Pimp Up My Van – Why Millennials are Choosing Caravans for UK Adventures

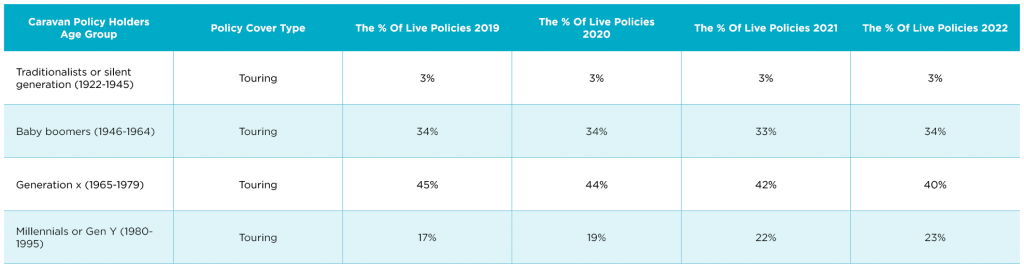

New research from our data team here at The Insurance Emporium of caravan policies has revealed ‘millennials’ are our biggest growing demographic, now accounting for 23% of all touring caravan policies in 2022, an increase of 5% since 2019. This demographic has shown growth by 85% (2022) since 2019. The surge behind this is being driven by an increase in caravan ownership for those under 40 since the pandemic.

Data collected for each year runs from 1st of Jan to the 31st of December.

And it’s not just new caravan’s that are piquing the interest of millennials. According to Pinterest Trends, searches for ‘caravan interior ideas’ are up 60% (March 2023) since last year (Feb 2022), with millennials accounting for approximately 52% of these searches, suggesting second-hand ownership is also on the up. With the increasing popularity of buying second-hand goods, buyers are looking to give older caravans a new lease of life and bring them in-line with the latest interior trends without it costing the earth (literally).

Millennials are known for their mindfulness towards sustainable travel, and this aligns perfectly with caravan ownership as it offers a reduced carbon footprint compared to air travel.

Francis Martin, CEO at The Insurance Emporium said: “Unsurprisingly, since the pandemic we have seen a shift in people’s attitudes towards travel, yet this has been further exacerbated by the cost of living crisis.

We know that millennials are a very family-orientated generation, therefore caravans provide the perfect opportunity for a family getaway. From weekends away to the coast to family-friendly festivals, caravan travel provides a new adventure each time. There’s also the multi-generational element that caravans can bring together several generations of the same family in one place.”

The recent announcement that more than 1,000 Passport Office workers are due to strike this spring could further boost UK staycations; with last minute travels plans potentially being scuppered.

Martin continues: “Travelling abroad has been plagued with issues since 2019. Firstly, the pandemic travel restrictions, then missing luggage and staff shortages last summer, and now strikes including passport office workers. It’s a no brainer that UK staycations offer travellers better flexibility as well as amazing experiences. Plus, dogs can come too!”

While the UK is in the midst of a cost of living crisis, holidays are still a spending priority according to ABTA with people planning to cut back on non-essentials elsewhere before reducing their spend on holidays.

CONCLUSION

Caravan holidays can open up a wealth of experiences, right on your doorstep and your getaway is completely built around you and your family’s needs. However, sometimes the unexpected can happen and having caravan insurance can help ensure your holiday home is protected.

Here at The Insurance Emporium we have a range of caravan insurance policies to suit you, whether you have a tourer or a static caravan. We are caravan lovers ourselves so know how important it is to have that peace of mind. Take a look today and get a free quote so you can head off on the open road without a hitch!

All content provided on this blog is for informational purposes only. We make no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. We will not be liable for any errors or omissions in this information nor for the availability of this information. We will not be liable for any loss, injury, or damage arising from the display or use of this information. This policy is subject to change at any time.

We offer a variety of cover levels, so please check the policy cover suits your needs before purchasing. For your protection, please ensure you read the Insurance Product Information Document (IPID) and policy wording, for information on policy exclusions and limitations.