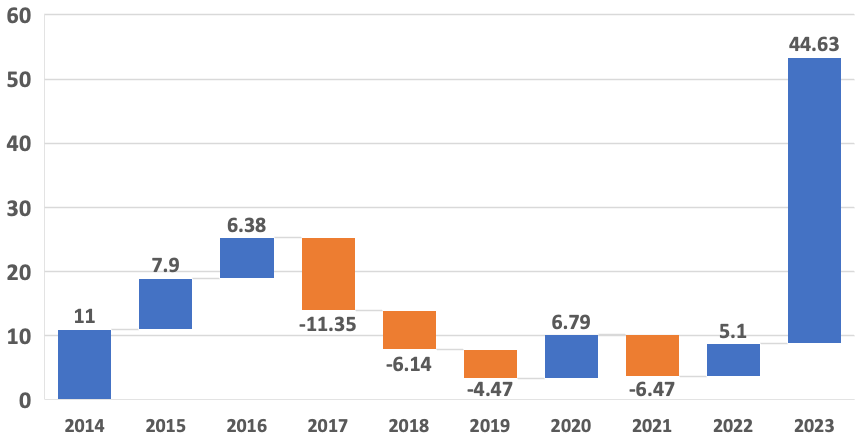

By the end of 2023, this mutual ILS fund had delivered an annual performance of 44.63%, which eclipsed any previous year in the fund’s ten year history of returns.

You can see that ten-year track-record in the waterfall diagram below, which is an interesting way to visualise this and helps to explain Swedroe’s thesis at the same time:

Swedroe notes that returns were within expectations for the first three years of the Stone Ridge ILS interval mutual funds life, but then along came 2017 and things changed.

“In four of the next five years, the fund not only underperformed expectations, but it produced losses. Unfortunately, that led many investors subject to recency bias to flee,” Swedroe explained.

This resulted in a steady decline in assets for this ILS fund strategy, which shrank from a high of more than $6 billion at the mid-point of 2018, to the $1.16 billion of assets the Reinsurance Risk Premium Interval Fund had at the end of October 2023.

Swedroe says there was, among investors, a “failure to understand that risk assets have what I call a “self-healing” mechanism.”

He compares the Stone Ridge strategy to other funds investors might have considered at the time, saying, “SRRIX exhibited a very low correlation to each of the three core funds – providing evidence of the diversification potential benefit of adding SRRIX to a balanced portfolio of stocks and bonds.”

Which should have been an attraction to investors, perhaps enough to keep them invested.

But, more importantly, “reinsurance has a self-healing mechanism” and Swedroe explained, “A self-healing mechanism occurs after periods of losses, not just with insurance but with all strategies that involve risky assets. When losses occurred due to the historic fires in California, not only did premiums rise dramatically, but underwriting standards tightened (such that you could not buy insurance if you had trees within 30 feet of your home, and all brush had to be cleared for another 30 feet) and deductibles increased significantly (reducing the risk of losses). Destruction from hurricanes in Florida caused the same combination of events to occur (rising premiums and deductibles, and tougher underwriting standards).”

He goes on to highlight that this is evident in the performance of the Stone Ridge interval ILS fund strategy, noting that, “Due to the losses, the resulting fleeing of capital, the rise in premiums and an increase in deductibles, the no-loss and the modeled returns have been persistently rising.”

Adding, “By 2023 the no-loss return for SRRIX was over 30%, and the 50th percentile modeled return was over 20%.”

Swedroe then explains that it’s not just a story of higher reinsurance prices, this is also a story of improved contract terms and conditions.

“The increase in premiums and deductibles along with tightened underwriting standards meant that not only was the expected return now higher, but the risk of losses was reduced,” he said.

Although he qualifies this by also pointing out that ILS funds still come with the potential of large drawdowns, saying “there is no risk premium without risk.”

Swedroe concludes that, “Those events are what led to the spectacular returns to reinsurance investments in 2023, with SRRIX returning 44.6%. Unfortunately, many investors had fled and did not earn those high returns.

“Those investors may have failed to understand that because premiums adjust on an annual basis, they need to have a long horizon to realize the true economics of the asset class.”

Adding, “The trend toward rising premiums and tightened underwriting standards has continued into 2024, with the expected return (the mean of a wide potential dispersion of outcomes) once again in the low 20s.”

Swedroe sums up, “Investors willing to accept the tracking variance risk (the risk of underperforming traditional assets) of investing in nontraditional assets that have historically documented risk premiums that have been persistent, pervasive, robust, and survive implementation costs, and have logical explanations for why the premium should persist, can improve the efficiency of their portfolio.”

Over the ten-year track record for the Stone Ridge Reinsurance Risk Premium Interval Fund, as displayed in the waterfall chart further up this article, negative years drove a -28.43 decline, but 2023’s returns alone more than compensated for that.

Of course, this is a rudimentary way to view it, but Swedroe is absolutely correct when he notes the self-healing mechanism of reinsurance and ILS.

That self-healing mechanism is disciplined underwriting and cycle management, something clearly evident over the last couple of years.

Investors can be forgiven for not being aware of this, as even within the reinsurance industry itself many experts had not expected the cycle to bounce back as strongly as it did. In fact, many had predicted the cycle would flatten out, in part thanks to the addition of increasingly efficient capital deployed by investment managers.

There’s still an open question over how long that discipline will last and where the new bottom of the next softening cycle will sit for different types of capital with different levels of efficiency and cost.

But, the ten-year example set by Stone Ridge’s fund clearly shows that investing in reinsurance and ILS should not be for the faint hearted and neither should it be for investors with a short time-horizon on their allocations.