Mortgage Protection with Neurological Issues

Life Insurance for Neurological Disorders: What You Need to Know

Welcome to our blog post on life insurance and mortgage protection for individuals with neurological disorders in Ireland.

While it’s not always easy to think about, having a plan in place to protect you and your loved ones is essential.

In this post, we’ll examine the most common neurological issues we advise on, and discuss the factors that insurance companies consider when underwriting policies.

We’ll also provide tips on how to navigate the application process and the options available for those with pre-existing neurological conditions.

By the end of this post, you’ll have a better understanding of how to find the right policy for your specific needs, even if you have a neurological disorder.

So, let’s crack on!

Migraines

Migraines are a common neurological condition in Ireland, affecting approximately 13% of the population.

They are characterised by severe headaches, often accompanied by nausea, vomiting, and sensitivity to light and sound.

While the exact cause of migraines is not fully understood, factors such as genetics, hormonal changes, and environmental triggers can contribute to their development.

Although an absolute pain, they won’t affect the price you will pay for your mortgage protection, life insurance or income protection (assuming fully investigated)

Epilepsy

Epilepsy is a neurological disorder that causes seizures.

According to the most recent statistics from Epilepsy Ireland, an estimated 40,000 people in the country have epilepsy, making it one of the most common neurological conditions in the country.

And that’s why it desreves it’s own blog:

Getting Life Insurance if you have Epilepsy

Head Injury

When applying for life insurance with a head injury, it is important to provide as much information as possible about the injury, including the cause, severity, and any ongoing treatments or medications. The insurance company may also request additional medical information from your GP to assess the level of risk.

If you have suffered just a minor concussion and have made a full recovery, you will pay the same premium as everyone else for mortgage protection, life insurance, illness cover and income protection.

However if you have suffered a severe head injury causing you to be unconscious for a long time or have serious problems like a broken skull, bleeding in the brain, or damage to the brain tissue, the insurers will need a medical report to assess your application.

Chronic Inflammatory Demyelinating Polyneuropathy | CIDP

We had never come across this condition until last month when we arranged cover for two separate clients within a week!

One male, one female.

Both in their 30s.

Both diagnosed over two years ago with symptoms affecting their hands and feet.

Treated initially with Corticosteroids and IVIG every two months.

We managed to get both clients mortgage protection.

Multiple Sclerosis

If you’re living with multiple sclerosis (MS) in Ireland, you’re not alone.

According to the MS Society of Ireland, there are over 9,000 people living with MS in the country, with the majority being female.

While living with MS can present challenges, it doesn’t mean that you can’t purchase a home or obtain mortgage protection.

In fact, it’s uncommon for an insurer to reject an applicaiton from someone with MS.

When applying for mortgage protection with MS, you must disclose your condition to your insurance provider. This can make sure that there are no surprises down the line. While MS may impact your eligibility for certain types of coverage, there are still options available, including mortgage protection insurance.

Mortgage protection insurance is a type of life insurance that is specifically designed to pay off your mortgage if you were to pass away before the mortgage is fully paid off. This can help ensure that your family can remain in their home even if you’re no longer there to contribute to mortgage payments.

MS is the most common neurological disorder we advise on so is deserving of it’s own blog here:

Getting Life Insurance with Multiple Sclerosis

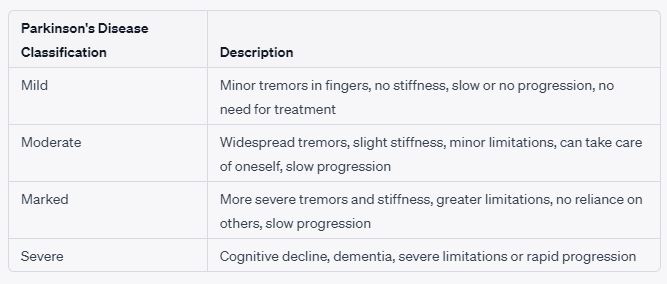

Parkinson’s Disease

Parkinson’s disease is a progressive neurological disorder that affects many people in Ireland.

It is caused by the gradual loss of cells in the brain that produce dopamine, a chemical that helps control movement.

As a result, people with Parkinson’s may experience a range of symptoms, including tremors, stiffness, and difficulty with balance and coordination.

While there is currently no cure for Parkinson’s, there are treatments available that can help manage the symptoms and improve quality of life.

Life insurance should be possible for people with mild to marked Parkinson’s.

Regrettably, the insurers will not offer cover where the illness is severe.

Wilson’s Disease

A rare genetic disorder that causes copper to accumulate in the liver and brain, leading to neurological symptoms.

It’s kind of the same thing as haemochromatosis, only with copper instead of iron.

Unfortunately it’s more destructive than that, and affects the liver far more significantly. It’s harder to treat too.

With iron overload, just releasing blood works but the copper overload is in really small amounts comparatively, so phlebotomy won’t work as too much blood would need to be lost.

Instead it’s treated by chelation, which is using another drug to try to chemically bind with the copper and allow it to be excreted.

This is in itself introducing another foreign agent into the system too, and often not without side effects.

The insurers will need to see up to date liver function test results, and assuming all is well, then cover will be possible with a loading.

Cerebral Palsy

Cerebral palsy is a neurological condition that affects movement and muscle coordination.

It is caused by damage to the brain during fetal development or shortly after birth.

In Ireland, there are approximately 1,200 children born with cerebral palsy each year, and it is estimated that around 8,000 people in the country are living with the condition.

You can expect to get the normal price assuming good motor skills, no epilepsy or mental impairment; otherwise there will be a loading. Where mental impairment is severe, it is more difficult to get cover.

Spinal Cord Injury & Paralysis

When underwriting applications, the insurers are most concerned about the level or location of the damage to the spinal cord.

Mortgage Protection and life insurance are possible for

Monoplegia| Paralysis of a single limb or group of muscles

Hemiplegia| Paralysis of one side of the body

Paraplegia| Paralysis of lower portion of the body and of both legs

Diplegia | Paralysis of both arms or both legs

Unfortunately, cover is not possible for Quadriplegia

Stroke

Another common issue we advise on:

Can you get Life Insurance after a Stroke?

Trigerminal Neuralgia

Trigeminal neuralgia is a type of chronic pain condition that affects the trigeminal nerve, which is responsible for sending sensation from the face to the brain.

Although the condition is not life-threatening, the intensity of the pain can be debilitating.

Assuming well controlled, the insurers will offer mortgage protection and life insurance but be make sure you apply to the most understandign insurer.

Income protection should be possible with an exclusion.

What Medical Evidence Will The Insurer Require?

The most important tip I can give is to ensure that your GP has access to all of your consultant reports.

If your GP does not have all your consultant reports, they may not be able to provide the underwriter with a complete picture of your medical history.

This can result in a higher premium rate, or in some cases, the underwriter may decline coverage altogether.

For this reason, it is essential to ensure that your GP has all of your consultant reports on file.

Even better, if you can obtain a copy of these reports upfront and give them to me, it can help streamline the underwriting process.

If you do not already have a copy of your consultant reports, you can request them from your consultant’s office.

It may take some time to obtain these reports, so it’s important to plan ahead and request them well in advance of your life insurance application.

Once you have the reports, give them to me and I’ll take over.

How We Can Help You

If you apply to the wrong insurer for your medical condition, it could cost you a lot in premiums.

Different insurers may underwrite neurological disorders differently, which means they may assess the risk of providing coverage for your condition differently.

For example, some insurers may be more willing to provide coverage for certain types of neurological disorders than others, and some may charge higher premiums or have more strict policy exclusions.

It is important to research and compare different insurers to find the one that is most likely to provide you with affordable coverage that meets your needs.

Now, you could, of course, fire ahead and do all of this yourself.

Or you could let me do the heavy lifting for you!

Complete this neurological quesitonnaire and I will discuss your case, anonyomously, with all five providers (Aviva, Irish Life, New Ireland, Royal London, and Zurich) and get back to you in a jiffy.

Right, that’s enough from me.

I hope you found the blog helpful.

Thanks for reading

Nick

lion.ie | Protection Broker of the Year ?