PFAS-Related Litigation May Signal an Emerging Liability for Insurers

Max Dorfman, Research Writer, Triple-I

Per- and Polyfluoroalkyl Substances (PFAS)—a varied group of human-made chemicals used in an array of consumer and industrial products—present a new potential liability for insurers, as U.S. regulatory activity continues to change, with lawsuit outcomes indicating this is an issue that will continue to develop.

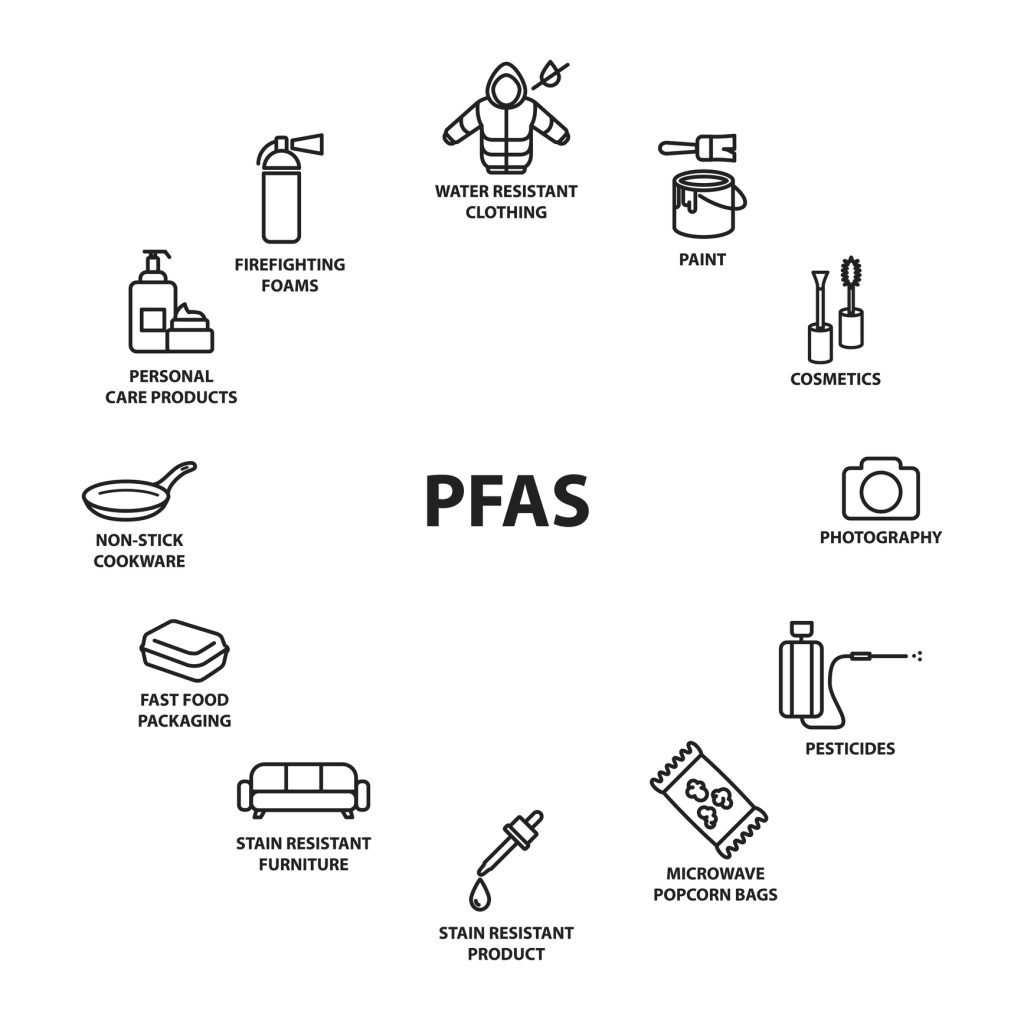

PFAS, which have existed since the 1930s, are creating concern because of how ubiquitous they are, as well as their potential to harm people’s lives. They are used in everything from Teflon coatings to food packaging to firefighting foam, due to their capacity to resist oil and moisture. These qualities are also potentially damaging because they often stay in the human body, never entirely breaking down.

Though studies surrounding PFAS are not conclusive, they have been connected to cancer, pregnancy-induced hypertension, and thyroid disease. Their pervasiveness means everyone likely has some amount of PFAS in their blood stream. There is fear about their presence in water supplies, as well.

“PFAS are water soluble and dissolve readily in soil,” said Cindy Wilk, Global Environmental Liability Expert, Allianz Risk Consulting at AGCS. “An industrial accident or firefighting incident can result in their release into water sources, making local communities vulnerable, but PFAS can also migrate quickly through groundwater pathways to contaminate areas far from their original source.”

PFAS litigation continues to rise

PFAS litigation has seen tremendous growth over the past 20 years, beginning with a lawsuit filed against DuPont, the company that makes Teflon. DuPont was accused of contaminating water from a plant in West Virginia—resulting in a settlement to provide up to $235 million for medical monitoring of over 70,000 people. Several similar lawsuits have followed.

As of 2021, more than 5,000 PFAS-related complaints have been filed in 40 courts, with 193 defendants in 82 industries.

Additionally, in 2021, the PFAS Action Act passed the House and set the Environmental Protection Agency (EPA) on the recent course toward developing new PFAS standards. The act does not include a liability exception for water-wastewater utilities, despite the fact that these entities are not the source of PFAS, thus causing concern that they will be the target of civil litigation

How can insurers respond?

Although the Insurance Services Office (ISO) has not produced a PFAS-specific exclusion for commercial liability policies, work is being done on a draft exclusion, which could be published in late 2022. With that process still underway, several PFAS-related exclusions are circulating, some as a modification to the Total Pollution Exclusion or by establishing a stand-alone PFAS exclusion. Still, insurers must be wary of the potential liabilities, as the Biden Administration’s regulatory focus on PFAS could lead to increased litigation.

Reinsurer Gen Re recommends that insurers:

Take inventory of previously underwritten risks;Carefully consider new risks at submissions; andKeep abreast of PFAS, both as to scientific developments and the litigation that it spawns.