Party’s Over: Health Plan Premiums Poised to Spike in 2023, After Period of Modest Growth

We’re in the middle of rate filing season for health insurers. Although most proposed premium rates for 2023 won’t be public until the end of July, a handful of state regulators require submissions in May or June and post those proposed rates on their websites. These early rate filings can provide hints about how insurers are responding to market trends, policy changes, and emerging drivers of health care costs. This year, insurers are setting premiums amidst a spike in inflation, uncertainty about federal policies affecting the Affordable Care Act (ACA) Marketplaces, and a pandemic with an unknown future trajectory. To gain insights into how individual market insurers are developing their 2023 premium rates, I reviewed* early proposed rate filings in the District of Columbia (D.C.), Maine, Maryland, Michigan, Oregon, Rhode Island, Vermont, and Washington.

Tick Tock: The 2023 Rate Filing Calendar Requires Decision-making Amidst Multiple Unknowns

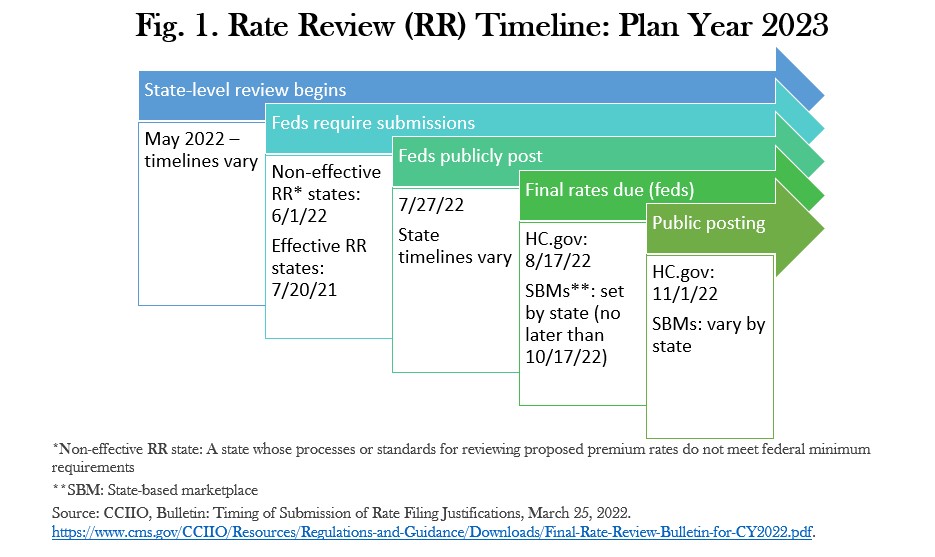

Determining premium rates for each plan year requires a long lead time. Under federal rules, insurers must submit proposed rates no later than July 17 for the next year, and some states require an earlier deadline. See Figure 1.

Although a number of states publicly post rate filings in May and June, HealthCare.gov will publicly post filings on July 27. Once rates are finalized, they are generally locked in for the entire next plan year, although some last-minute changes before November 1st may be possible. The long lead time for the annual rate review process means insurers are setting rates for all of 2023 without knowing whether Congress will extend the American Rescue Plan’s enhanced premium tax credits, which are currently scheduled to expire in December 2022. They also do not know when the COVID-19 Public Health Emergency (PHE) will end, triggering the disenrollment of up to 16 million people from Medicaid. And no one can know how much longer COVID-19 will continue to affect health care costs and utilization.

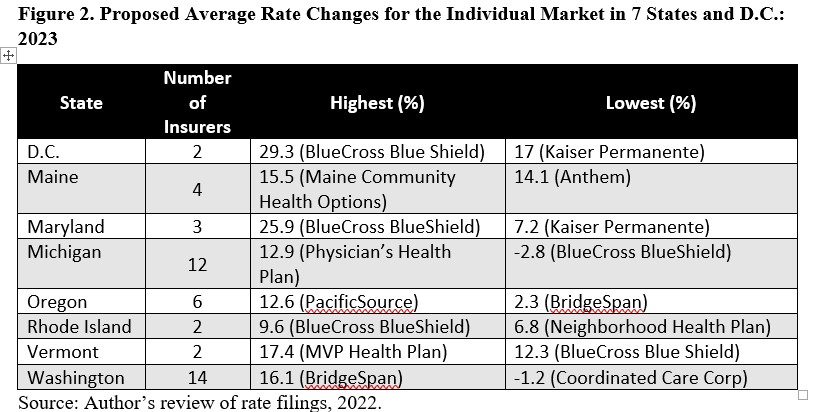

In the selected states with early filing deadlines, average rate increases are considerably higher than they have been in the last couple of years, although there are a few insurers proposing only modest hikes, or even small reductions. See Figure 2.

Paying it Forward (Not in a Good Way)

After a banner year in 2020, many insurers had higher-than-expected utilization in 2021 and in early 2022, resulting in a market-wide $1.7 billion underwriting loss that many are seeking to recoup with higher premiums in 2023. In their rate filings, insurers attributed this to pent up demand for health care services that people had delayed or foregone in 2020 because of COVID-19, as well as the emergence of the Delta variant in mid-2021. Some insurers also reported that those who enrolled through 2021’s extended special enrollment period (SEP) tended to be sicker than those who signed up during the annual open enrollment window. For example, Molina of Washington had a pretax net income loss of almost $35.5 million in 2021; Kaiser Permanente in Maryland lost over $4 million. Premera Blue Cross Blue Shield in Washington attributes fully 9% of its 15.41% proposed rate increase to “worse than expected” experience in 2021. MVP Health Plan in Vermont reports that its experience this year is “more adverse” than they priced for, accounting for a 16.1 percent increase in their rates.

It’s [Always] the Prices, Stupid

A primary driver of 2023’s proposed rate increases is the rising cost of health care goods and services. Hospitals in particular are seeking reimbursement increases to account for higher labor and supply costs, driven in part by the COVID-19 pandemic. As Blue Cross Blue Shield of Vermont put it: “To a greater extent than usual, trend [in medical costs] is the most significant driver to the change in rates.” The insurer, which is seeking an average increase of 12.3 percent, expects prices for its Vermont providers to jump by 9.7 percent next year. Blue Cross Blue Shield of Rhode Island similarly cites “significant inflation” in provider costs for 2023. Additionally, although used by only a minority of enrollees, insurers pointed to the high and rising prices of specialty pharmaceuticals as a significant driver of this year’s proposed rate hikes.

Expected Federal Policy Changes Push Premiums Up

Although provider and pharmaceutical prices are key factors, health care actuaries are also predicting an increase in the use of medical services (utilization) and a decline in the overall health status (morbidity) of the individual market risk pool. One reason is the expected expiration of the enhanced premium tax credits provided under the American Rescue Plan Act (ARPA). Unless Congress extends those subsidies, they will expire at the end of 2022, resulting in significant net premium increases for most Marketplace enrollees. Many insurers’ proposed rates for 2023 assume that their enrollment will be smaller and sicker as a result. For example, Blue Cross Blue Shield of Michigan is attributing a 0.3 percent increase in premiums to the end of the ARP subsidies, while Oscar expects the increase in market morbidity to cost enrollees 1.7 percent more in premiums. On the other hand, some insurers are shrugging off the impact of the end of the ARP subsidies. Molina of Washington, for example, is assuming that its 2023 enrollees will have the same risk profile as its 2022 enrollees.

Several insurers are also seeking a premium increase because enrollees who are disenrolled from Medicaid after the end of the PHE are expected to have poorer health, on average, than typical commercial market enrollees. For example, Neighborhood Health Plan of Rhode Island writes in its rate filing: “[We] made assumptions around increases in enrollment and higher claims expenses from [members transitioning from Medicaid]. [We are] anticipating a morbidity increase of 1.5% due to the end of the PHE.”

The Never-ending Pandemic

Insurers have different projections about the COVID-19 pandemic. Although most predict a decline in COVID-related costs, a few have a less rosy outlook. Blue Cross Blue Shield of Rhode Island, for example, expects to spend 50 percent less on COVID-related services than it did in 2021. Similarly, PacificSource of Oregon wrote, “…during the beginning months of 2022, we have seen a significant decrease in utilization as well as cost associated with COVID-19. We are projecting that utilization and costs due to COVID-19 in the projection period will continue to remain well below levels seen in [2021].” A few insurers, such as Anthem and Aetna in Maine, are assuming that their 2023 COVID claims costs will be the same as they were in 2021. And some are predicting that certain COVID-related expenses, such as for tests and booster shots, will increase. For example, Providence of Oregon is adding .4 percent to its 2023 premium to cover COVID booster shots.

Tighten Our Belts? Nah.

For affected families, the eye-popping premium increases that many insurers are seeking will compound the pinch of inflated gas, grocery and other prices. But that’s not stopping some insurers, particularly the for-profit ones, from building big profit margins into their rates. United Healthcare and Centene in Washington want hefty 5 percent margins in 2023, while Oscar in Michigan wants 4.3 percent and Anthem in Maine is seeking 4 percent. Non-profit insurers are seeking somewhat smaller but still significant margins, such as the 3 percent sought by Neighborhood Health Plan in Rhode Island.

Looking Ahead

The 2023 proposed rates are not the final word. Many (but not all) state departments of insurance (DOIs) will review the proposed increases, and some will push back on rates they find to be excessive or unreasonable. If Congress manages to enact a reconciliation bill that extends the ARPA subsidies, many state DOIs will demand that insurers reduce their rates accordingly. But Congress will need to act swiftly, before these 2023 rates become irreversible.

* My review of these rate filings was largely limited to the actuarial memoranda that must accompany each rate filing. These memos explain, in lay language, insurers’ past experience, current assumptions, and predictions for the next plan year.