Put Your Money Where Your Heart Is: How One Insurer Makes Insurance More Affordable & Accessible

This post was written in collaboration with Prudential. While we are financially compensated by them, we nonetheless strive to maintain our editorial integrity and review products with the same objective lens. We are committed to providing the best information in order for you to make personal financial decisions with confidence. You can view our Editorial Guidelines here.

This is the second article in Put Your Money Where Your Heart Is, a series of five articles written in collaboration with Prudential that tackles the topic of Environmental, Social and Governance (ESG) and takes a closer look at responsible insurance and investment.

We’ve said it time and time again: Insurance is an essential part of any financial plan and we all need some form of insurance to protect ourselves.

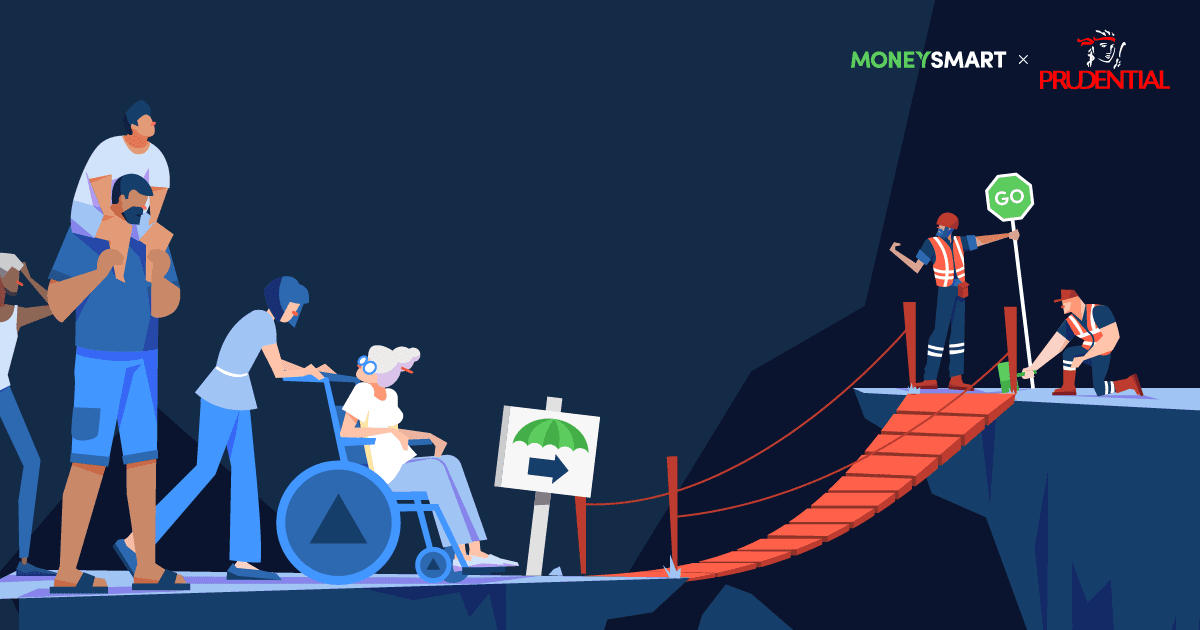

However, the hard truth is that not everyone can afford to pay for insurance.

Do insurers actually care about the under-served, and are they doing anything to help this group of people?

What happens to those who can’t afford insurance?

Those who may fall in this category include low income families, who aren’t able to afford adequate insurance coverage.

Some middle income households might also find themselves with less than adequate coverage, especially as they might have to take care of the financial and insurance needs of three generations of family members, aka the sandwiched generation.

While MediSave and MediShield Life help, those without adequate insurance coverage could still land up with a big bill if they bust the claim limits due to whatever reason, such as needing special procedures or extended treatment. They may also need to bear additional costs on their own, such as outpatient treatment, long-term medication or aids/care, as well as the opportunity cost of possibly not being able to work.

In a similar vein, a family with kids who cannot afford life insurance could be plunging their dependents into a life of hardship if the sole breadwinner passes away.

But is it really enough? How about those in the middle income group that don’t qualify for government assistance yet have tons of financial commitments and are not adequately insured?

In addition, given escalating healthcare costs and rising life expectancy (ours is among the highest in the world), we’d need higher protection to cover the costs and coverage for a longer period of time.

What can insurers do to better help this group of people?

There is an emphasis on personal responsibility in the Singapore healthcare system, which means that a significant fraction of medical costs must be borne privately rather than by the government, whether through private insurers, MediSave savings or out-of-pocket expenses.

That puts insurers in a strong position to help those who don’t have adequate access to medical care or insurance — and some insurers have stepped up to the plate by making plans more affordable, enabling a larger swathe of the population to get coverage.

For instance, by offering micro-insurance products, insurers can enable people with lower incomes or those fresh out of school to purchase bite-sized amounts of coverage as and when they need it, with less money.

Another way insurers can help is to offer free coverage to the needy, whether through a charity organisation, an event or a nationwide drive, whenever society is in need of it.

Here’s one example of an insurer that has genuinely been trying to give back to society.

Case study: Prudential

In making health and financial security accessible, insurer Prudential recognises the importance of ensuring that its products and services are inclusive for its customers, including under-served segments, such as vulnerable communities. To best serve its customers’ needs, Prudential brings diversity to, and expands, its product offerings. Here’s what this insurer has been doing:

Narrowing the protection gap

To create long-term value for our customers and meet the needs of vulnerable communities, Prudential introduced the Spark Kindness Movement that ran from 1 to 31 December 2020. The movement aims to narrow the protection gap by providing underprivileged families financial support in the event of accidental death.

Through this movement, Prudential’s customers can pay it forward and help tide these families through some of life’s difficulties, while protecting themselves as part of a policy-matching scheme. For every PRUActive Protect or PRUCancer 360 policy sold during the period, Prudential provided a complimentary 2-year Accidental Death Insurance Coverage of S$10,000 to a parent of a low-income family supported by its community partner, AMKFSC Community Services Limited. This coverage provides a sliver of hope to the children of these families by ensuring that their developmental needs are supported.

As a result, a total of 3,022 individuals from these families benefited from the Spark Kindness Movement and received the complimentary coverage. In the long term, Prudential aims to extend this programme to serve more vulnerable communities so they can better plan for their financial and healthcare needs.

Micro-insurance to cover more people

Prudential also tries to boost access to and affordability of insurance with micro-insurance products that are simpler to understand and enable customers to purchase smaller amounts of coverage for specific needs. These can be purchased on the Pulse by Prudential app, which can be downloaded for free.

The Pulse app further bridges any other common barriers to entry as it aims to uncomplicate insurance and the process of getting coverage. Embedded within the free Pulse app are also personalised AI-powered and data-driven insights that support one’s health and well-being, for a healthier and wealthier life.

Swift offerings for pressing needs

Prudential is also swift to roll out insurance policies that offer protection from new or pressing threats. For instance, since 2020, inspired by a spike in dengue fever cases, Prudential’s PRUSafe Dengue plan has been offering insurance protection from the disease.

Free COVID-19 vaccination protection

Also in 2021 Prudential launched PRUSafe COVIDCover, a complimentary plan to offer financial protection from COVID-19 vaccination side effects upon hospitalisation.

Affordable, complete coverage

Some other plans currently available include PRUSafe BreastCancer and PRUSafe ProstateCancer, both of which offer affordable, complete coverage for two of Singapore’s more common cancers for women and men respectively.

Making insurance more accessible to all

Prudential has been active in giving back to the community and responding to the needs of people in Singapore. This is in line with the altruistic insurer’s Environmental, Social and Governance (ESG) strategy, which aims to “help people get the most out of life…to ensure that we use our capabilities to maximise our positive social and environmental impact”.

Prudential’s ESG strategy distills the many ways in which the insurer helps its stakeholders into three pillars: making health and financial security accessible; stewarding the human impacts of climate change; and building social capital.

Indeed, Prudential has been working hard to raise its inclusive offerings to make health and financial security accessible, especially to under-served segments.

Do insurers care enough about those who cannot afford to buy insurance plans? Well, we know that Prudential’s here for us.

Find out more about Prudential’s ESG initiatives.

This article is for your information only and does not have regard to the specific investment objectives, financial situation and particular needs of any persons. Please seek advice from a qualified Financial Consultant for a financial analysis before purchasing a policy suitable to meet your needs.