Reinsurance capital still pressured, but ILS opportunity grows: Aon CEO & President

The catastrophe bond market is seen as a bright spot when it comes to reinsurance capital inflows, but overall the market’s capital base remains pressured, although property catastrophe risks appear to have found a pricing equilibrium, Aon’s senior leadership said last week.

Speaking during the broking giant’s second-quarter earnings call, CEO Greg Case and President Eric Andersen both commented on reinsurance capital levels and the fact the catastrophe bond market has seen the most success, when it comes to bringing new capital to clients.

CEO Case noted that Aon is actively helping clients make the best of available capital.

“Our teams continue to help clients navigate a challenging and complex market and are already preparing data, analytics and insight as we help our clients understand and address ongoing volatility and capital considerations,” he explained.

Adding that, “We’re also seeing capital come into the market, particularly in cat bonds. Our team has placed over $5 billion across 21 deals year-to-date.”

Case said, “If you think about what we’re doing in cat bonds and in ILS, you know, we lead the world in this.”

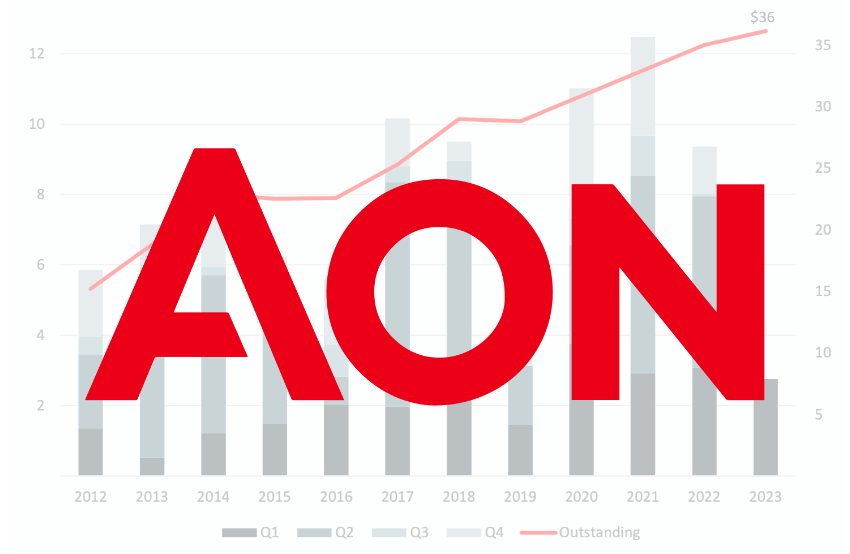

The brokers’ Aon Securities division remains at the top of our catastrophe bond issuance banks and brokers leaderboard.

But, on broader reinsurance capital levels, he explained, “There’s still pressure here. There continues to be pressure on the capital side. We’re incredibly vigilant about finding options, matching capital with risk, in terms of what we do for our clients every day.

“We’re navigating through it, you’re seeing movement on the ILS side. You know, we talked about $5 billion we’ve done, 21 deals year-to-date, which has been phenomenal. So we have seen opportunity there. But it’s still constrained, it’s still pressured.”

Aon President Eric Andersen went on to discuss some of the dynamics being seen with investors in the insurance-linked securities (ILS) market.

“Ultimately we’re seeing investors that have historically invested in cat bonds, either allocate more to it, so they see opportunity, investors that had walked away from the area have sort of returned, as well as new.

“So you’re seeing some expanded market opportunity, which is why I think that market has been so dynamic in the first six months,” he commented.

Then speaking more broadly, on reinsurance capital and property catastrophe risks in particular, Andersen said, “I think on the on the overall capital provision in the reinsurance market, you’re starting to see an equilibrium .

“You’re seeing the big players get more active, who see opportunities, especially on the property cat side and you’re seeing investors look to participate in support.

“Either through their funds or other ways, not necessarily in new company creation, which is sort of what would normally happen in this cycle, but more in support of existing players who are already leaders in the industry.

“So we’re getting to an equilibrium around pricing property cat.”

Looking towards the end of the year, Andersen expects the conversation may not have changed too much.

“Certainly as you go into the the 1-1 renewals, you know, in five months, there’ll be talk of inflation, there’ll be talk of, you know what happens over this hurricane season in the summer and other events, but I do think that as the market has moved, it has found in equilibrium in property cat, as well as on the casualty side of the business,” he explained.