Providers Challenge Payments In ‘No Surprises’ Act Dispute Resolution Process

Under the No Surprises Act, consumers are protected from financial liability beyond normal in-network cost sharing when they receive emergency services by an out-of-network facility or provider, including air ambulance services, or when out-of-network providers at in-network facilities provide nonemergency services. Under the law, out-of-network providers and facilities are banned from sending consumers bills for amounts beyond in-network cost sharing.

A key component of the law is the federal process for determining how much a patient’s insurer or health plan will pay an out-of-network facility or provider. If the provider does not accept the payer’s initial payment, the parties must first enter into 30 days of private negotiations to try and reach an agreement on the payment amount. If negotiations fail, either party may request use of an independent dispute resolution (IDR) process, during which each party offers an amount and an arbitrator selects one of the two offers, which is binding on the parties.

In December, the three federal agencies with responsibility for the No Surprises Act—the Departments of Health and Human Services, Labor, and Treasury—released an initial report on the IDR process connected with the No Surprises Act. The report highlighted the large number of IDR cases filed in the program’s first six months—well above earlier projections from the agencies. Information on decisions made by the IDR entities—excluded from this report—will be provided in a later report.

Below, we discuss what the report from the three agencies tells us about how the IDR process is working so far. However, all this comes with a big caveat in the form of a decision by Texas federal district court judge Jeremy Kernodle invalidating the rules promulgated by the agencies to govern the federal IDR process. The agencies had tweaked their original IDR rules in response to Judge Kernodle’s previous finding that the earlier versions gave undue emphasis to the “qualifying payment amount,” roughly defined as the median amount an insurer would have paid for the item or service in the same geographic area if provided by an in-network provider or facility.

However, Judge Kernodle found that the revised rules still gave the qualifying payment amount an unduly privileged status, impermissibly tilting the balance in IDR hearings in favor of insurers and against providers. It is unclear whether Judge Kernodle’s latest decision will be appealed or what its aftermath might be, but it obviously represents a wild card that could change the IDR balance of power in the direction of providers at the expense of insurers. On February 24, 2023, the Department of Health and Human Services resumed consideration of cases involving services delivered before October 25, 2022, using guidance that relies solely on the statutory provisions. The agency continues to examine Judge Kernodle’s ruling and to weigh the options with regard to cases on or after October 25, 2022.

How Many IDR Cases Are Being Filed?

Many more cases have been filed for the IDR process than projected in the interim final rule that established the process. In the rule, the federal agencies expected about 22,000 IDR cases for the entire year of 2022. By the end of September, 90,078 cases had been filed. A December update notice reported 164,000 cases filed as of December 5.

On a weekly basis, the rate of filings has grown from 1,650 per week during the April–June period to as high as 13,300 during a single November week. If filings in 2023 were to occur at the rate of that November week, there could be as many as 700,000 cases filed. The rate filing, however, may be reduced because the increased administration fee for filing a case—from $50 to $350—creates a strong disincentive for claims with low-dollar fees such as emergency department visits.

Many Filed Cases Are Being Challenged As Ineligible

One potential explanation for the large numbers is the large share of cases ultimately deemed ineligible for the federal IDR process. According to the December 5 memorandum, more than 40 percent of all cases filed were challenged as ineligible by the non-initiating party. To date, many challenges have been successful. About 80 percent of all cases that were challenged and closed by September 30 were deemed ineligible. The report indicates several common reasons for cases being deemed ineligible.

First, some cases filed with the federal IDR system belonged in their state’s system for resolving payments. The No Surprises Act preserves processes in 22 state laws for determining payments in settings regulated under state laws. Some providers may have been uncertain about which cases belong in a state system. Even where state systems are deemed to take precedence over the federal system for most cases involving fully insured plans, cases involving self-funded health plans typically belong in the federal system. It may be that these ineligible filings will become less frequent with more time and experience.

Second, cases may be ineligible if they do not follow the batching rules correctly. Batched cases generally must involve the same provider and insurer, the same or similar condition, and be within a 30-day period. The federal agencies’ interpretation of these rules has become contentious and is the subject of another legal challenge filed by the Texas Medical Association.

In addition, some cases may be ineligible if they fail to meet the required timelines set forth in the law and its associated regulations. For example, cases may be deemed ineligible for IDR if the parties have failed to complete the 30-day open negotiation requirement.

How Many Cases Are Fully Resolved?

In assessing how well the IDR system is working, it is noteworthy that through September 30, only one out of four cases had been closed. Furthermore, IDR entities had made payment determination in only 3,300 cases. Although the number of payment determinations had grown to 11,000 by December 5, this remains a small share (7 percent) of the 164,000 cases filed by then. Even if the cases challenged as ineligible are excluded, decisions have been made in only 11 percent of the unchallenged cases. This small share may reflect the growing pains of a new system beset both by an unexpected volume of cases and by legal challenges to the process itself. As noted above, the initial reporting does not include information on which parties prevailed in the decided cases or on the selected payment amounts.

What Types Of Services Are Generating IDR Cases?

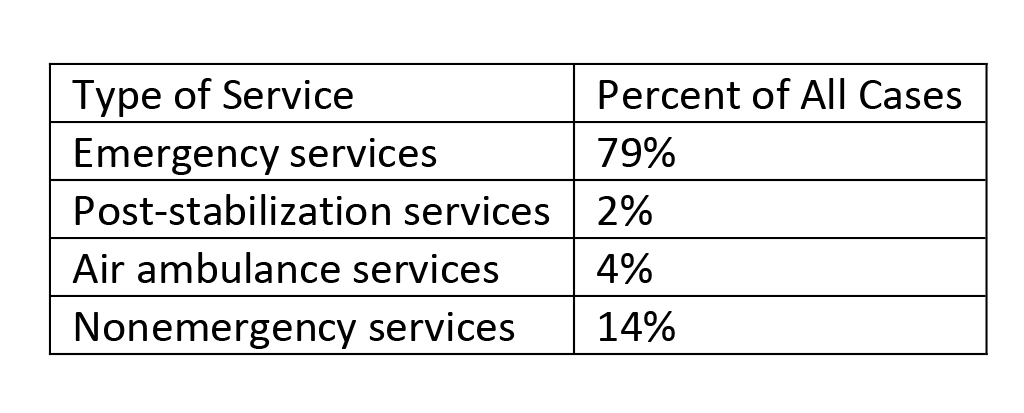

The No Surprises Act focuses on four types of services: emergency services provided in facilities, mostly hospital emergency departments; post-stabilization services; air ambulance services; and nonemergency services delivered at in-network facilities (exhibit 1). The vast majority of IDR cases filed by September 30 involved emergency care. More than half of all emergency services are for emergency department visit codes. About one of seven cases filed were for nonemergency services—mostly anesthesia, radiology, neurology, and neuromuscular procedures.

Exhibit 1: Distribution of IDR cases filed by September 20, 2022

Source: Centers for Medicare and Medicaid Services. Initial report on the independent dispute resolution (IDR) process, April 15–September 30, 2022. Baltimore (MD): CMS; 2022 [cited 2023 Mar 13].

Smaller numbers of cases were for air ambulance services and post-stabilization care. Most of the air ambulance cases were for helicopter services. Because air ambulance services are used far less frequently than other services subject to the No Surprises Act, these cases may still represent a significant share of all air ambulance services. The report notes that the small share of cases filed for post-stabilization care may underestimate how many cases fit in this category because of coding issues.

Where Are The IDR Cases Coming From?

The IDR report provides considerable information on what organizations are filing cases and what states they come from. The numbers suggest that use of the IDR process is far from uniform across the provider community. Cases are concentrated in several southern states and a few organizations.

Geographically, two-thirds of all cases were filed in six southern states: Texas, Florida, Georgia, Tennessee, North Carolina, and Virginia. While they are all large-population states, they still represent six of the top seven states by cases filed even when the numbers are adjusted for state population. Tennessee has the highest rate of filed cases adjusted by population.

States where providers are least likely to file (adjusted for population) are Hawaii, Michigan, North Dakota, New Hampshire, Maine, and Minnesota. Providers filed fewer than 150 cases in each of these states. It might be expected that filing rates would be lower in states with their own systems for determining payments (for example, Texas and Florida), but rates are generally no lower compared to states without such systems (for example, Tennessee and North Carolina).

About three-fourths of all cases to date were filed by 10 organizations, and half were filed by three organizations: SCP Health, R1 Revenue Cycle Management, and LogixHealth. SCP Health is a physician staffing firm with a focus on staffing emergency departments. R1 Revenue Cycle Management works for physician practices and hospitals to manage financial matters. Finally, LogixHealth is another financial management firm with a focus on emergency medicine. These organizations file cases on behalf of individual physicians or group practices. TeamHealth and Envision Healthcare—both in the top as well—have been cited in recent years as making surprise billing for emergency department services part of their revenue strategies. At least half of the top 10 firms filing IDR cases are either publicly traded companies or are owned by private equity firms.

Ten organizations listed in the report as the most frequent responding parties in IDR cases represent about 86 percent of all cases filed. They include many of the nation’s largest insurers (for example, UnitedHealthcare, Aetna, and Anthem), as well as some health plan service organizations (for example, Multiplan and Clear Health Strategies).

Implications

Reporting on the IDR process offers insights into the impact of the No Surprises Act. The high volume could be a sign of provider frustration over the payments received from payers for out-of-network claims. It could also be evidence that providers are testing the system to see whether taking claims to arbitration is worthwhile. The delays in resolving cases may be a natural outcome in a new system that has faced challenges due to litigation and technical issues. But it is a concern for providers and payers who want to see their cases resolved.

The new reporting also documents the high share of IDR cases being deemed ineligible. Assuming IDR cases restart, we should have a better sense over the coming months whether there is a learning curve that leads to fewer ineligible cases and fewer overall cases. As noted above, the increased administrative fee required of organizations filing for the IDR process—if not invalidated by the courts—is likely to deter cases with fewer dollars in dispute.

Nevertheless, the concentration of cases in relatively few states and provider organizations suggests that many providers are not invoking the IDR process. It may be that many providers are satisfied with payments made by payers or at least find the payments sufficient not to use the IDR process. By contrast, there are providers—mostly emergency medicine doctors—who are using the system more actively. Organizations supported by private equity are a significant part of this more aggressive approach to IDR.

Once information is available on payment amounts for IDR cases, there will be more evidence on the law’s impact. IDR decisions favoring providers will increase claims payments beyond what plans initially offer. In addition to driving costs higher for the specific claims, they could encourage future IDR filings and strengthen providers’ hands in future negotiations with payers over in-network rates. Notably, the Congressional Budget Office projected that IDR decisions would not often result in higher payments, guiding them to an estimate that premiums would settle out at 0.5 percent to 1.0 percent below current trends. Furthermore, the ongoing litigation over IDR rules and procedures, especially the Texas decision to invalidate the IDR procedures promulgated by the federal agencies. could make the 2022 experience moot as a guide to long-term trends.

It is critical that the federal agencies continue releasing information on the IDR process. Researchers and policy makers, in addition to payers and providers, are eager to learn more about the decisions emerging from the IDR entities.

Jack Hoadley and Kevin Lucia, “Providers Challenge Payments In ‘No Surprises’ Act Dispute Resolution Process,” Health Affairs Forefront, March 21, 2023, https://www.healthaffairs.org/content/forefront/providers-challenge-payments-no-surprises-act-dispute-resolution-process Copyright © 2023 Health Affairs by Project HOPE – The People-to-People Health Foundation, Inc.