Protecting Your Business: General Liability Insurance for HVAC Contractors

The Importance of General Liability Insurance for HVAC Contractors

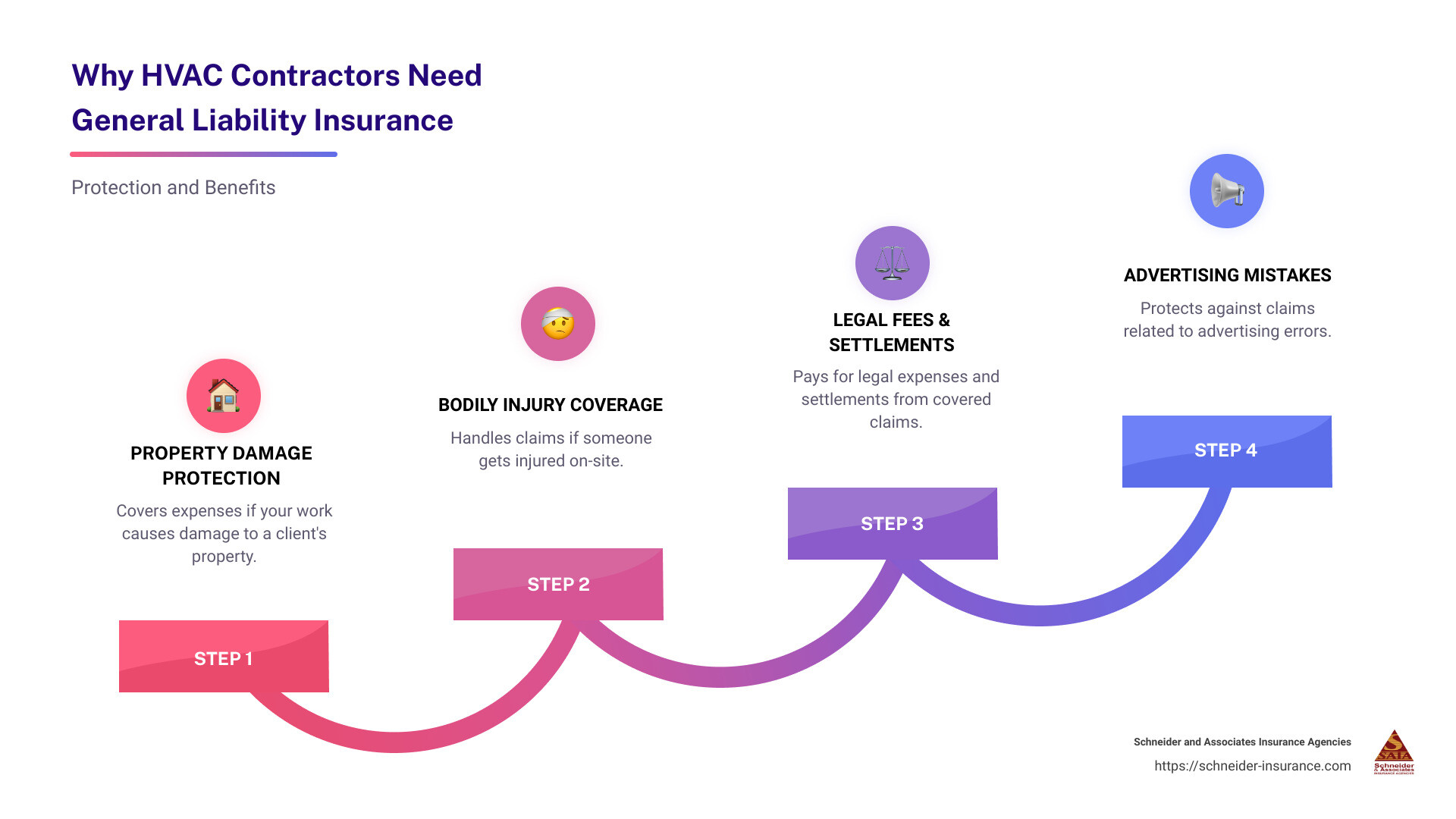

Ensuring your HVAC business is well-protected is essential for success. General liability insurance for HVAC contractors is crucial, as it shields your business from potential claims due to property damage, bodily injury, and even advertising mistakes.

To quickly address your question:

Why HVAC contractors need general liability insurance:

– Protects against property damage

– Covers bodily injuries on-site

– Shields from legal fees and settlements

As an HVAC contractor, you’re often working in diverse environments, from residential homes to commercial buildings. Each job site can present unique risks. Imagine a situation where your technician accidentally damages a client’s property or someone trips over your equipment. Without proper insurance, your business could face hefty out-of-pocket expenses.

I’m Paul Schneider, with a wealth of experience in recommending tailored insurance solutions for HVAC contractors. My background includes managing insurance for small businesses, ensuring they have the necessary coverage to mitigate risks effectively.

Next, we’ll delve into understanding the specific coverage provided by general liability insurance for HVAC contractors.

Understanding General Liability Insurance for HVAC Contractors

General liability insurance is essential for HVAC contractors. It protects your business from various risks, including bodily injury, property damage, and advertising injury. Let’s break down what this coverage entails and why it’s vital for your business.

What Does General Liability Insurance Cover?

1. Property Damage:

Imagine you’re installing a new air conditioning unit and accidentally damage your client’s siding. General liability insurance will cover the cost of repairs or replacements, saving you from paying out-of-pocket.

2. Bodily Injury:

Suppose a passerby trips over your tools and gets hurt. Your general liability insurance will help cover medical expenses and any legal fees that may arise from the incident.

3. Legal Fees and Settlements:

Legal battles can be costly. If someone sues your business for property damage or bodily injury, this insurance will help cover your legal defense costs and any settlements or judgments against you.

4. Advertising Injury:

If your business is accused of defaming another company in your advertisements, general liability insurance can help cover the costs of defending your business in court.

Why HVAC Contractors Need General Liability Insurance

Risk Exposure:

HVAC contractors face numerous risks daily, from working with heavy equipment to dealing with hazardous materials. These risks can lead to accidents, making liability coverage crucial.

Client Property:

Your work often involves being on clients’ properties. Whether you’re installing, repairing, or maintaining HVAC systems, there’s always a chance of accidental damage. General liability insurance protects you from the financial fallout of such incidents.

Employee Actions:

Even the most careful employees can make mistakes. General liability insurance ensures that your business is covered if an employee’s actions cause damage or injury.

Legal Requirements:

In some states, having general liability insurance is mandatory for HVAC contractors. Even if it’s not required, having this coverage can make your business more attractive to potential clients and partners.

In the next section, we’ll explore additional essential insurance policies for HVAC contractors, including Business Owner’s Policy (BOP), commercial auto insurance, and workers’ compensation insurance.

Additional Essential Insurance Policies for HVAC Contractors

Running an HVAC business involves a lot more than just installing and repairing heating and cooling systems. You need the right insurance to protect your business from various risks. Here are some other essential policies to consider:

Business Owner’s Policy (BOP)

A Business Owner’s Policy (BOP) combines multiple coverages into one package. BOP typically includes:

General Liability: Protects against claims of bodily injury or property damage.Property Coverage: Covers your business property, including buildings and equipment, from risks like fire, theft, and vandalism.Business Interruption: Helps cover lost income if your business is forced to close temporarily due to a covered event, like a fire or storm.

Example: Imagine a frozen pipe bursts in your office, causing significant water damage. A BOP can help cover the repair costs and the income you lose while your office is being fixed.

Commercial Auto Insurance

As an HVAC contractor, you likely spend a lot of time on the road, traveling to job sites and transporting tools and equipment. Commercial Auto Insurance is crucial for covering:

Company Vehicles: Protects vehicles you use for business purposes.Accident Coverage: Covers costs if you’re involved in a collision.Vandalism and Theft: Provides coverage if your vehicle is stolen or vandalized.

Example: During a storm, a tree branch falls on your work truck, shattering the windshield. Commercial auto insurance would help pay for the repairs, ensuring you can get back on the road quickly.

Workers’ Compensation Insurance

Your employees are your most valuable asset, and their safety is paramount. Workers’ Compensation Insurance covers:

Employee Protection: Pays for medical expenses and lost wages if an employee gets injured on the job.Legal Requirements: In many states, it’s mandatory to have workers’ compensation insurance if you have employees.

Example: An employee gets a cut that requires stitches while repairing a client’s furnace. Workers’ comp coverage can help cover medical bills and lost wages, ensuring your employee gets the care they need without financial stress.

Factors Affecting HVAC Insurance Costs

How to Save on Your HVAC Insurance Premium

Understanding the factors that affect your HVAC insurance costs can help you manage your expenses and find ways to save. Here are the key elements that influence your premium:

Claims History

Your claims history plays a big role in determining your insurance costs. If your HVAC business has a history of claims, insurers see you as a higher risk. This means higher premiums.

Tip: Maintain a clean claims record by implementing safety protocols and regularly training your employees. This can help reduce the likelihood of accidents and claims.

Coverage Needs

The type and amount of coverage you need will also impact your premium. For example, if you require higher limits on your general liability insurance, you’ll pay more.

Tip: Evaluate your coverage needs carefully. Don’t over-insure, but make sure you have enough coverage to protect your business against common risks.

Risk Exposure

Risks vary depending on the nature of your HVAC business. Factors such as the size of your projects, the locations you work in, and the types of clients you serve can all affect your risk exposure.

Tip: Consider risk management strategies to mitigate potential hazards. This can include regular equipment maintenance, employee safety training, and site inspections.

Premium Rates

Premium rates are influenced by several factors, including your business size, operations, and industry risk level. Larger businesses or those with more complex operations typically have higher premiums.

Tip: Shop around and compare quotes from different insurers. This can help you find the best rates for your specific business needs.

How to Save on Your HVAC Insurance Premium

Here are some practical tips to help you save on your HVAC insurance premium:

Maintain a Clean Claims Record: As mentioned earlier, a clean claims history can significantly reduce your premiums. Focus on safety and risk management to avoid claims.

Bundle Policies: Bundling multiple insurance policies with the same insurer can lead to discounts. For example, you can bundle your general liability insurance with commercial auto or workers’ compensation insurance.

Implement Risk Management Strategies: Proactively managing risks can lower your insurance costs. Regularly review and update your safety protocols, provide ongoing employee training, and conduct routine equipment checks.

Increase Deductibles: Opting for higher deductibles can lower your premium. Just make sure you can afford to pay the deductible in case of a claim.

Work with a Local Insurance Agent: A local agent understands the specific needs and risks of HVAC contractors in your area. They can help you find tailored coverage at competitive rates.

By understanding these factors and implementing these strategies, you can effectively manage your HVAC insurance costs and ensure your business is adequately protected.

In the next section, we’ll address frequently asked questions about general liability insurance for HVAC contractors.

Frequently Asked Questions about General Liability Insurance for HVAC Contractors

What is the general liability code for HVAC?

The general liability code for HVAC work is 95647. This code is used to classify heating and air conditioning work for insurance purposes. By using this code, insurers can better understand the specific risks associated with HVAC activities and provide appropriate coverage.

Will a commercial general liability policy cover the claim?

Yes, a commercial general liability policy can cover various types of claims that HVAC contractors might face. Here are some examples:

Property Damage: If you accidentally damage a client’s property while installing or repairing HVAC systems, your general liability insurance will help cover the repair or replacement costs.

Personal Injury: If someone gets injured due to your work, such as tripping over tools you left on-site, your policy will cover medical expenses and legal fees.

Bodily Injury: This includes injuries to third parties that occur as a result of your business operations, like a passerby getting injured by falling debris.

Advertising Injury: If your business is accused of libel, slander, or copyright infringement in your advertising, your general liability insurance can help cover legal costs and settlements.

What does Coverage A Commercial General Liability cover?

Coverage A of a commercial general liability policy typically includes:

Financial Loss: Protection against claims that your business activities caused a client to lose money.

Property Damage: Coverage for damage to someone else’s property caused by your business operations.

Personal Injury: Includes injuries such as libel, slander, and defamation that might arise from your business activities.

Bodily Injury: Covers medical costs and legal fees if someone is physically injured due to your business operations.

Business Operations: General liability insurance also covers incidents that occur during the normal course of your business, such as accidents at a job site.

By understanding these key aspects, HVAC contractors can ensure they have the right coverage to protect their business from various risks.

In the next section, we’ll dive into the additional essential insurance policies that HVAC contractors should consider.

Conclusion

At Schneider and Associates Insurance Agencies, we understand the unique challenges and risks that HVAC contractors face. Our goal is to provide personalized service and tailored coverage to meet your specific needs.

Personalized Service

We believe that every business is unique, and so are its insurance needs. That’s why we take the time to get to know your business. Whether you’re a small startup or an established company, we offer customized solutions to ensure you’re adequately protected.

Tailored Coverage

From general liability insurance for HVAC contractors to specialized policies like a Business Owner’s Policy (BOP), commercial auto insurance, and workers’ compensation, we have a comprehensive range of options. Our tailored coverage ensures that you’re protected against the most common risks in your industry, such as property damage, bodily injury, and equipment theft.

Local Expertise

Operating in Monmouth and Ocean counties and beyond, we have a deep understanding of the local market and regulatory requirements. Our local expertise allows us to provide you with the best advice and coverage options, ensuring compliance and peace of mind.

Ready to protect your business? Contact us today for a personalized quote and take the first step towards comprehensive coverage.

Get a Quote

By partnering with Schneider and Associates Insurance Agencies, you’re not just getting an insurance policy. You’re gaining a trusted advisor dedicated to helping you navigate the complexities of insurance, so you can focus on what you do best—serving your customers.