Munich Re stretches lead at top of AM Best global reinsurer ranking

Reinsurance giant Munich Re has stretched its lead at the top of the AM Best ranking of the world’s largest reinsurers and while there was not much change at the top of the table, there are signs some may slide down it due to a growing aversion to property catastrophe risks.

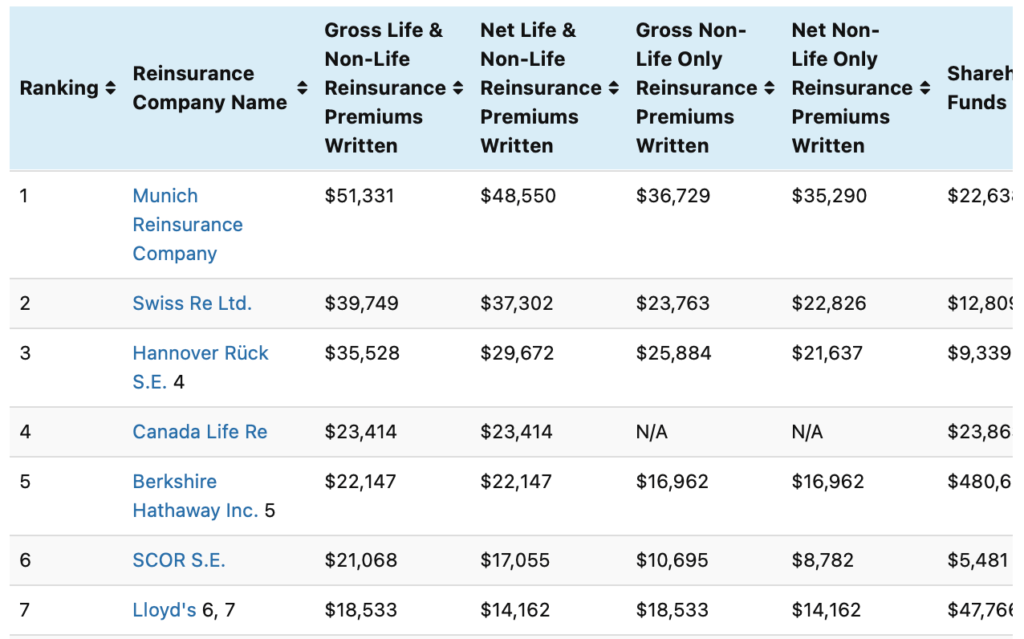

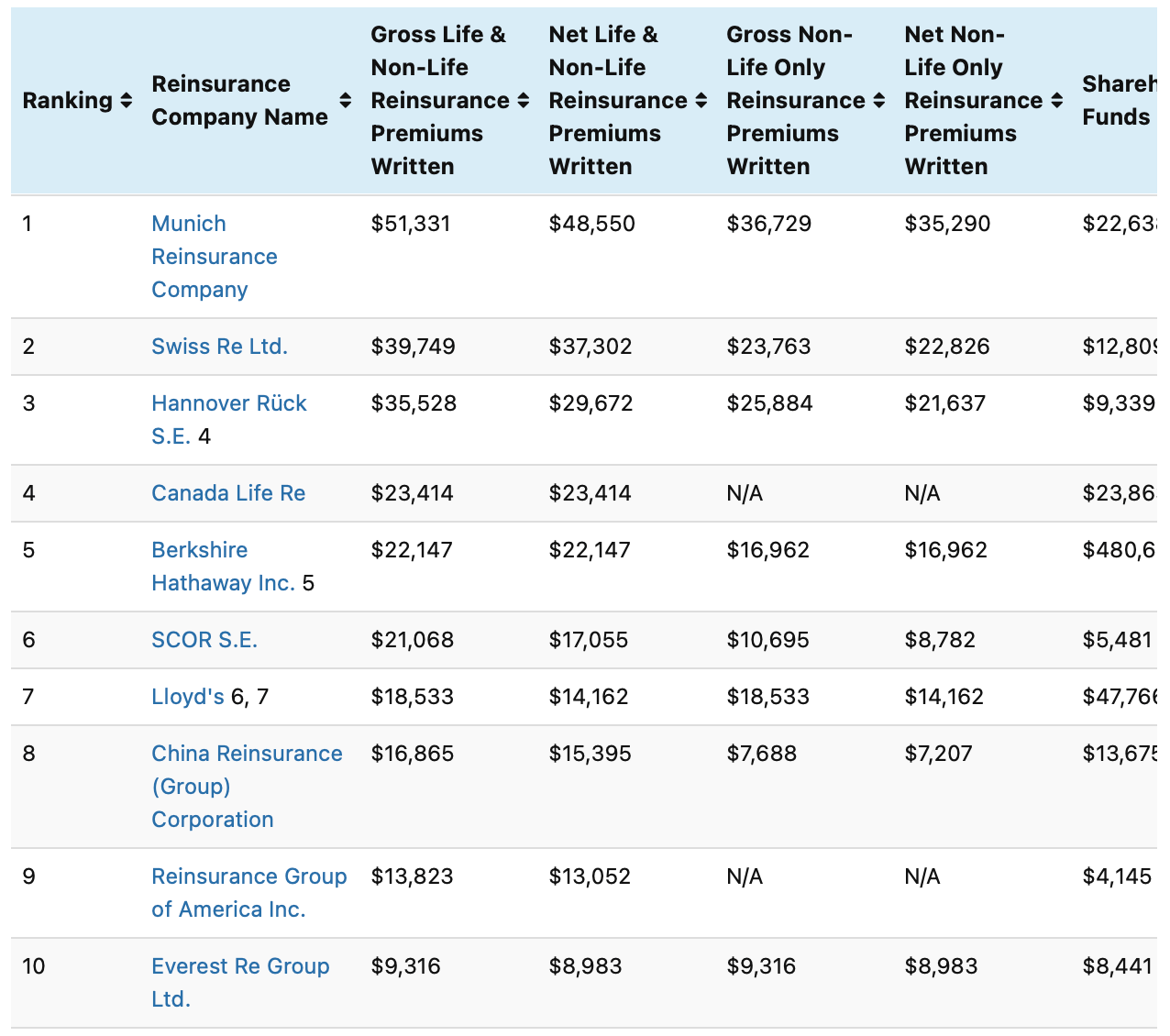

Reflecting the dominance of the largest reinsurance companies in the world, while Munich Reinsurance Company held the top spot in AM Best’s annual ranking of the Top 50 Global Reinsurance groups in 2022 for the third year in a row, Swiss Re followed it again and together the pair account for a stunning one-quarter of the top 50 reinsurance gross premiums written in 2022.

Total gross reinsurance premiums underwritten by the top 50 reinsurers in the world increased by 2.6% to US $363.6 billion in 2022, AM Best explained.

Christopher Pennings, financial analyst, AM Best commented that, “For many reinsurers, premium growth was driven primarily by strong rate increases, not exposure growth.

“At the same time, global reinsurers have become somewhat concerned about exchange rate fluctuations, as foreign exchange losses have had a dampening effect on premium volume.”

Munich Re has stretched its lead at the top of AM Best’s ranking over the course of 2022.

For 2021, Munich Re had written a combined $46.8 billion in life and non-life reinsurance premiums, but that has increased to $51.3 billion for 2022.

Swiss Re, the second place company by AM Best’s measure, wrote $39.2 billion of combined life and non-life premiums in 2021, but that only increased to almost $39.8 billion last year.

Third and fourth spots in the list were Hannover Rück SE and Canada Life Re, respectively, while Berkshire Hathaway Inc. moved up one spot fifth, pushing SCOR S.E. down to sixth this year.

However, AM Best highlights that more-significant movement in the rankings was seen below the top 10, and that this has been primarily driven by shifts in the portfolio mix of business being underwritten.

It’s been well-documented that SCOR’s appetite for certain property catastrophe risks has diminished at recent renewals, while Berkshire Hathaway has written significant cat exposed lines of late, which may go some way to explaining the change in their positions.

But, lower down the reinsurance company ranking, there are signs of shifts in appetite for property catastrophe risk also changing the order.

Take Fidelis, the Bermuda based specialty writer that had been a new entrant to this list in 2021, but that has now dropped out of the top-50, which AM Best puts down to the firm “working to reduce its catastrophe exposure.”

Similarly, AM Best notes that AXA XL fell from sixteenth to twenty-first, primarily due to the firms “decision to pull back from the property catastrophe reinsurance business as it looks to minimize volatility.”

On the other hand, there are firms that are expected to leap higher up the list, not least RenaissanceRe with its impending acquisition of Validus from AIG set to boost its premiums written.

Pennings noted that, on RenRe, “In combination, the two entities had gross life and non-life premiums written of USD 12.3 billion at year-end 2022, which would have ranked No. 10.”

You can analyse the data on the Top 50 Global Reinsurance groups in the world over at our sister site Reinsurance News, where a sortable ranking is maintained thanks to AM Best’s data.

Analyse the Top 50 Global Reinsurance groups.