Pros and Cons of Multiple Life Insurance Policies

You can apply for multiple life insurance policies, but it will entail a lot of filling out forms.

But is the extra hassle worth it?

Let’s find out.

Can you have more than one life insurance policy?

The legal bit.

Legally, you can apply to as many life insurers as you like.

There’s no limit to the amount of life insurance policies you can hold.

But!

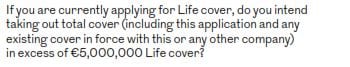

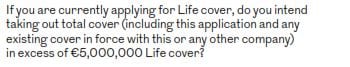

If the total cover you’re applying for exceeds a certain amount, you must inform each insurer you apply to.

And if the total cover you’re applying for is off the wall—you earn €30k, and you’re looking for €5m—it’s not going to happen, chief.

The insurer will refuse unless you prove why you need so much cover.

Remember, life insurance exists to replace your future earnings, not to leave a windfall should you die.

Now that you know you can apply for multiple life insurance policies, the next question is whether you should apply to multiple insurers.

What are the benefits of multiple life insurance policies?

Add-ons

Each insurer offers additional benefits such as:

What if you want all of these and an Everlasting Gobstopper?

Well, you do you and buy a separate policy from each insurer.

Different Underwriting Approaches

Each insurer has its own underwriting philosophy.

Insurer A may be more sympathetic than Insurer B for your health issue.

Applying to multiple insurers can give you a better chance of getting a lower price.

Lower Financial Risk

It’s rare for a life insurance company to go broke.

But, if you have policies from different insurers, you mitigate that risk.

What are the drawbacks of multiple life insurance policies?

Time

As mentioned, each insurer has a separate application form, so to apply to all five, you need to complete five forms.

This is a time suck if you’re in perfect health but imagine what if you have to complete health questionnaires too.

That means five application forms and five sets of health questionnaires.

What if the insurer needs a medical report or a nurse screening

That means five application forms, questionnaires, nurse screenings, and your GP must complete five medical reports.

As you can see, you could spend much of your life filling out application forms and getting poked and prodded by said GP.

Policy Fees

Each life insurance policy has a built-in fee.

If you have five policies, you’ll have five times the fees, making it more expensive than holding one policy.

Multiple Direct Debits

You’ll also have five direct debits to monitor, plus their associated fees.

If you miss a payment, that’s five referral charges.

Ouch!

Cumbersome Reviews

It’s a good idea to review your life insurance every few years. Reviewing one policy is time-consuming; imagine trying to review five.

Should you apply to multiple life insurance companies?

For most people, the answer is no.

One insurer is enough.

However, you may need to apply to multiple insurers for the best price if you have health issues.

Contact a specialist advisor (oh, hi there!) who can assess your health and recommend the best insurer for your underlying conditions.

In most cases, you’d be better off buying insurance from one provider.

Unless you’re buying different types of policies.

In this case, buy from the insurer offering the best coverage type.

Despite what they would lead you to believe, no one insurer is best for mortgage protection, life insurance, serious illness cover, and income protection.

The one reason you should split your life insurance company among multiple insurers

Non-medical limits.

Non-medical what nows?

The non-medical limit is the maximum coverage a person can get before doing extra medical stuff like a nurse screening or a medical exam.

The non-medical limits are quite generous when you are young.

If you are 36 or under, you can get up to €1,000,000 cover based solely on an application form.

However, as you get older, these non-medical limits get stricter.

At 50, the maximum coverage you could get without further medical evidence is €550,000.

But what if you’re 50 and need €700,000 ASAP and don’t have time for medicals, or you just want to avoid them?

Well, in that case, you can split your cover.

Get €350,000 from insurer A and €350,000 from insurer B.

Bish, bash, bosh!

Bob’s your uncle, Fanny’s your aunt.

Over to you…

If you’re wondering which insurer is best for you and would like me to guide you, simply fill in this form, and I’ll be right back.

My job is to ensure that you don’t waste time applying to the wrong insurer, especially if you have a health issue.

You can grab a time here if you’d prefer a call first.

Thanks for reading

Nick

Editor’s Note | We published this article in 2017 and have regularly updated it.