Mortgage & Life Insurance with Crohn’s or Ulcerative Colitis

Complete this questionnaire and I’ll send you a quote taking your IBD into account.

—

Hi,

I was just wondering could you help? We are in the process of applying for mortgage protection and have been declined twice so far. It is just my partner that they are declining to cover and presumably this is due to his Crohns. I was just wondering do you have different companies that you apply to other than usual ones listed?

Selina

How to get Life Insurance with Inflammatory Bowel Disease?

We managed to get Selina’s partner cover as we knew which insurer would be most sympathetic to his medical history.

Our understanding of the different underwriting approaches each insurer takes is the key to getting you cover if you have IBD.

We Make Sure You Choose The Correct Insurer First Time Around

The underwriting departments of the various insurance providers don’t always agree with each other.

Foe example:

Royal London may tread carefully around IBD (including Crohn’s disease and Ulcerative Colitis) while Aviva may be much more lenient. If this was the case, we would recommend you apply to Aviva first, saving you time and hassle.

By the way, this is only an example, we’re not saying that Aviva are the best insurer if you have Crohn’s or Ulcerative Colitis!

What are your chances of getting insurance with Crohn’s?

Whether you can get cover depends on a number of factors.

How severe your symptoms are:

Mild

Affects small intestine only

Very infrequent use of steroids

Not more than one surgical procedure

Disease in remission/no current disease activity

Stable weight

Moderate

Localised involvement of the colon

Occasional use of steroids

No more than 2 surgical procedures

Tendency to recurrent episodes

Severe

Widespread involvement of the colon or extension beyond the colon and small intestine

Frequent use of steroids

Multiple surgical procedures

Recurrent episodes or sustained disease activity

Complications such as anaemia.

Obviously, the milder your symptoms, the easier it will be to get you cover.

Time since diagnosis or last major episode

If you have had a flare up within the last 3 months, the insurers are likely to postpone offering cover.

Is your condition being treated with steroids?

If yes, the insurers will add a loading to your premium

Any complications?

Frequent relapses

Musculoskeletal issues or associated skin disorders?

Weight loss

Elevate liver enzymes

Cirrhosis

What about Mortgage Protection if you have Ulcerative Colitis?

The factors the underwriters assess are:

Extent of disease

Proctitis

Left side colitis

Extensive colitis

Severity of symptoms

Mild

Single or isolated attacks (no more than 2 per year) or short duration.

Asymptomatic or with minimal symptoms between attacks

ESR<=20

Disease stable, no hospital admisssions

No extra-colonic manifestations

Stable weight

Moderate

More frequent attacks (more than 2 per year).

Asymptomatic or with mild symptoms between attacks

ESR 21 – 30

Disease stable.

No extra-colonic manifestations other than mild anaemia.

Stable weight

Stable

Continuous symptoms, severe attacks and/or frequent relapses

ESR >30

Disease unstable. Treatment resistane or poor treatment compliance.

Past hospital admissions

Various extra-colonic manifestations, eg. Joint, gastrointestinal and skin disorders, anaemia.

Weight loss or underweight.

Is your condition being treated with steroids?

If yes, the insurers will add a loading to your premium.

Complications

Primary sclerosing cholangitis (this will likely be declined, unfortunately)

Cirrhosis

Hepatomegaly, Splenomegaly, jaundice

Elevated liver enzymes

Colon Polyps

Anaemia

What Medical Evidence will the Insurers need?

Giving sufficient detail on your application form and questionnaire may avoid the need for a medical report from your doctor.

As above, the more severe your IBD, the more medical evidence will be required.

Usually a medical report from your GP will be requested.

It can take ages for yoru GP to return their report to the insurer so please give yourself plenty of time to apply.

How much will Life Insurance with IBD cost?

If you have been symptom-free for over 4 years, without using oral steroids and there have been no complications, you may be able to get the normal price for life insurance.

Otherwise it will depend on the severity of the condition and the date of the last major flare up.

The usual increase in price is 75% to 150% e.g if the normal price is €10 per month, you would pay between €17.50 and €25 per month.

Can you get Serious Illness Cover with IBD?

It’s possible but as above depends on severity and when the last flare up occurred.

Can you get Income Protection if you have IBD?

See above re. severity and last flare up. Your best chance of cover is 4 years after the last flare up.

Does all of the above apply for IBS too?

No, if you have been diagnosed with IBS (Irritable Bowel Syndrome) and there is no underlying condition (e.g stress), you shouldn’t pay more than normal for your cover.

IBS (Irritable Bowel Syndrome):

IBS is like having a sensitive stomach.

It’s a common digestive disorder that affects how your intestines (the tubes in your belly that process food) work.

People with IBS often experience symptoms like abdominal pain, bloating, gas, and diarrhea or constipation.

It doesn’t cause lasting damage to your intestines, and doctors usually diagnose it based on your symptoms.

IBD (Inflammatory Bowel Disease):

IBD is like having a more serious gut problem.

It’s actually a group of diseases, with the two most common types being Crohn’s disease and ulcerative colitis.

IBD is different because it involves inflammation (swelling) and damage to your intestines.

People with IBD often have more severe symptoms like intense abdominal pain, frequent diarrhea (sometimes with blood), weight loss, and fatigue.

IBD is a long-term condition that can require ongoing medical treatment and sometimes surgery to manage.

So, in summary:

IBS is a less serious, more common digestive issue with uncomfortable symptoms but no lasting damage.

IBD is a more serious condition where your intestines become inflamed and damaged, leading to more severe and long-lasting symptoms.

Read: Life Insurance with Irritable Bowel Syndrome

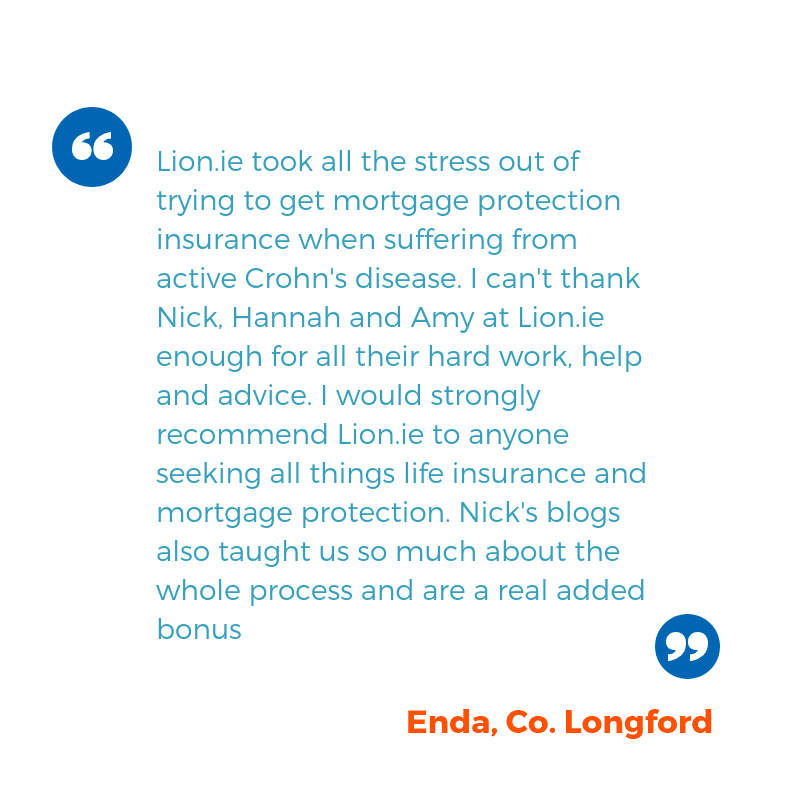

Case Study : Enda

Ileal Crohn’s Disease (Small bowel only)

Diagnosed 5 years ago

3 flares since diagnosis

Most recent flare up was 5 months ago

Colonoscopy showed he had terminal ileal Crohn’s Disease

Medication : Azathioprine 150mg daily (Budesonide previously)

Enda was sale agreed on his family home but couldn’t get cover anywhere having being postponed by another insurer.

We managed to get him cover (albeit at a premium increase of +125%).

He was delighted (and left us a lovely testimonial)

Over to you…

If you’re considering applying for life insurance or mortgage protection with Crohn’s Disease or Ulcerative Colitos, please get in touch using the short form below or even better complete this questionnaire.

I look forward to hearing from you.

Nick McGowan

Insurance Expert | Founder of Lion.ie

Helping You Navigate Life Insurance, Especially if you have a Health Issue

The Go-To Resource for All Things Life Insurance in Ireland

Blogging Since 2008!

Editor’s Note. We first published this blog in 2019 and have regularly updated it since