Nat cat gap expands 5.2% to $385bn, but protection more available: Swiss Re

The global natural catastrophe protection gap widened again in 2023, rising 5.2% to US $385 billion in premium equivalent terms, but at the same time Swiss Re reports that there are signs of more protection being available, which over time should see more losses covered by insurance and reinsurance.

Swiss Re’s Institute sigma research team said that the firm’s measure for the global natural catastrophe insurance protection gap widened due to economic growth and inflation last year.

Positively though, “Global protection available increased by 10.1% yoy in 2023, greater than the 6.3% yoy rise in protection needed, resulting in improved resilience, an encouraging underlying trend in risk protection,” the reinsurance company explained.

Adding that, “These growth rates indicate that although there are more, or more expensive, assets to protect, an increasing share of them are covered by insurance.

“This is a positive trend for global resilience if it continues in the long term.”

According to Swiss Re’s analysis, global insurance resilience was stable at 58% in 2023, helped by gains in mortality resilience due to higher life insurance take-up, and in emerging markets’ health resilience as well.

Overall though, the global protection gap across insurance perils reached a new high of US $1.83 trillion in premium equivalent terms in 2023, up by 3.1% in nominal terms from a restated US $1.77 trillion for 2022.

The global protection gap has expanded by 3.6% annually in nominal terms since 2013, Swiss Re said, which roughly matches nominal GDP growth trends.

Natural catastrophe resilience, a measure of how much in economic losses was covered by insurance and reinsurance, rose to 25.7% in 2023.

But Swiss Re noted that a key driver of this was the fact 2023 saw a high proportion of severe convective storm losses, especially in the US, which is a peril and region that is relatively more insured than others.

“The past 10 years have seen improvement in global natural catastrophe insurance resilience. However, the key driver has been a strong rise in advanced markets resilience, which increased to above 38% in 2023 from around 35% in 2013. In emerging markets, resilience is typically still extremely low, and regions are almost entirely unprotected from natural catastrophe risk,” Swiss Re’s sigma team explained.

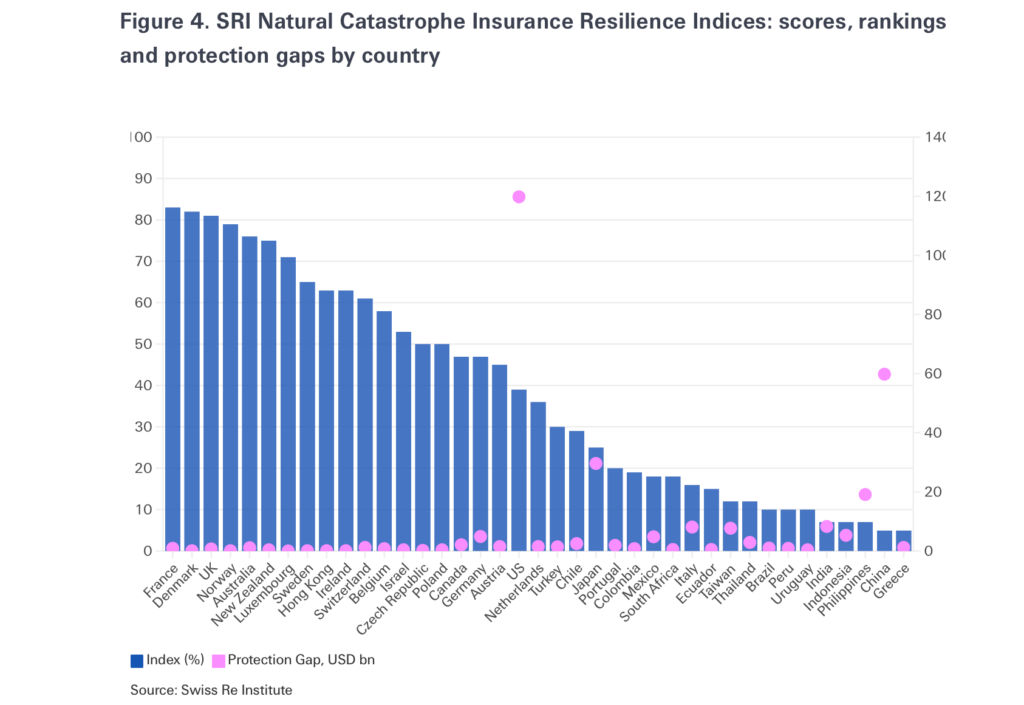

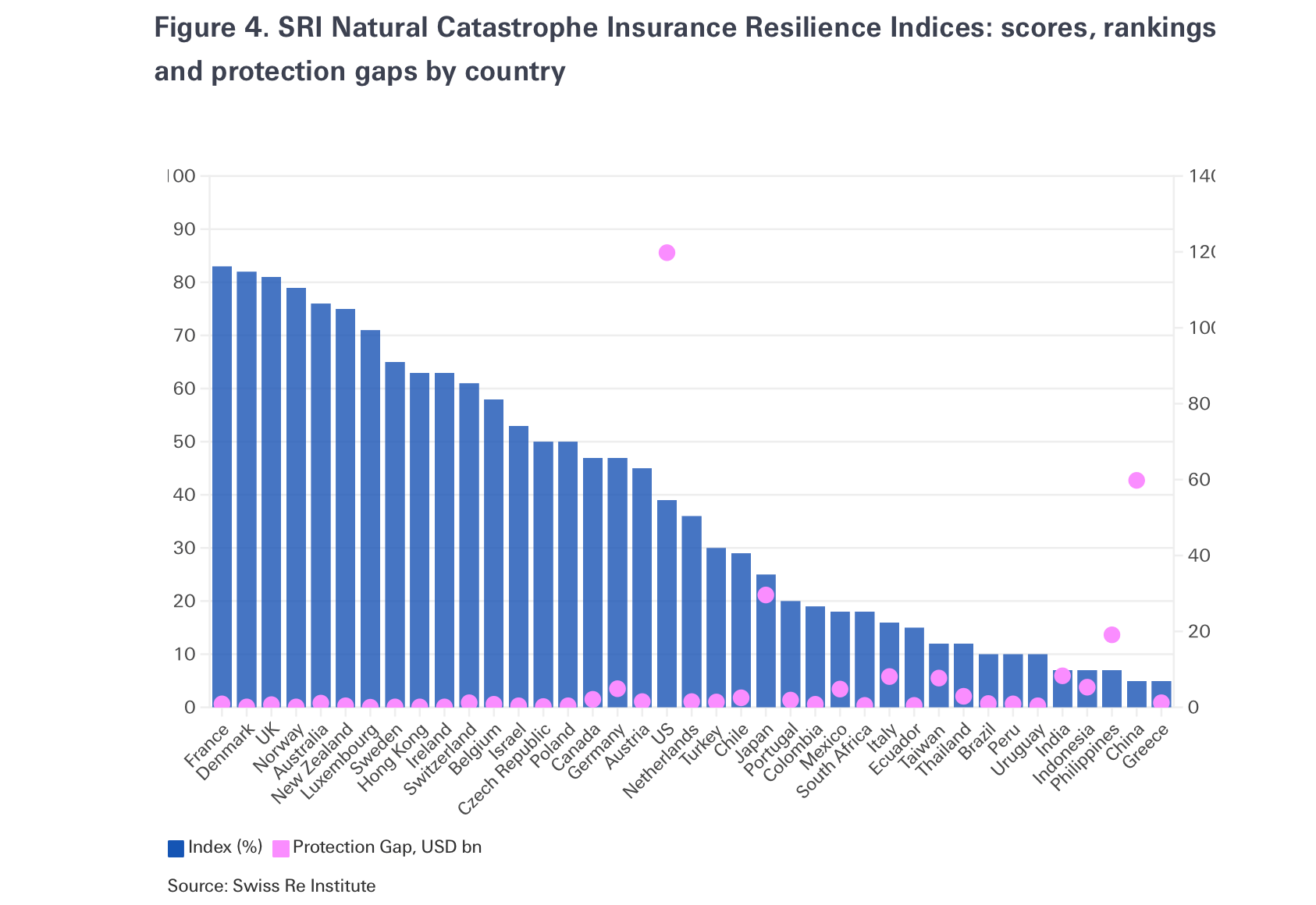

There is a significant dispersion in how resilient and protected by insurance countries are from natural catastrophe events, with some countries such as France, Denmark and the UK indexing above 80% resilient, but the United States down at 39%, and other countries as low as 5%.

Demonstrating the continued opportunity to deliver more catastrophe risk capital to support the needs of country’s with high protection gaps, the United States had a significant US $119.8 billion nat cat protection gap in 2023, while China had US $59.8 billion of the global total, Japan US $29.6 billion and the Philippines US $19.1 billion.

Swiss Re noted that global crop resilience is an area of opportunity for the insurance and reinsurance market, with a need to strengthen it further and re/insurance able to play a role.

In addition, the research suggests a growing role for innovative risk transfer arrangements such as those using parametric triggers to help in driving global crop protection higher.

While at the same time, more crop reinsurance coverage is also needed to support expansion of programs and to cover more critical global crop production.

On a more cautionary note, Swiss Re also highlighted that rising natural catastrophe and weather insurance losses are driving prices higher, which can have the effect of widening the protection gap further still.

“So far there has been little evidence that a lack of affordability of property catastrophe insurance is jeopardising resilience gains, but it is yet to be seen if this remains so in the future,” the reinsurer said.

Which speaks to the need for more efficient catastrophe risk capital to help in provision of the reinsurance needed to support primary insurers as they adapt to the nat cat reality we see today.

So, while there may be signs that more protection is available today and that is positive for the future, it appears more capital and capacity, as well as use of innovative risk transfer structures, may be required to meaningfully narrow these gaps.