Protecting Your Business: General Liability Insurance for Independent Contractors

Why General Liability Insurance for Independent Contractors is Important

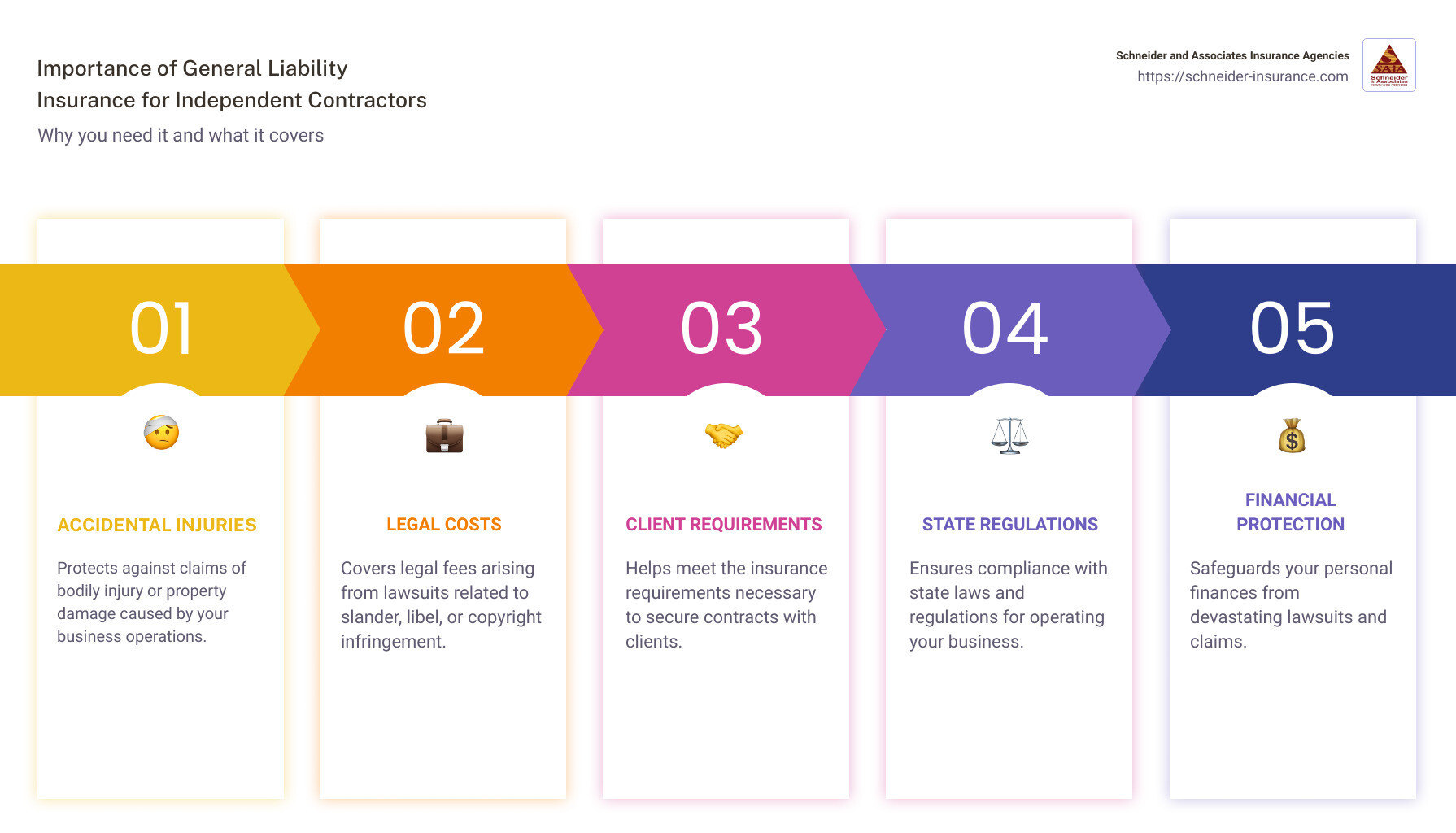

When it comes to running your own business as an independent contractor, having general liability insurance is crucial. Why? Because it protects your business from some of the biggest financial risks you can face. Here’s a quick rundown:

General liability insurance for independent contractors:

Protects against accidental injuries and property damage claims.Covers legal costs from lawsuits related to slander, libel, or copyright infringement.Helps meet legal and client requirements to carry out your work.

As an independent contractor, you are exposed to unique risks. Whether you are a handyman, freelance writer, or consultant, the threat of facing expensive liability claims looms large. General liability insurance is your safety net, safeguarding your personal finances from devastating lawsuits.

I’m Paul Schneider, and I’ve been helping small business owners like you steer the complex world of insurance for years. With expertise in general liability insurance for independent contractors, I’m here to simplify what you need to know and help you protect your business effectively.

What is General Liability Insurance?

General liability insurance is a type of coverage that protects your business from claims involving bodily injuries, property damage, and other common risks. It’s essential for independent contractors because it helps shield you from financial losses that could arise from lawsuits and other legal actions.

Coverage Details

General liability insurance covers several key areas:

Bodily Injury: If someone gets hurt due to your business activities, this insurance can cover their medical expenses and your legal fees. For example, if you accidentally drop a heavy tool on a client’s foot, your general liability insurance can handle the resulting costs.

Property Damage: This covers damage to someone else’s property caused by your business activities. Imagine you’re a painter and accidentally spill paint on a client’s expensive carpet. Your insurance would cover the cost of cleaning or replacing the carpet.

Reputational Harm: If someone claims that your business defamed them, general liability insurance can help cover the legal costs associated with defending yourself. This includes claims of libel and slander.

Advertising Injury: If your business’s advertising inadvertently harms another business, such as using a copyrighted image without permission, this insurance can help cover the legal repercussions.

Common Risks

Independent contractors face various risks that general liability insurance can mitigate:

Accidental Injuries: Whether you’re a handyman or a freelance photographer, accidents can happen. A client slipping on a wet floor or tripping over your equipment can lead to costly medical bills and lawsuits.

Property Damage: Contractors often work at clients’ locations, increasing the risk of accidentally damaging their property. Whether it’s a broken window or a scratched floor, these damages can be expensive to fix.

Legal Actions: Even if you’re careful, you could still face lawsuits. General liability insurance covers the legal costs of defending your business in court, which can be substantial.

Legal Obligations

In some states, independent contractors in certain professions are required by law to carry general liability insurance. For instance, construction workers often need this coverage to comply with state regulations and to secure contracts with clients.

Moreover, many clients and business partners may require you to have general liability insurance before they agree to work with you. This requirement helps protect them from being held responsible for any damages or injuries that might occur during the project.

In summary, general liability insurance for independent contractors is a must-have to protect against the financial fallout from accidents, property damage, and legal claims. It not only safeguards your business but also helps you comply with legal and contractual obligations.

Next, we’ll explore why independent contractors specifically need this type of insurance and how it provides a safety net for your business.

Why Independent Contractors Need General Liability Insurance

As an independent contractor, you face unique risks that can lead to expensive lawsuits and financial losses. Here’s why general liability insurance for independent contractors is crucial:

Liability Exposures

Independent contractors have the same liability exposures as larger businesses. You can be sued for:

Property Damage: If you accidentally damage a client’s property, you could be held financially responsible.Bodily Injury: Suppose a client trips over your equipment and gets injured. You could be sued for medical expenses and more.Reputational Harm: If you unintentionally defame a client or competitor, you could face legal action.

Potential Lawsuits

Without insurance, you would have to pay out-of-pocket to defend yourself in court and cover any damages. Legal fees can add up quickly, potentially wiping out your savings and closing your business. According to Forbes, liability claims are expensive and can crush a small business that doesn’t have insurance.

Client Requirements

Many clients require you to have general liability insurance before they’ll sign a contract with you. This is to protect themselves from being held responsible for any damages or injuries caused by your work. For instance, if you’re a construction contractor, your clients might insist on seeing a certificate of liability insurance before allowing you on the job site.

State Regulations

In some states, independent contractors in certain industries, like construction, are required by law to carry general liability insurance. This regulation ensures that both you and your clients are protected from financial losses due to accidents or other incidents. For example, Investopedia notes that some states mandate professional liability insurance for legal and medical professionals.

In summary, general liability insurance for independent contractors is essential to protect against financial risks, meet client requirements, and comply with state regulations. It acts as a safety net, ensuring that one lawsuit doesn’t end your business.

Next, we’ll dive into the specific coverage details of general liability insurance for independent contractors.

Coverage Details of General Liability Insurance for Independent Contractors

General liability insurance for independent contractors provides crucial coverage in several key areas. Let’s break down what this means for you.

Property Damage

Property damage coverage protects you if you accidentally damage someone else’s property while performing your work. For example, if you’re a handyman and you accidentally break a client’s window, this insurance will cover the repair costs. This coverage is vital because property damage claims can be expensive and may lead to lawsuits.

Bodily Injury

Bodily injury coverage steps in if someone gets hurt as a result of your work. Imagine you’re a contractor, and a heavy tool slips from your hand, injuring a client. This insurance will cover medical expenses, legal fees, and any settlements or judgments. Without this coverage, you could be personally liable for these costs, which can be financially devastating.

Reputational Harm

Reputational harm, also known as personal and advertising injury, covers claims of defamation, slander, or libel. For instance, if you unintentionally make a false statement about a competitor that harms their reputation, you could be sued. This insurance helps cover the legal costs and any damages awarded in such cases.

Advertising Injury

Advertising injury coverage is similar to reputational harm but specifically relates to advertising activities. If you use copyrighted material without permission in your advertisements, or if your marketing inadvertently copies another company’s slogan, you could face legal action. This insurance will cover the costs associated with these claims, protecting your business from financial strain.

By understanding these coverage details, you can see how general liability insurance for independent contractors provides a safety net against various risks. This protection allows you to focus on your work without constantly worrying about potential financial pitfalls.

Next, we’ll explore how to obtain this essential insurance coverage for your business.

How to Obtain General Liability Insurance

Insurance Providers

Finding the right insurance provider is crucial for securing general liability insurance for independent contractors. It’s important to choose a provider that understands the unique needs of independent contractors and offers comprehensive coverage options.

Policy Options

When selecting a policy, you’ll need to consider the specific needs of your business. General liability insurance typically covers:

Property Damage: If you accidentally damage a client’s property.Bodily Injury: If someone gets hurt due to your business operations.Reputational Harm: If you face claims of defamation or slander.

You can also customize your policy with additional coverages, such as professional liability insurance or commercial auto insurance. This ensures you have the right protection tailored to your specific industry risks.

Cost Factors

The cost of general liability insurance varies based on several factors:

Type of Business: Different industries have different risk levels. For example, a construction contractor might pay more than a freelance writer.Coverage Limits: Higher coverage limits mean higher premiums.Deductible Amount: A higher deductible can lower your premium, but you’ll pay more out of pocket if you file a claim.Location: Insurance costs can vary by state and even by city.

On average, general liability insurance costs around $42 per month. However, your specific rate will depend on the factors mentioned above.

Certificate of Liability Insurance

Once you have selected a policy, you’ll receive a Certificate of Liability Insurance. This document is crucial as it:

Proves Coverage: It shows clients and partners that you have the necessary insurance.Lists Coverage Details: It includes your policy number, coverage limits, and effective dates.Facilitates Contracts: Many clients require this certificate before signing contracts or allowing you to start work.

Having this certificate readily available can streamline your business operations and build trust with your clients.

Additional Insurance Types for Independent Contractors

While general liability insurance for independent contractors is essential, there are several other types of insurance that can provide additional protection. Let’s explore these options:

Commercial Auto Insurance

If you use a vehicle for work-related tasks, such as meeting clients or transporting materials, you need commercial auto insurance. Personal car insurance often doesn’t cover business use. Here’s what commercial auto insurance can cover:

Bodily Injury Liability: Covers injuries to others caused by you or your employees.Property Damage Liability: Covers damage to others’ property.Collision Insurance: Covers repair costs if your vehicle is damaged in an accident.Comprehensive Insurance: Covers non-collision-related damage, like theft or vandalism.

Workers’ Compensation

Workers’ compensation insurance is crucial if you have employees. It covers:

Medical Expenses: For work-related injuries or illnesses.Disability Benefits: For employees unable to work due to injury.Lawsuits from Employee Injuries: Protects against legal action taken by injured employees.

Most states require this insurance if you have employees. Even if you’re a sole proprietor, it can protect you from costly medical expenses.

Errors and Omissions Insurance

Also known as professional liability insurance, errors and omissions (E&O) insurance covers:

Legal Costs: If a client claims your mistake caused them financial loss.Missed Deadlines: If you fail to deliver a service on time.Professional Negligence: If your advice or service causes harm.

For example, if you’re a consultant and your advice leads to a client’s financial loss, E&O insurance can cover the legal fees and settlements.

Business Income Insurance

Business income insurance helps replace lost income if your business operations are disrupted by a covered event, such as a fire. It can cover:

Lost Revenue: Income you would have earned.Operating Expenses: Ongoing costs like rent and payroll.Temporary Relocation: Costs of moving to and operating from a temporary location.

This insurance ensures your business can survive financially during unexpected interruptions.

Commercial Property Insurance

Commercial property insurance protects your business’s physical assets, including:

Buildings: Structures owned by your business.Equipment: Tools and machinery.Inventory: Products and materials you store.

For instance, if a fire damages your office, commercial property insurance can cover the repair costs and replacement of damaged equipment.

Next, we’ll address some frequently asked questions about general liability insurance for independent contractors.

Frequently Asked Questions about General Liability Insurance for Independent Contractors

How Much Does General Liability Insurance Cost?

The cost of general liability insurance for independent contractors varies based on several factors:

Risk exposure: High-risk industries like construction may pay more.Business location: Costs can differ by state or city.Experience: Longer time in business may reduce premiums.Coverage limits and deductible amounts: Higher limits and lower deductibles increase costs.

Can Clients Add Independent Contractors to Their Insurance Policy?

Yes, clients can add independent contractors to their general liability insurance policy as an additional insured. This means you’re covered by their policy while working on their project. However, it can be costlier for the client.

Another option is a blanket additional insured endorsement. This extends coverage to a group of contractors without naming each one. It’s more efficient but still adds to the client’s cost.

What is the Difference Between Contractor Insurance and Independent Contractor Insurance?

Contractor insurance and independent contractor insurance essentially offer the same coverage. Both protect against claims of bodily injury, property damage, and reputational harm. The terminology might differ, but the coverage is similar.

Next, we’ll dive into the additional insurance types that independent contractors might need to consider.

Conclusion

In summary, general liability insurance for independent contractors offers crucial protection against claims of bodily injury, property damage, and reputational harm. This coverage is essential for safeguarding your personal and business assets from the financial strain of lawsuits and accidents.

Custom coverage is vital for independent contractors. Depending on your industry, you may face unique risks that require specialized insurance solutions. For instance, a photographer might need coverage for expensive camera equipment, while a construction contractor might require additional protection for heavy machinery and worksite accidents.

At Schneider and Associates Insurance Agencies, we understand the diverse needs of independent contractors. Our expertise and experience help us craft insurance packages that fit your specific requirements. We work closely with you to identify risks and provide coverage that offers peace of mind, allowing you to focus on growing your business.

Get a Quote today and find how we can help protect your business. It only takes a minute to get started. If you prefer a more personal touch, get in touch with one of our agents. We’re here to support you every step of the way.