'Protected' vs. 'Guaranteed': The Same But Different

What You Need to Know

Research finds advisors tend to think the term ‘guaranteed’ resonates more with consumers, but that’s not the case.

Among both advisors and consumers, ‘protected’ arouses less skepticism.

Overall, consumers are likely to be relatively indifferent about these terms, research suggests.

A variety of words can be used to describe a product or solution that offers benefits with some level of assurance. Two of the more common terms in the financial field are “protected” and “guaranteed,” and we recently asked consumers and financial advisors about their perspectives of the terms to understand if any misperceptions existed.

Interestingly, we found that while interest in products described as “protected” or “guaranteed” was effectively the same among both financial advisors and consumers, financial advisors overwhelmingly thought that products described as “guaranteed” would be more attractive (which wasn’t the case). In other words, while financial advisors might think that the term “guaranteed” resonates more with consumers, this evidence suggests otherwise.

There was a clear difference in perceived skepticism, though, where both financial advisors and consumers were more skeptical of products that described themselves as “guaranteed.”

Overall, the analysis suggests that interest in a product or solution that is described as “protected” is likely to be very similar to one described as “guaranteed,” although likely with slightly less skepticism around the potential benefits.

What’s in a Name? Consumer Perceptions

A consumer survey was fielded by Morning Consult from June 27-29 with 2,206 respondents. It was a split survey, in which half the respondents were asked questions using terminology around “protected” and the other half using “guaranteed.” There were five questions of interest and one open text question.

The accompanying graphic includes a word cloud with responses for the open text question, which asked how the respondent would describe either “Protected Income” or “Guaranteed Income” to a young child.

We can see that while there are similarities in perceptions, there are also differences. Perhaps most notably, while the word “guaranteed” featured prominently among those asked about “protected income,” the term “protected” was not commonly cited among those asked about “guaranteed income.” To some extent, this suggests that consumers may be less familiar with the “protected income” terminology.

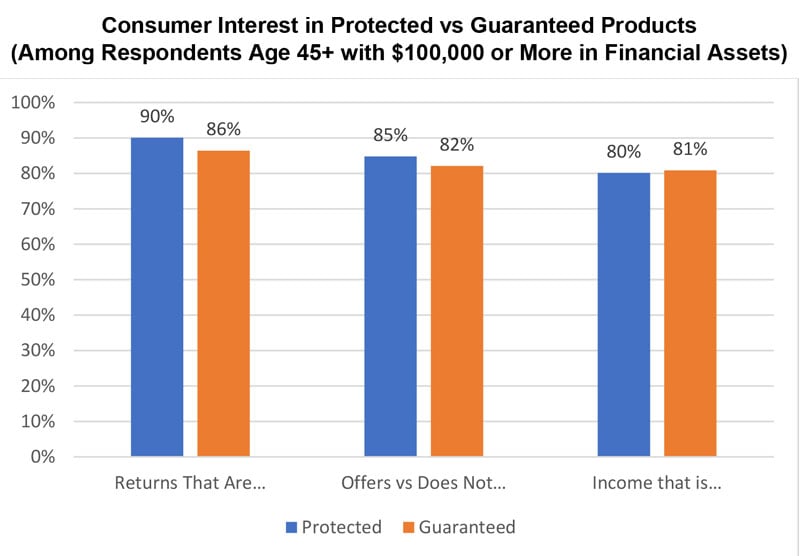

For our consumer analysis, we narrowed the respondent profile to those older than 45 with at least $100,000 in financial assets, since these are the individuals who are most likely to actually purchase an annuity, or similar product, offering either type of benefit (And while perceptions of younger respondents with lower assets would be interesting, they are unlikely to reflect the cohort of households who would actually buy these products).

A total of 313 respondents met this threshold, and the accompanying exhibit includes information about the percentage of respondents either agreeing or strongly agreeing to being interested in such a product that offers attributes that are either protected or guaranteed.

We can see that while Protected has a slight edge over Guaranteed, there is no meaningful difference in interest between products described using those two terms. There is, however, a notable difference in the skepticism around the potential benefits.