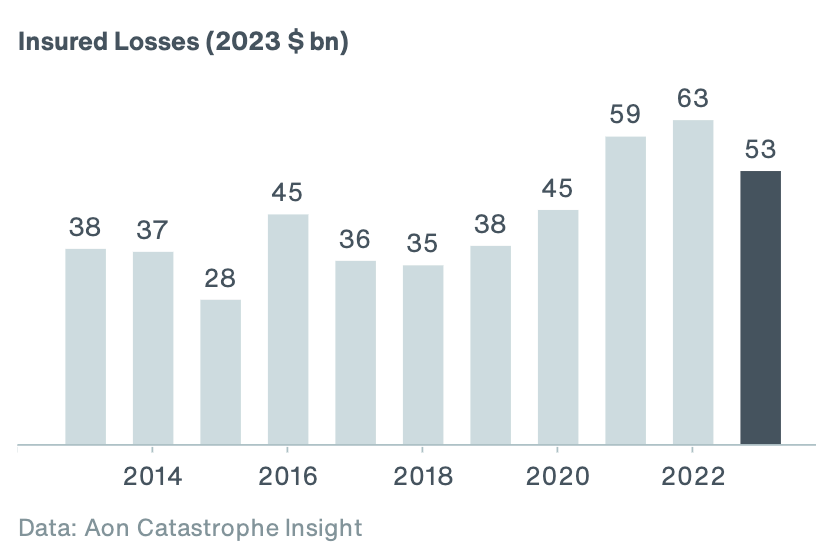

Natural disaster insured losses of $53bn in H1 were 46% above average: Aon

Natural disaster losses covered by the insurance and reinsurance industry reached an estimated $53 billion, according to broker Aon, which it notes was some 46% above the 21st-century average.

Like its broking rival Gallagher Re had reported earlier this week, Aon said that severe convective storm activity in the United States was the dominant source of insured losses during the first six months of this year.

Aon highlighted that “relentless SCS activity in the U.S.” drove 13 individual billion-dollar industry loss events during the period.

Aon also highlighted the continued inflationary trends that have been affecting loss quantum.

“Disaster costs continued to be affected by inflationary pressure, still persistent in many parts of the world, as well as other societal factors including demographics and wealth distribution that remain a major driver of financial loss,” the broking group said.

On the economic loss front from natural disasters, Aon estimates the global total for H1 2023 at $194 billion.

That is again above the H1 average of $128 billion for the 21st century, but perhaps more notably is the fifth highest on record and the highest experienced since 2011.

The devastating Turkey and Syria earthquakes drove almost half the economic losses, at an estimated $91 billion, which has now become the deadliest global disaster since 2010 and the costliest in both countries’ modern histories.

Because of the quakes, economic losses in the EMEA region were “unprecedented” at $111 billion Aon says, well above the previous H1 record of $71 billion set in 1990.

“Despite the reality that communities globally remain at risk to catastrophes, only about 27 percent of economic losses this year have been insured. These devastating events reinforce the importance of resilience and the mitigation of risk – such as enforcing building codes, which was highlighted by the Turkey and Syria earthquakes,” commented Michal Lörinc, head of Catastrophe Insight, Aon. “As we continue to face interconnected risks, we are focused on scaling risk mitigation and helping organizations make better decisions to close the global protection gap and enrich lives around the world.”

Back to severe convective storms, which Aon notes have driven an estimated $35 billion in total preliminary insured losses for the first-half, setting a new H1 record.

Of course, the levels of losses experienced has ramifications for the reinsurance sector, even at a time when more of these losses are being retained at the primary insurer level.

We’re seeing evidence of these convective storm losses in reporting already, such as re/insurer QBE’s raising of its catastrophe budget, insurer Travelers Q2 cat losses weighing on its results, and insurer Allstate revealing a heavy Q2 cat loss burden.

Aon explained the ramifications of a relatively heavy first-half of disaster loss activity, saying, “Heading into 1/1 renewals, reinsurers are carefully observing these trends with concern about the increased frequency of events.

“Insurers need to demonstrate ownership of their view of risk to differentiate their portfolios and prepare for potential catastrophes in Q3 and Q4.”