Online Life Insurance: Market 2022 Overview with detailed analysis, Competitive landscape Forecast 2028 | Japan Post Insurance, State Farm, Haven Life, AIG – ChattTenn Sports – ChattTenn Sports

Online Life Insurance Market 2022 this report is including with the COVID19 Outbreak Impact analysis of key points influencing the growth of the market. Also, Online Life Insurance Market (By major key players, By Types, By Applications, and Leading Regions) Segments outlook, Business assessment, Competition scenario, Trends and Forecast by Upcoming Year’s. The study of the Online Life Insurance report is done based on the significant research methodology that provides the analytical inspection of the global market based on various segments the Industry is alienated into also the summary and advance size of the marketplace owing to the various outlook possibilities. The report also gives 360-degree overview of the competitive landscape of the industries. SWOT analysis has been used to understand the strength, weaknesses, opportunities, and threats in front of the businesses. Thus, helping the companies to understand the threats and challenges in front of the businesses. Online Life Insurance market is showing steady growth and CAGR is expected to improve during the forecast period.

This Free report sample includes:

A brief introduction to the Online Life Insurance Market research report.

Graphical introduction of the regional analysis.

Top players in the Online Life Insurance Market with their revenue analysis.

Selected illustrations of Online Life Insurance Market insights and trends.

Example pages from the Online Life Insurance Market report.

The Major Players in the Online Life Insurance Market.

Japan Post Insurance

State Farm

Haven Life

AIG

Northwestern Mutual

MetLif

Manulife Financial

New York Life

Nippon Life Insurance Co.

Banner

ACE

Lifenet Insurance

TIAA Life

Dai-ichi Life Insurance

Key Businesses Segmentation of Online Life Insurance Market

on the basis of types, the Online Life Insurance market from 2015 to 2025 is primarily split into:

Investment Policies

Protection Policies

on the basis of applications, the Online Life Insurance market from 2015 to 2025 covers:

Kids

Adults

Some of the key factors contributing to the Online Life Insurance market growth include:

Growing per capita disposable income

Favorable for youth Demographics

Technology advancement

In terms of COVID 19 impact, the Online Life Insurance market report also includes following data points:

Impact on Online Life Insurance market Size

End User Trend, Preferences and Budget Impact of Online Life Insurance market

Regulatory Framework/Government Policies

Key Players Strategy to Tackle Negative Impact of Online Life Insurance market

New Opportunity Window of Online Life Insurance market

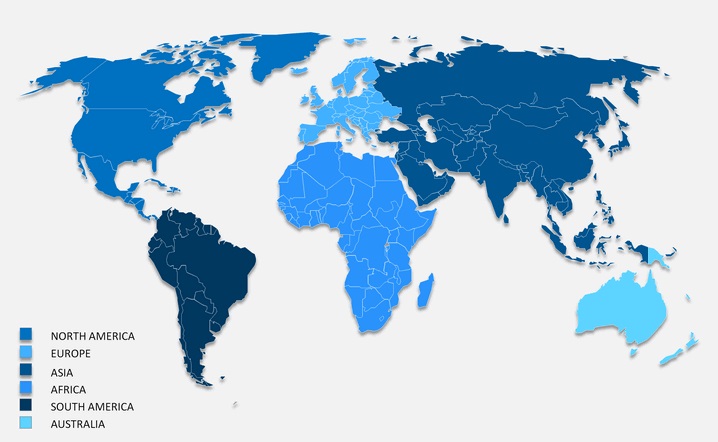

Regional Online Life Insurance Market Analysis:

It could be divided into two different sections: one for regional production analysis and the other for regional consumption analysis. Here, the analysts share gross margin, price, revenue, production, CAGR, and other factors that indicate the growth of all regional markets studied in the report. covering North America, Europe, Asia-Pacific, South America, Middle East, and Africa.

Key Question Answered in Online Life Insurance Market Report.

What are the strengths and weaknesses of the Online Life Insurance Market?

What are the different marketing and distribution channels?

What is the current CAGR of the Online Life Insurance Market?

What are the Online Life Insurance market opportunities in front of the market?

What are the highest competitors in Online Life Insurance market?

What are the key outcomes of SWOT and Porter’s five techniques?

What is the Online Life Insurance market size and growth rate in the forecast period?

Purchase FULL Report Now! https://www.qurateresearch.com/report/buy/HnM/global-online-life-insurance-market/QBI-MR-HnM-1076842

A free report data (as a form of Excel Datasheet) will also be provided upon request along with a new purchase.

Major Points from Table of Contents:

There are 13 Chapters to thoroughly display the Online Life Insurance market. This report included the analysis of market overview, market characteristics, industry chain, competition landscape, historical and future data by types, applications, and regions.

Chapter 1: Online Life Insurance Market Overview, Product Overview, Market Segmentation, Market Overview of Regions, Market Dynamics, Limitations, Opportunities and Industry News and Policies.

Chapter 2: Online Life Insurance Industry Chain Analysis, Upstream Raw Material Suppliers, Major Players, Production Process Analysis, Cost Analysis, Market Channels, and Major Downstream Buyers.

Chapter 3: Value Analysis, Production, Growth Rate and Price Analysis by Type of Online Life Insurance.

Chapter 4: Downstream Characteristics, Consumption and Market Share by Application of Online Life Insurance.

Chapter 5: Production Volume, Price, Gross Margin, and Revenue ($) of Online Life Insurance by Regions.

Chapter 6: Online Life Insurance Production, Consumption, Export, and Import by Regions.

Chapter 7: Online Life Insurance Market Status and SWOT Analysis by Regions.

Chapter 8: Competitive Landscape, Product Introduction, Company Profiles, Market Distribution Status by Players of Online Life Insurance.

Chapter 9: Online Life Insurance Market Analysis and Forecast by Type and Application.

Chapter 10: Online Life Insurance Market Analysis and Forecast by Regions.

Chapter 11: Online Life Insurance Industry Characteristics, Key Factors, New Entrants SWOT Analysis, Investment Feasibility Analysis.

Chapter 12: Online Life Insurance Market Conclusion of the Whole Report.

Chapter 13: Appendix Such as Methodology and Data Resources of Online Life Insurance Market Research.

(*If you have any special requirements, please let us know and we will offer you the report as you want.)

Note – In order to provide more accurate market forecast, all our reports will be updated before delivery by considering the impact of COVID-19.

Contact Us:

Web: www.qurateresearch.com

E-mail: [email protected]

Ph: US – +13393375221, IN – +919881074592