Protecting Your Business: General Liability Insurance for Florida Contractors

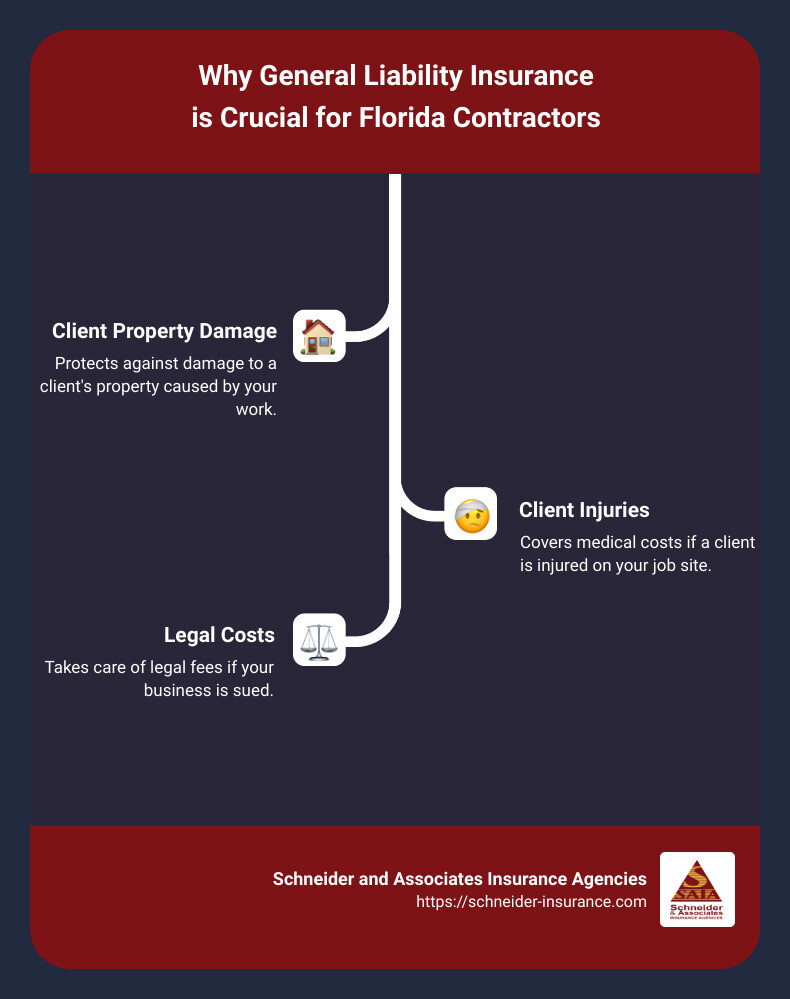

Why General Liability Insurance is Crucial for Florida Contractors

When it comes to running a successful contracting business in Florida, general liability insurance for contractors in Florida is essential. This insurance not only meets legal requirements but also protects your business from potential risks and liabilities that could otherwise put you out of business.

To quickly answer your need:

General liability insurance for contractors in Florida covers:

– Client property damage

– Client injuries

– Advertising injuries

– Legal costs

For a contractor in Florida, understanding these coverage elements can help you realize the importance of having this insurance. Accidents happen, and even a minor mistake could lead to significant financial losses if you’re not properly insured.

I’m Paul Schneider, and I bring years of experience helping contractors navigate the unique challenges of acquiring general liability insurance in Florida. Our team at Schneider and Associates Insurance Agencies specializes in offering customized and affordable insurance solutions tailored specifically for contractors.

Now, let’s dive deeper into why general liability insurance is crucial for your business and what specific coverages it includes.

Understanding General Liability Insurance for Contractors in Florida

What Does General Liability Insurance Cover?

General liability insurance for contractors in Florida is designed to protect your business from a range of risks. Here’s a breakdown of what it typically covers:

Bodily Injury: If a client or third party is injured on your job site, your policy can cover medical expenses, legal fees, and any settlements or judgments. For example, if a homeowner trips over your extension cord and breaks an ankle, your insurance would help cover medical costs and legal fees.

Property Damage: This covers damage to a client’s property caused by your work. Imagine your ladder slips and crashes through a living room window; your insurance would help pay for the replacement.

Advertising Injury: If your business is sued for slander, libel, or false advertising, your policy can cover legal costs and any damages awarded. For instance, if a competitor claims that your advertisement falsely represented their services, your insurance would step in.

Legal Fees: Legal battles can be costly. General liability insurance covers the legal costs associated with defending your business in a lawsuit. This includes attorney fees, court costs, and settlements.

Why is General Liability Insurance Essential for Florida Contractors?

Legal Requirements: In Florida, general contractors are often required by law to carry general liability insurance. The minimum coverage limits are typically $300,000 for bodily injury and $50,000 for property damage. However, many property owners may require higher limits.

Financial Protection: Even a small mishap can lead to a significant financial burden. General liability insurance helps protect your business from unexpected costs that could otherwise cripple your operations.

Client Trust: Having insurance can make your business more attractive to potential clients. It shows that you are professional, responsible, and prepared for unforeseen events. This can be a deciding factor for clients when choosing between contractors.

Business Reputation: In today’s litigious society, your reputation is on the line. Being insured not only protects your finances but also helps maintain your business’s reputation. Clients are more likely to trust and recommend a contractor who is adequately insured.

General liability insurance is not just a legal requirement; it’s a smart business move. It offers peace of mind, knowing that your business is protected from the unexpected.

Now that we’ve covered what general liability insurance includes and why it’s essential, let’s explore the different types of insurance policies available for Florida contractors.

Types of Insurance Policies for Florida Contractors

As a contractor in Florida, it’s crucial to have a variety of insurance policies to protect your business from different risks. Here are the key types you should consider:

General Liability Insurance

General liability insurance is the foundation of your insurance coverage. It protects against common mishaps like client property damage, bodily injuries, and advertising injuries. For example, if a client’s property is damaged during a project or someone gets injured on your job site, this insurance covers the costs. It’s often required by commercial landlords, clients, and lenders.

Workers’ Compensation Insurance

If you have employees, workers’ compensation insurance is a must. It’s not just a legal requirement in Florida; it also covers medical bills and lost wages if an employee gets injured on the job. For instance, if a worker cuts their finger with a drill, this insurance will help pay for their medical care and compensate for lost income.

Commercial Auto Insurance

If your business owns vehicles, you’ll need commercial auto insurance. This policy covers property damage and medical bills in case of an accident, along with theft, vandalism, and weather damage. For example, if you get into a fender bender with your work truck, this insurance will help cover the repair costs and rental expenses.

Builder’s Risk Insurance

Builder’s risk insurance is essential for protecting structures under construction. It covers damage from fires, vandalism, equipment theft, and other risks. Imagine a scenario where your construction site is vandalized or equipment is stolen; this insurance will help cover the losses.

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance protects against lawsuits for professional mistakes. If you miss a deadline on a construction project and the client sues for financial loss, this policy can cover legal fees and other costs.

Surety Bonds

Surety bonds ensure that you fulfill your contractual obligations. Common types include bid bonds, performance bonds, and payment bonds. For example, a performance bond guarantees that you will complete a project according to the terms of the contract, providing peace of mind for your clients.

In summary, having the right mix of insurance policies can protect your business from various risks, ensuring you can focus on what you do best—building and contracting. Next, we’ll delve into the costs associated with these insurance policies for Florida contractors.

Cost of General Liability Insurance for Contractors in Florida

Factors Influencing Insurance Premiums

The cost of general liability insurance for contractors in Florida varies based on several factors:

Number of Employees: More employees mean higher risk, which increases premiums.Annual Revenue: Higher revenue can lead to higher premiums as it often correlates with increased business activity and risk.Business Operations: The type of work you do impacts your premiums. High-risk activities like roofing may cost more than lower-risk tasks like painting.Location: Your business location affects your premiums. For example, operating in a high-risk area like a hurricane zone can increase costs.

Average Costs for Different Types of Insurance

General Liability Insurance

General liability insurance is essential for protecting against client property damage, injuries, and legal fees. In Florida, the median annual cost for general liability insurance is around $1,500. However, this can vary widely based on the factors mentioned above.

Workers’ Compensation Insurance

If you have employees, Florida law requires you to carry workers’ compensation insurance. This covers medical bills and lost wages for employees injured on the job. The median annual premium for workers’ compensation insurance in Florida is $1,637, which is lower than the national median.

Commercial Auto Insurance

For contractors using vehicles for business, commercial auto insurance is crucial. It covers property damage, medical bills from accidents, theft, and vandalism. In Florida, the median annual cost for commercial auto insurance is significantly higher at $6,105, compared to the national median of $2,417.

Tools and Equipment Insurance

Contractors rely on their tools and equipment for daily operations. Tools and equipment insurance protects these assets from damage or theft. While specific costs can vary, it’s a small price to pay for the peace of mind knowing your essential tools are covered.

Comparison with National Median

Florida contractors can expect to pay more than the national median for some types of insurance and less for others. For instance, commercial auto insurance costs significantly more in Florida, while workers’ compensation insurance is cheaper.

Understanding these costs and factors can help you budget effectively and ensure you have the coverage you need. Next, we’ll discuss how to obtain general liability insurance for contractors in Florida.

How to Obtain General Liability Insurance for Contractors in Florida

Steps to Apply for Insurance

Getting general liability insurance for contractors in Florida is a straightforward process if you follow these steps:

Gather Information

Before applying, gather details about your business. This includes the number of employees, annual revenue, and the nature of your business operations.

Compare Quotes

Use online tools or contact insurance agents to get quotes from multiple providers. This helps you find the best coverage at the best price.

Choose Coverage

Decide on the coverage limits and additional policies you may need, such as workers’ compensation or commercial auto insurance.

Submit Application

Fill out the application forms with the gathered information and submit them to your chosen insurance provider.

Importance of a Certificate of Insurance (COI)

A Certificate of Insurance (COI) is crucial for several reasons:

Proof of Coverage: A COI serves as proof that you have the necessary insurance coverage. This is important for both legal compliance and client trust.

Client Requirements: Many clients will require you to provide a COI before they sign a contract with you. This assures them that you are insured against potential risks.

Legal Compliance: In Florida, contractors must have insurance to be licensed. A COI helps you meet these legal requirements.

By following these steps and understanding the importance of a COI, you can ensure that your business is protected and compliant with Florida laws. Next, we’ll answer some frequently asked questions about general liability insurance for contractors in Florida.

Frequently Asked Questions about General Liability Insurance for Contractors in Florida

What are the insurance requirements for a general contractor in Florida?

In Florida, general contractors must have general liability insurance to protect against potential risks. The minimum coverage required includes:

Bodily Injury: $300,000 per occurrence. This covers medical expenses if someone gets hurt due to your business operations.Property Damage: $50,000 per occurrence. This covers costs if your work damages someone else’s property.

Additionally, many property owners might require higher limits than the state minimums. It’s crucial to verify the specific requirements for each project you undertake.

How much is general contractor insurance in Florida?

The cost of general contractor insurance in Florida can vary based on several factors, including the number of employees, annual revenue, and the nature of your business operations.

Monthly Premiums: On average, general liability insurance premiums can range from $50 to $200 per month.Annual Premiums: This translates to approximately $600 to $2,400 per year.

These costs can fluctuate based on the level of coverage you choose and the specific risks associated with your trade. For instance, high-risk trades like roofing might face higher premiums.

What is the minimum general liability insurance in Florida?

The minimum general liability insurance requirements for contractors in Florida include:

Public Liability: $300,000 for bodily injury per occurrence.Property Damage: $50,000 per occurrence.Combined Single Limit: Some contractors opt for a combined single limit policy, which provides a total coverage amount. For example, a combined single limit of $800,000 could cover both bodily injury and property damage up to that amount.

While these are the minimums, many clients and projects will require higher limits to ensure adequate protection.

By understanding these requirements and costs, you can make informed decisions about your insurance needs and ensure that your business is properly protected.

Conclusion

In summary, general liability insurance for contractors in Florida is not just a legal requirement but a crucial safeguard for your business. This coverage protects you from financial losses due to property damage, bodily injuries, and legal fees, ensuring that your business can continue to operate smoothly even when unexpected accidents occur.

At Schneider and Associates Insurance Agencies, we understand the unique challenges that Florida contractors face. Our personalized solutions are designed to meet your specific needs, providing you with peace of mind and the confidence to focus on growing your business.

Why choose us?

Personalized Solutions: We tailor our insurance packages to fit the unique needs of your business, ensuring comprehensive coverage.Local Expertise: Based in Florida, our agents are familiar with the local regulations and risks, providing you with the best advice and support.Client Trust: Our commitment to protecting your business helps build trust with your clients, enhancing your reputation and securing more projects.

Don’t leave your business vulnerable. Protect it with the right insurance coverage from Schneider and Associates Insurance Agencies. Get your quote today and ensure your business’s security and success.

Get Your Insurance Quote