Nasdaq 100 Set for Worst Day Since December 2022

U.S. 10-year yields were little changed at 4.15%. The dollar fell against most major peers, with the yen up 1.3%.

The Biden administration is in a tenuous position. U.S. companies feel that restrictions on exports to China have unfairly punished them and are pushing for changes. Allies, meanwhile, see little reason to alter their policies when the presidential election is just a few months away.

“Normally, the impact of these types of headlines isn’t long-lasting, but in this case, we would note that semis have been underperforming the broader market for the last couple of weeks now,” said Bespoke Investment Group strategists. “So that’s something to watch.”

The tech underperformance is coming after a first half which saw megacaps like Nvidia, Microsoft Corp. and Alphabet Inc. propel the market higher, stretching valuations for these names and leaving them with a tougher setup for the rest of 2024.

At Goldman Sachs Group Inc., Scott Rubner says “I am not buying the dip.”

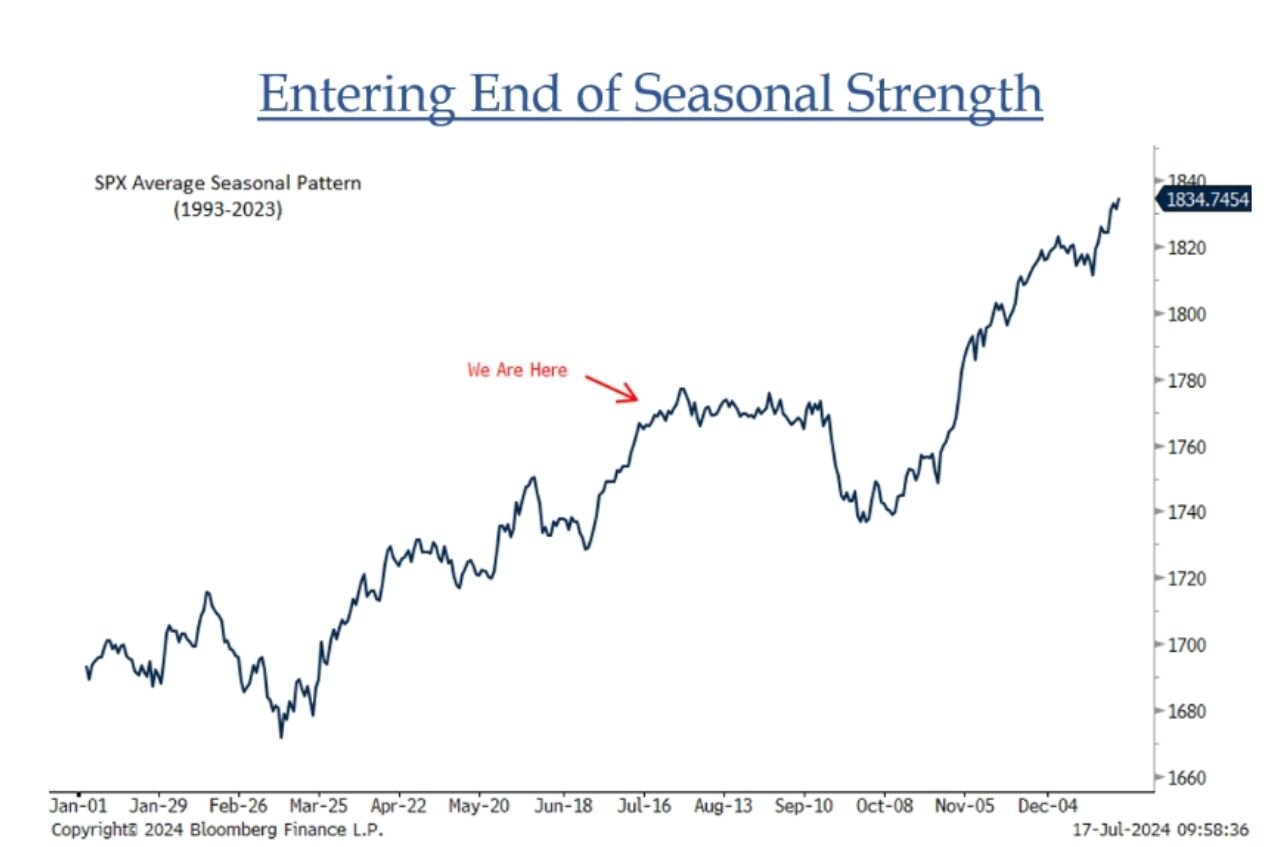

The tactical strategist bets the S&P 500 has nowhere to go from here but down. That’s because this Wednesday, July 17, has historically marked a turning point for returns on the equity benchmark, he said, citing data going back to 1928.

And what follows, he says, is August — typically the worst month for outflows from passive equity and mutual funds.

Source: BTIG

Source: BTIG

Jonathan Krinsky at BTIG says the market is “nearing the end of the typical bullish window.”

Sentiment remains extremely complacent on the surveys and transactional indicators, he noted.

“While the rotation out of megacap tech into cyclicals and small-caps is encouraging, it felt a bit forced happening in such a short period of time,” Krinsky said. “Even if this is going to be a more long-lasting rotation, we likely won’t be able to see that new leadership until after we see a higher correlation correction and then see what leads coming out of that.”

Image: Adobe Stock