Navigating uncertainty: A fixed income update

In this Off the Cuff video, fixed income senior portfolio manager Albert Ngo discusses inflation, economic growth and possible outcomes for the market.

https://www.youtube.com/watch?v=BMjNqqbQFrg

Summary:

Hi, this is Albert Ngo, Senior Portfolio Manager at Empire Life. Given the recent volatility, I wanted to provide an update and share a little bit about how we are thinking about this market.

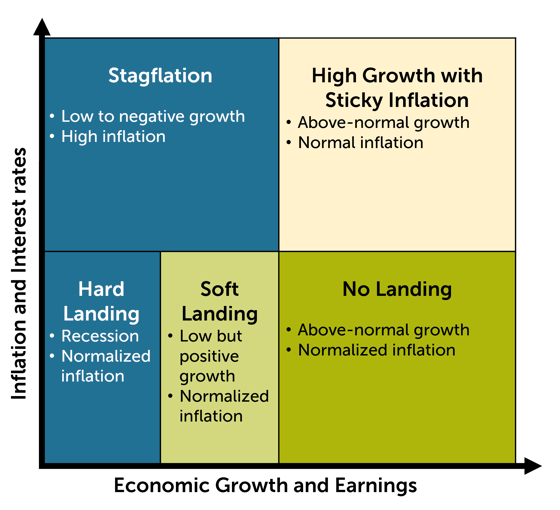

We are certainly in confusing times. The market appears dependent on the Fed; the Fed is dependent on data; and the data is dependent on an economy that has been difficult to predict. I think where this market ends up, will ultimately come down to the path of both growth and inflation, which are unpredictable but I think can be summarized into the following scenarios:

The best possible outcome is a “No Landing” scenario, where growth is above-normal and inflation declines

Another potential scenario is one with a resilient economy but inflation remains sticky

Other potential scenarios are a “Soft Landing” where we growth is below-normal but still positive while inflation declines or a “Hard Landing” where we enter into a recession

And the worst outcome would be “Stagflation” where we have no growth while inflation remains high

Unfortunately, it is impossible to predict where the economy will end up. For instance, from September to January, inflation had been on a downward trend while the economy remained resilient, so the market began pricing-in the chance of a no landing scenario, which resulted in strong performance across fixed income and equities. However, in February, data suggested the economy remained resilient with sticky inflation and so markets priced-in higher rates and a more inverted yield curve and fixed income and equity markets gave back much of the January performance

So, what are we thinking and how are we positioning our fixed income portfolios? Given the unpredictability of market directions, as always, we are taking a balanced approach. Given attractive all-in yields and with an inverted yield curve, we are overweight higher quality short-term corporate bonds that yield between 5 and 6.5% that have low volatility and very high downside protection. We still maintain diversified and have balanced exposure to longer term government bonds as we believe longer-term inflation will normalize. When we dig deeper into the inflation data, we are seeing disinflation in the price of goods and early signs of easing inflation in shelter. However, the stickiest components of inflation have been within non-housing services such as airfare and car insurance, which we are monitoring very closely and will adjust our positioning accordingly.

The increased inversion of yield curves is sending a stronger signal of a slowing economy, which has historically benefitted fixed income while big coupon yields of 4 to 6% provide high income to cushion our fixed income portfolios in the event of increased volatility.

With that, I wanted to thank you for listening and as always, we appreciate your support.

Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). Empire Life Investments Inc. is the Portfolio Manager of the Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance. All returns are calculated after taking expenses, management and administration fees into account.

This video/document includes forward-looking information that is based on the opinions and views of Empire Life Investments Inc. as of the date stated and is subject to change without notice. This information should not be considered a recommendation to buy or sell nor should it be relied upon as investment, tax or legal advice. Information contained in this report has been obtained from third-party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. and its affiliates do not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

March 8, 2023