Private cat bond issuance hits $642m in 2023, as Eclipse Re issues $100m deal

Private catastrophe bond issuance for 2023 has now reached $642 million, as a new issuance of privately placed insurance-linked securities (ILS) has been completed by the Eclipse Re vehicle, a nearly $100 million Eclipse Re Ltd. (Series 2023-9A) deal.

Eclipse Re Ltd. is a private syndicated collateralised reinsurance note, private catastrophe bond, issuance and reinsurance transformer platform, that is domiciled in Bermuda and owned / operated by ILS market facilitator Artex Capital Solutions.

Back in November we reported that Eclipse Re had issued six new private cat bond issuances totalling almost $91.2 million of risk capital issued.

Those issues took the volume of deals we had recorded year-to-date from Eclipse Re Ltd. to roughly $110 million, across 8 series of private cat bond notes issued. So it was running behind its 2022 total of almost $189.3 million of risk capital issued across seven issues.

But now, with a new almost $100 million private cat bond and the ninth to come from Eclipse Re this year now completed, the structure is back on track for another strong showing in 2023.

Eclipse Re Ltd. is a Bermuda domiciled special purpose insurer (SPI) and segregated account company.

The structure is managed by insurance-linked securities (ILS) market facilitator and service provider Artex Capital Solutions and is used in the main by ILS fund managers, with Fermat Capital Management one of the names linked to the structure as a user in recent years.

We’ve now learned that Eclipse Re Ltd. has issued just under $100 million of Series 2023-09A notes ($99,999,975), on behalf of Segregated Account EC59, with these notes having a final maturity date, of September 30th 2025.

The notes have been privately placed with qualified investors.

We don’t know what the trigger or peril(s) featured in this private catastrophe bond deal are, but assume they will be some kind of property catastrophe reinsurance or retrocessional risk.

The proceeds from the sale of the nearly $100 million of Series 2023-09A private cat bond notes issued by Eclipse Re will have been used as collateral to underpin a related reinsurance or retrocession contract, held in a trust, enabling the risk transfer and the creation of investable catastrophe-linked securities.

Given the maturity date of this private cat bond is for the end of September 2025, it is possible this deal represents the securitization of an up to two year reinsurance or retrocession arrangement.

This new Eclipse Re Ltd. (Series 2023-9A) deal takes the Eclipse Re platform total issuance for 2023 so far to just under $210 million of private cat bond risk capital issued, so eclipsing the prior year total

Including this new Eclipse Re deal, the Artemis tracked total for private cat bond issuance in 2023 is just under $642 million.

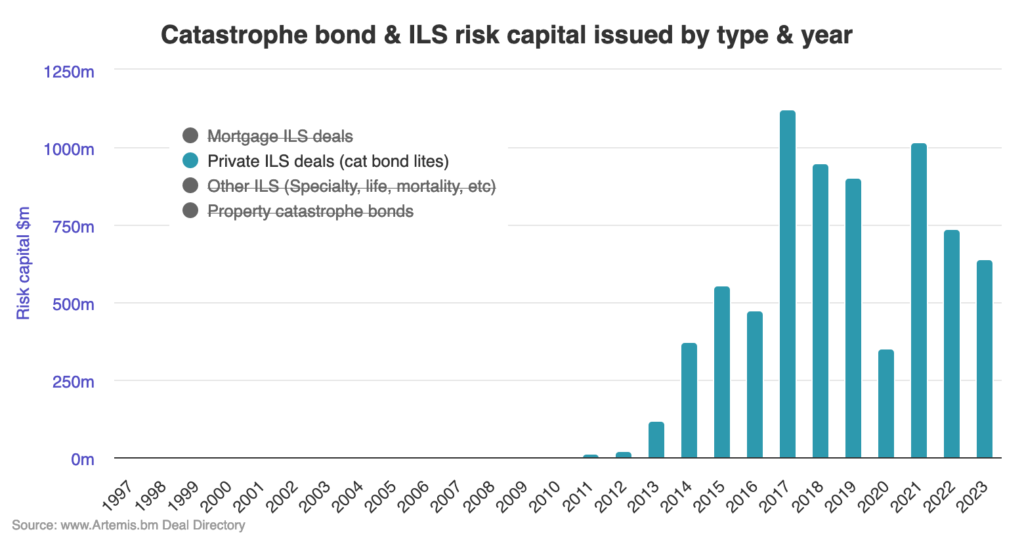

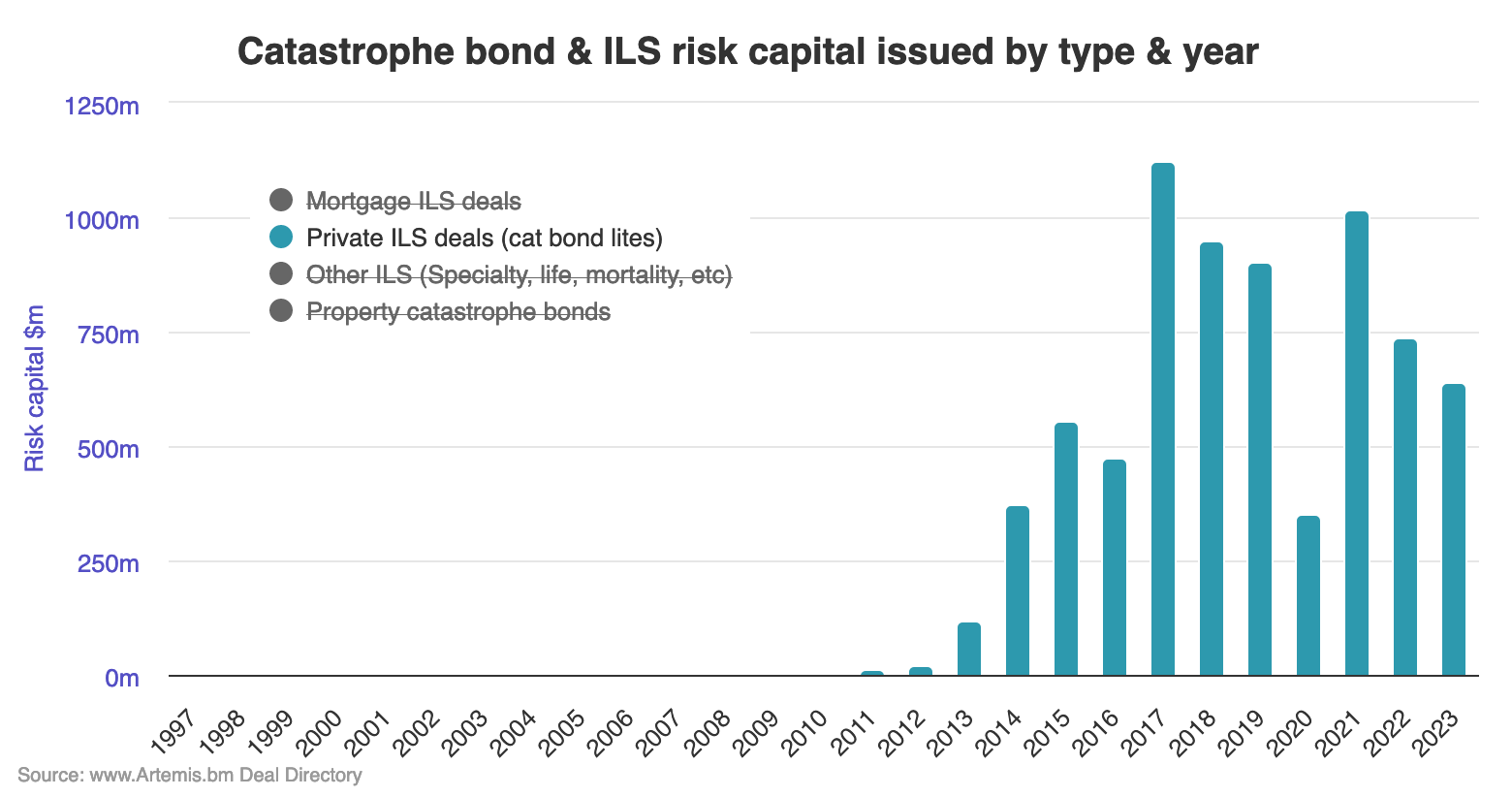

That’s now creeping closer to the 2022 total, when private cat bond and private ILS deal volumes tracked in our Deal Directory reached almost $738 million for the full-year.

But still well below the peaks seen in 2017, or more recently in 2021, when issuance of privately placed catastrophe bond deals of this kind surpassed the billion dollar level.

Analyse private catastrophe bond issuance by year using our interactive chart.

You can view details of every private cat bond we’ve tracked by filtering our Deal Directory to see private ILS transactions only.