Private ILS fund seasonality evident in strong 1.67% average August returns

Private ILS funds, so those allocating to collateralised reinsurance and instruments other than catastrophe bonds, saw a very strong August as seasonality boosted the average returns of this segment of the market to 1.67%, according to ILS Advisers.

The returns of insurance-linked securities (ILS) funds as a group remain on a record-setting pace in 2023.

With August performance just reported, the Eurekahedge ILS Advisers Index was up by 1.37% for for the month, taking the year-to-date performance to an impressive 9.31%.

While August saw a number of significant catastrophe loss events, such as the Lahaina wildfire in Maui, Hawaii, hurricane Hilary and Idalia in the United States, and typhoon Saola in Hong Kong and China, none of these were sufficiently large events to derail ILS fund performance in the month.

ILS Advisers did note though that these smaller catastrophe losses “will lead to further ero- sion of annual aggregates.”

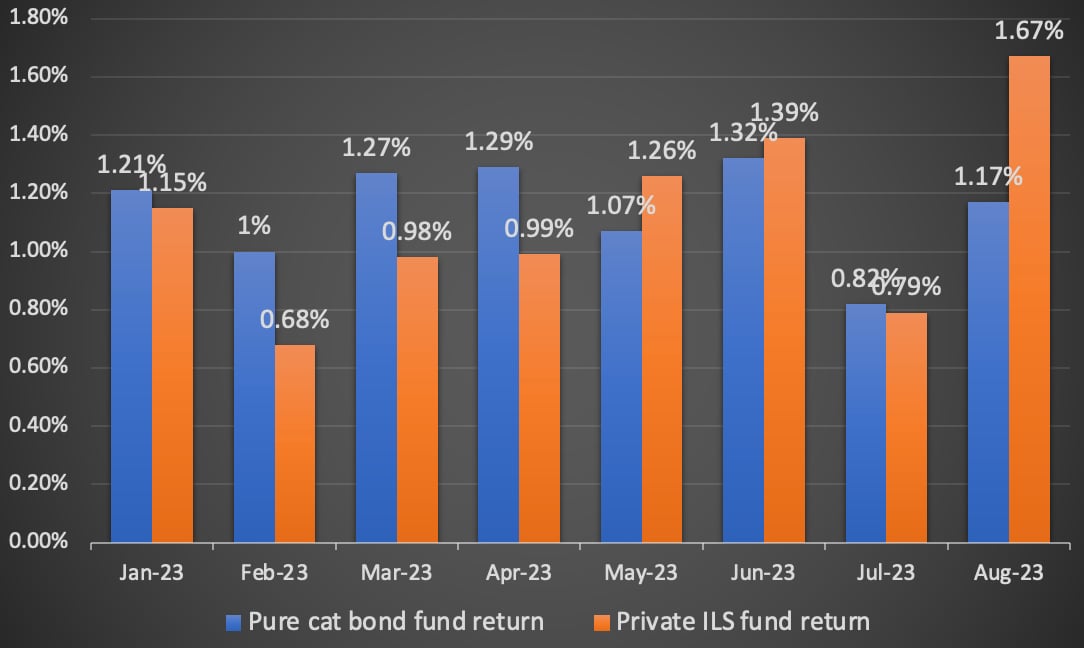

During the month of August 2023, pure catastrophe bond funds as a group delivered a positive return of 1.17%.

This was driven by strong cat bond price performance and spread widening, that drove a very high cat bond market total return for the month.

However, those private ILS funds that invest across collateralized reinsurance instruments performed even better, thanks to the emergence of strong seasonality effects in their return profile.

As a result, private ILS funds as a group delivered 1.67% for the month of August.

You can see the split of cat bond fund versus private ILS fund returns for 2023 so far below, with August being the strong month so far for the private ILS side of the market:

Every fund tracked in the Eurekahedge ILS Advisers Index delivered positive returns for August 2023.

2023 is so far the second strongest annual return for the ILS market, as tracked by this Index.

At 1.37%, this was the strongest August return on record for the Index and for the first eight months of the year, the Index performance has also now set a new record.

There was, as ever, quite a performance gap though between the ILS funds tracked, with the worst performing ILS fund only delivering a 0.04% return for August 2023, while the best performing ILS fund returned +2.80%.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 26 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.