Munich Re retro shrinks slightly, but still $513m from collateralised sidecars for 2023

The retrocession program of global reinsurance giant Munich Re has shrunk slightly for 2023 as the company navigated the challenging market environment, while still securing $513 million of collateralised capacity for its quota share sidecar vehicles.

Munich Re has touted continuity in its retrocessional arrangements, despite the difficult market environment around the reinsurance renewals for 2023.

Munich Re said that its retro placement for this year remains “robust”, but it noted that it had to balance price and volume, which overall looks to have resulted in a slight shrinking of the retro tower the company secured.

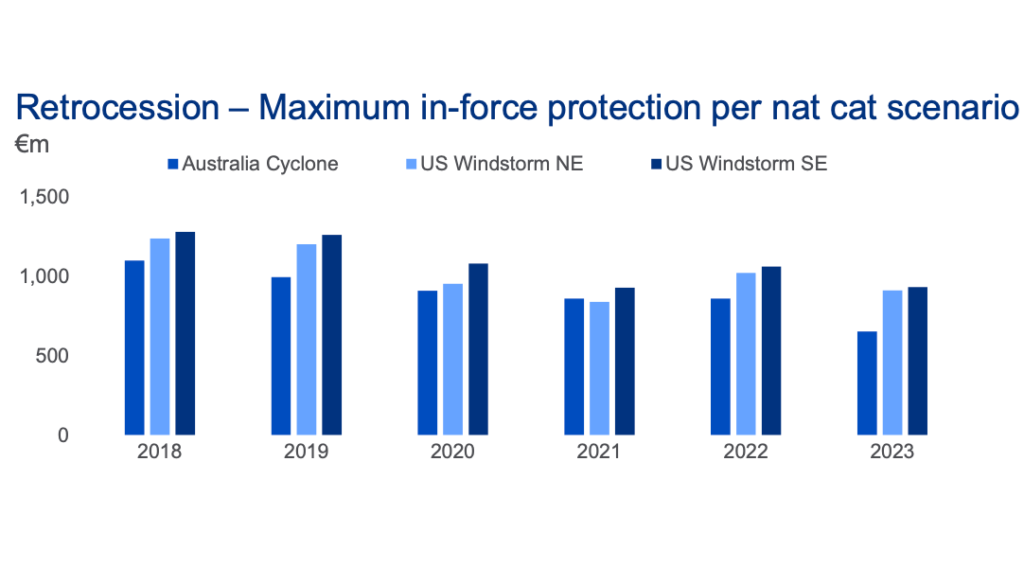

Across each of its three most protected peak perils, Australia cyclone, US northeast windstorm and US southeast windstorm, Munich Re has seen its retro protection reduced for 2023.

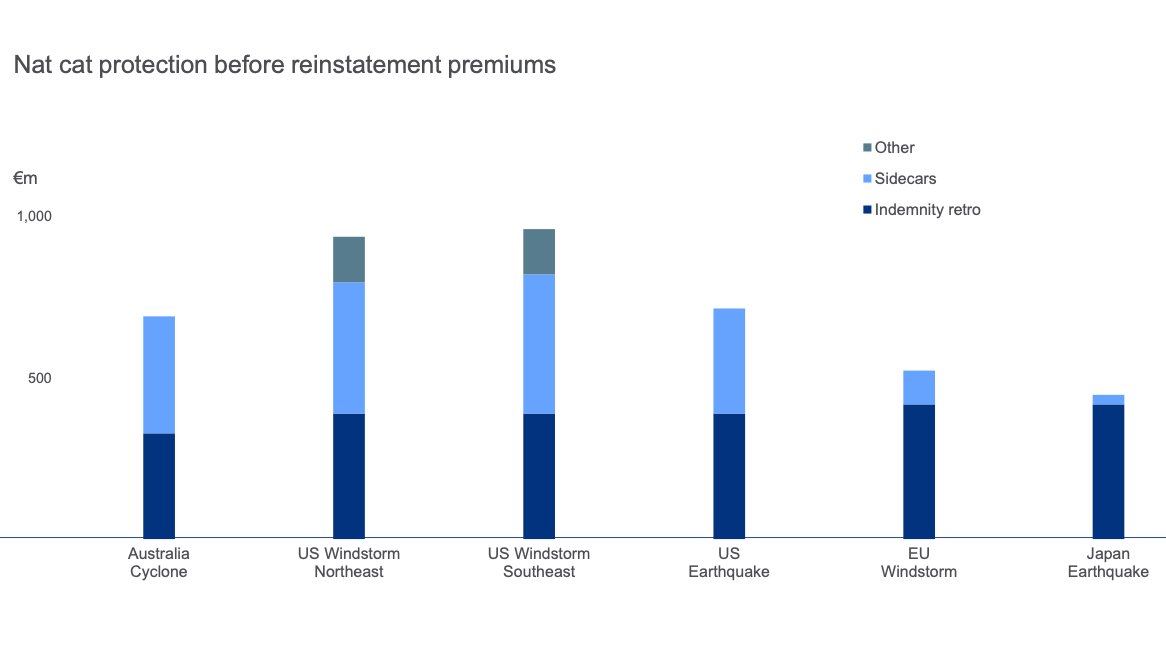

The chart below shows Munich Re’s retro protection from instruments including indemnity retrocession, industry-loss warranty (ILW) or derivatives, risk swaps, catastrophe bonds and its collateralised reinsurance sidecars including the flagship Eden Re vehicle.

Cover for all three of these peak peril scenarios are down year-on-year, although the US hurricane scenarios are similar to 2021.

The chart above provides a clear signal of rising retrocession costs over the last few years, as well as of dwindling retro capacity for certain loss-affected perils, such as Australian cyclone risk.

As we reported this morning, Munich Re has significantly grown its natural catastrophe book at the January 2023 renewals, with a roughly 40% increase in volume written. So it goes into this year with far more catastrophe risk on its books, while less is protected by retro.

Of course, Munich Re’s overall book has also expanded significantly in recent years, so the diversification effects are much greater and can help to offset some of the peak nat cat exposure within its results, balancing performance for the reinsurer.

Munich Re’s peak peril protection is largely from its traditional catastrophe excess-of-loss retrocession and its sidecar vehicles, while the multi-format retro program means the reinsurer has good access to both rated-paper retro capacity and multiple pools of investors and ILS fund capacity as well.

On the collateralised reinsurance sidecar side, where Eden Re is the main structure in use as well as some private sidecars, but also the Leo Re sidecar that we assume is still in place between Munich Re and pension investor PGGM, the reinsurer has secured US $513 million in collateralised quota share capacity for 2023.

Munich Re’s sidecar platform targets long-term relationships with big institutional investors, such as pension funds, providing a sustainable source of partner capital to help in absorbing losses, but also in expanding its nat cat risk appetite as well.

The reinsurance sidecar capacity makes up a significant amount of the protection Munich Re has in place for US hurricane, Australia cyclone and US earthquake loss scenarios, as the chart below demonstrates.

Munich Re has not disclosed its retrocession arrangements in such a degree of detail before, as a result of which we haven’t seen details of all of its quota share reinsurance sidecar arrangements for a number of years now.

As we reported previously, Munich Re secured $17.5 million of retro through a Eden Re II Ltd. (Series 2023-1) Class A sidecar issuance in December and a further $113.6 million from a Eden Re II Ltd. (Series 2023-1) Class B sidecar issuance in January.

So Eden Re was around $131.1 million in size, that we knew of. But there could be other Eden Re sidecar tranches, as well as a Leo Re Ltd. sidecar deal for 2023 as well, contributing to the overall $513 million of Munich Re’s collateralised reinsurance sidecar capacity.

The Leo Re Ltd. sidecar, which was funded by PGGM on behalf of PFZW pension, was last seen to be close to $400 million in size, so it is possible this continues to make up the largest share of Munich Re’s sidecar arrangements.

For details of many reinsurance sidecar investments and transactions over the history of the ILS market, view our comprehensive list of collateralized reinsurance sidecars transactions.