RACQ joins cyclone reinsurance pool

RACQ joins cyclone reinsurance pool | Insurance Business Australia

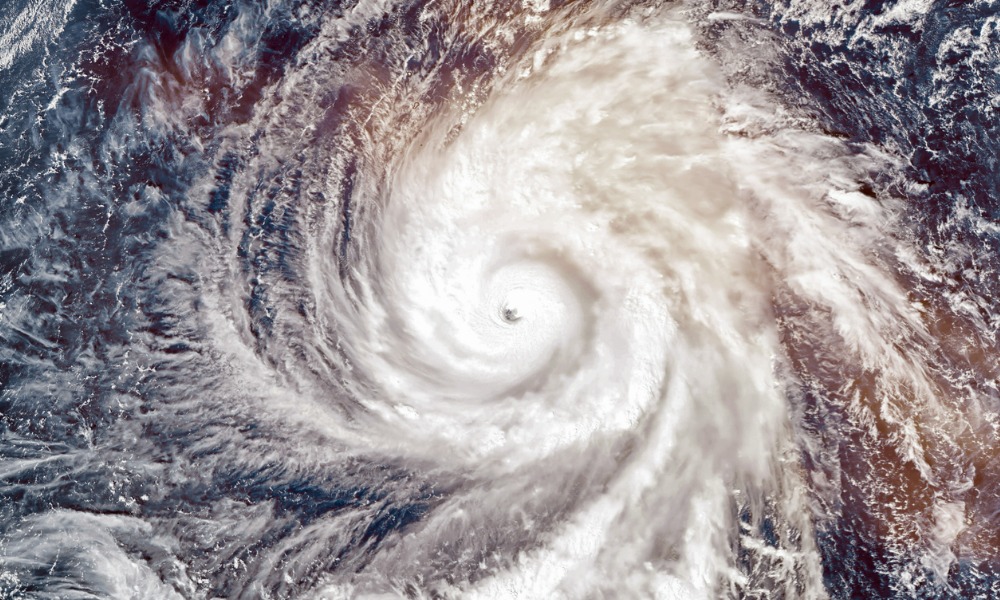

Catastrophe & Flood

RACQ joins cyclone reinsurance pool

CEO highlights crucial points about current model

Catastrophe & Flood

By

Mika Pangilinan

The Royal Automobile Club of Queensland (RACQ) has announced its participation in the federal government’s cyclone reinsurance pool ahead of the 2023-24 cyclone season.

The move comes as Queenslanders grapple with the severe impacts of extreme weather events, coupled with significant premium hikes across the insurance industry.

RACQ CEO Trent Sayers expressed support for the establishment of the pool but highlighted concerns regarding the current model’s design and implementation, stating that it would only yield “marginal benefits” for policyholders residing in the north.

“Unfortunately, home insurance premiums will remain high despite RACQ passing on all the benefits gained from the pool to our members,” said Sayers. “This is a disappointing outcome, and with a review scheduled for 2025, RACQ will continue to recommend changes to the pool’s design that will achieve maximum benefits for homeowners.”

He went on to say that the benefits provided by the pool will “be more than offset by the affordability challenges facing the insurance industry,” such as climate risk and inflation.

The pool charges insurance providers for offering cyclone coverage. It does not provide free cyclone cover to insurers.

The pool offers only partial cyclone cover. For instance, it does not cover insurers for two days following the cyclone’s transition into an ex-tropical cyclone, a period when weather systems often cause the most damage. Insurers must then acquire reinsurance to bridge this gap.

Implementing the pool has incurred significant costs, including ongoing regulatory inquiries and system changes, which ultimately get passed on to consumers.

In addition to joining the pool, RACQ has long advocated for increased investments in natural disaster mitigation and resilience initiatives.

Sayers said RACQ shares the federal government’s goal of maintaining affordable insurance, emphasising the need for further measures to protect Queenslanders. These measures include the removal of stamp duty, increased funding for disaster mitigation infrastructure, home upgrades, and stronger land planning and building regulations.

“Last month we commended the federal government for allocating $84 million of its $200 million Disaster Ready Fund to Queensland and for its commitment to building a long-awaited flood levee in Bundaberg,” he said.

“RACQ will continue to engage all levels of government on this important issue, while advocating on behalf of our members for initiatives and changes that will improve our resilience against the growing threat of climate change.”

What are your thoughts on this story? Feel free to comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!