Personal Auto Insurers’ Losses Keep RisingDue to Multiple Factors

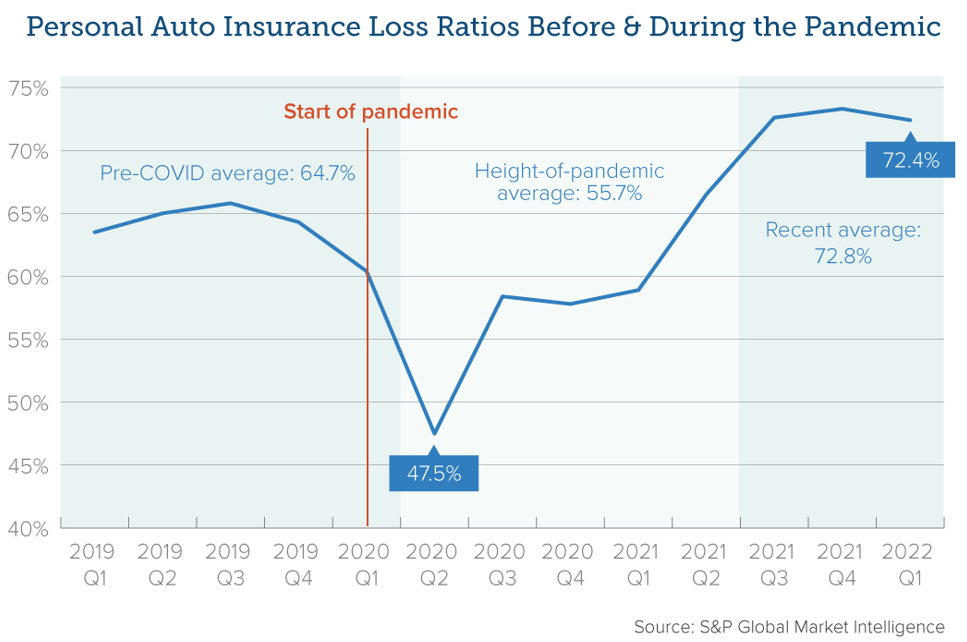

Nearly all the largest U.S. personal auto insurers reported poor financial results in the second quarter of 2022, according to an S&P Global Market Intelligence analysis. Several issues contributed to this trend and are putting upward pressure on premium rates as insurers’ loss ratios grow. The loss ratio is the percentage of each premium dollar an insurer spends on claims.

The factors driving negative auto insurer economic performance include:

Rising insurer losses due to increasing accident frequency and severity;More fatalities and injuries on the road, leading to increased attorney involvement in claims;Continuing supply-chain issues, leading to rising costs for autos, auto replacement parts, and labor; andMore costly auto repairs due to safer, more technologically sophisticated vehicles.

“The private auto business, besieged by the impact of inflation on vehicle repair and replacement costs, swung to a combined ratio of nearly 101.5 percent in 2021 from 92.5 percent in 2020 and 98.8 percent in 2019,” S&P reports. Combined ratio represents the difference between claims and expenses paid and premiums collected by insurers. A combined ratio below 100 represents an underwriting profit, and a ratio above 100 represents a loss. “After the private auto business nearly brought the industry to the brink of breakeven in 2021, we project that it will push the overall combined ratio into the red in 2022.”

At the beginning of the pandemic in 2020, auto insurers – anticipating fewer accidents amid the economic lockdown – gave back approximately $14 billion to policyholders in the form of cash refunds and account credits. While insurers’ personal auto loss ratios fell briefly and sharply in 2020, they have since climbed steadily to exceed pre-pandemic levels.

With more drivers returning to the road in 2022, this loss trend is expected to continue. The severity of the post-pandemic riskiness of U.S. highways is illustrated by the fact that traffic deaths – after decades of decline – have increased in the past several years due to more drivers speeding, driving under the influence, or not wearing seat belts during the pandemic. In 2021, U.S. traffic fatalities reached a 16-year high, with nearly 43,000 deaths.

“When everyday life came to a halt in March 2020, risky behaviors skyrocketed and traffic fatalities spiked,” said National Highway Traffic Safety Administration (NHTSA) administrator Steven Cliff. “We’d hoped these trends were limited to 2020, but, sadly, they aren’t.”

This year, NHTSA estimates, 9,560 people died in motor vehicle crashes between January and March, up 7 percent from the same period in 2021, making it the deadliest first quarter since 2002.

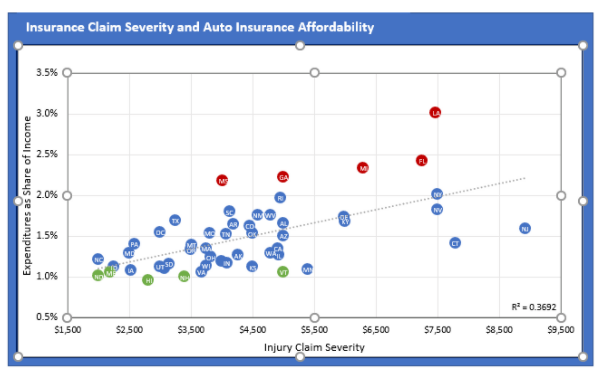

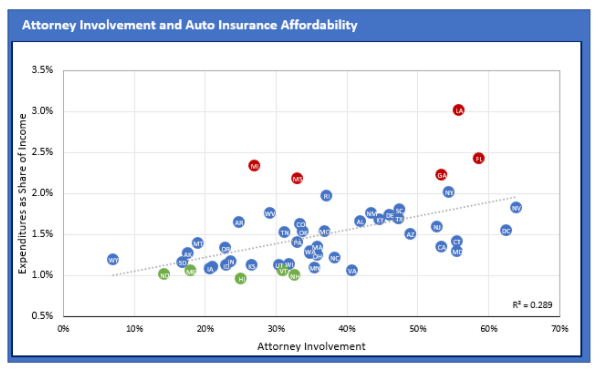

Auto insurers also must contend with cost factors beyond what is occurring on the nation’s roadways. A recent auto insurance affordability study published by the Insurance Research Council (IRC) highlights the role of attorney involvement in driving up insurer expenses – and, ultimately, policyholder premiums – in the states where auto coverage is least affordable. As attorney involvement tends to be more prevalent in claims cases involving bodily injury, the NHTSA numbers are important for understanding upward pressure on auto insurance premium rates.

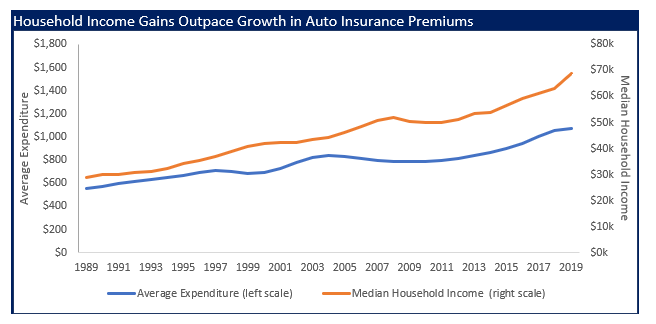

The IRC – like Triple-I, an affiliate of The Institutes – also points out that consumer spending on auto insurance has grown more slowly over the past 30 years than median household income, at least through year-end 2019 (see chart below).

In a society as dependent as ours is on access to transportation, availability and affordability of auto insurance are important components of overall consumer expenses. Triple-I will continue to report on trends in this important line.

Learn More:

IRC Releases State Auto Insurance Affordability Rankings

Cellphone Bans Cut Crashes; Telematics Can Help Reduce Distracted Driving

2022 P&C Underwriting Profitability Seen Worsening as Inflation, Hard Market Persist

Pot Legalization Link to Car Crashes Varies by State, Study Finds

Delaware Legislature Adjourns Without Action on Banning Gender as Auto Insurance Factor

IRC Study: Public Perceives Impact of Litigation on Auto Insurance Claims

Distracted Driving Surges Since Start of Pandemic