Mortgage Income Protection

You probably remember learning about Maslow’s Hierarchy of Needs in school.

You know the one: the pyramid of stuff you need in life to be happy.

WiFi lols.

Not to be confused, of course, with the food pyramid – though I’ll fight anyone who argues that potatoes, bread, and chocolate aren’t anything other than fundamental to happiness.

So, at the bottom of Maslow’s pyramid are basic physical needs.

More specifically: food, water, warmth, rest, security and safety.

In a word:

Home.

While home may be where the heart is, it’s mostly a warm place with a comfy bed you can kip in and a Wi-Fi box to connect to so you can watch the new season of True Detective

A home is a crucial component of happiness; it’s why so many people go through the rigmarole of saving for the god-awful deposit and spending the next 30 years of their lives chipping away at their mortgage.

But what happens if the ‘chipping away’ comes to a screeching halt because you’re out of work, long-term, with an illness or disability and can’t make the repayments?

Your options if you’re out sick for a long time

You’re probably thinking, ‘ah jaysis; this is awful doom and gloom, sure it won’t happen to me.’

No one ever thinks it will happen to them.

But then it does.

Cancer or a car crash or depression or some other awful disease swoops in and robs you of your independence and your ability to work.

It’s grand if you’re out of work for a couple of weeks or your other half can foot the mortgage on their own for a bit, but what happens if you’re out of action for months, years, or even indeterminately?

Here’s Mark’s story – don’t worry it’s not a tear jerker, just an honest account from a normal fella of how income protection pretty much saved his life.

You might be thinking that you could rely on the State’s illness benefit.

The top rate is €1005 a month.

The average mortgage is just over €1750.

Good luck paying for everything else too.

And don’t be thinking your employer is going to swoop in and save the day. Legally you’re entitled to just 5 paid sick days.

So jaysis, yes, this is all a bit of doom and gloom but with good reason.

When it comes to protecting your home and keeping everything afloat, Mortgage Income Protection or maybe Serious Illness Cover is magic because it’ll pull money out of the air just when you need it most.

What the difference between Mortgage Income Protection and Serious Illness Cover?

Mortgage Income Protection is a type of insurance that covers up to 75 per cent of your salary if you’re not able to work due to any illness, injury or disability.

Mortgage income protection is living insurance. With Life Insurance, there’s a pay-out, but you’re dead, so it’s not as if you’re suddenly living the lifestyle of the rich and famous.

Mortgage Income Protection is different in that you use it to pay your mortgage until you go back to work. As yer man on the Ronseal ad says: it does exactly what it says on the tin.

Now, the critical part here is the: up to 75 per cent of your salary less state illness benefit if you’re entitled to it (currently €10,556 per year).

Let’s say you’re an employee on €50,000 per year.

You can insure up to 75% x €50,000 (minus €12,064 = €25,436

You can choose whatever percentage you want, up to 75. Obviously, the more you insure, the more the cost creeps up. So if you find insuring the full 75% is outside your budget, you can just insure your mortgage repayment to make sure you keep a roof over your head while you get better.

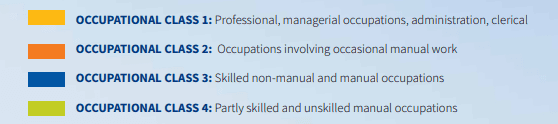

Likewise, the price is also affected by age, health, and occupation. Software engineers for example will pay less than sales assistants who in turn will pay less than nurses.

The price is also contingent on the deferred period – this is the amount of time before your coverage kicks in. Or: the amount of time between going out sick and getting paid. You can choose between 4, 8, 13, 26 or 52 weeks. A longer deferred period means it’s cheaper, however, have a good think about how long you could afford to be out of work for without moolah coming in.

Six months is a verrrrrry long time living on cheap chicken nuggets and noodles.

Pro-tip: Check your contract in work before you do anything. Your employer may cover you for a certain amount of time. Consider that as a breathing period and factor it into the length you go for with your deferred period.

e.g. if you employer will pay your full pay for 13 weeks, you may get away with a 26-week deferred period before things get dicey.

Now, onto the other one.

Serious Illness Cover pays you a one-off lump sum if you get sick with an illness that’s covered by your policy. But more on that in a second.

Is there anything else I should know about when getting Mortgage Income Protection?

☑️ Amount of income you want to cover (up to 75 per cent)

☑️ Deferral (waiting) period until cover kicks in.

☑️ If you have any cover in your contract with work.

☑️ Any additional benefits.

☑️ How much it’s all gonna cost.

Those are your top things to think about before signing on the dotted line. We’ve looked at most of them. The ‘additional benefits’ is a big one, though it’s not one people often think about – often they don’t know it’s an option.

But spoiler alert: the vast majority of insurances come with extra benefits that could make it worth a few extra quid.

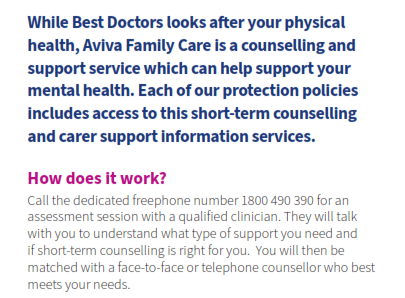

With Aviva, for example, their policies come with Best Doctors and Family Care:

Oh and one more thing!

☑️ Income Insurance is eligible for full income tax relief at your marginal rate of income tax. Which means you pay less for your cover.

But what about Serious Illness Cover?

So I know this blog is about Income Protection versus Serious Illness Cover, but there’s a reason why I’ve focused much more on Mortgage Income Protection.

It’s much, much better insurance.

Serious Illness Cover pays you a lump sum if you get one of the illnesses covered by your policy (cancer, heart attack and stroke being the

BUT most policies only cover a certain amount of illnesses. If you get one that’s not in your plan, or if it’s not at a certain level of severity, you get no pay-out.

For example, it’s useless if you can’t work due to stress or back pain.

Income Protection is more expensive, but 99 per cent of the time, I’d tell you to go with it instead of Mortgage Income Protection.

Let’s look at an example.

Sarah is 40 and in good health. She’s an accountant.

In example 1, she has Mortgage Income Protection to cover 75 per cent of her €50,000 salary. Her deferral period is 13 weeks.

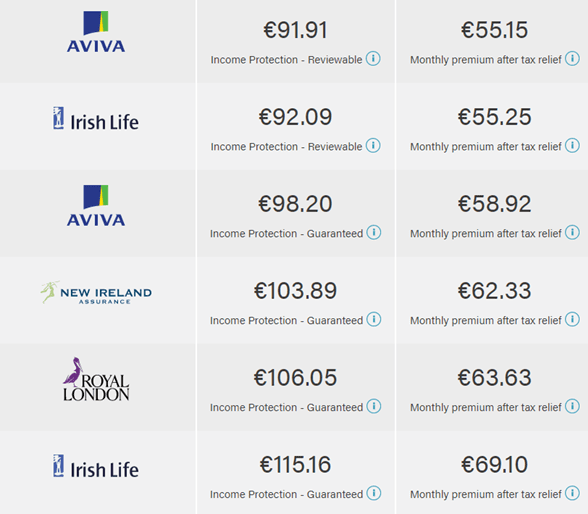

Her quote looks like this:

The price after tax relief is where you should be looking.

Sarah’s mother dies unexpectedly, and it hits her so hard she has a breakdown and can’t return to work. She’s entitled to €26,944 a year until she turns 65. That’s over €400,000 across those 25 years.

In this second example, Sarah is bundling Life Insurance and Serious Illness Cover (your best bet to get it cheap). She’s looking at around €30,000 SIC to go with €250,000 Life Insurance. Now, remember: those 250gs are no use to Sarah; they’re for her kids or whoever, after she kicks the proverbial.

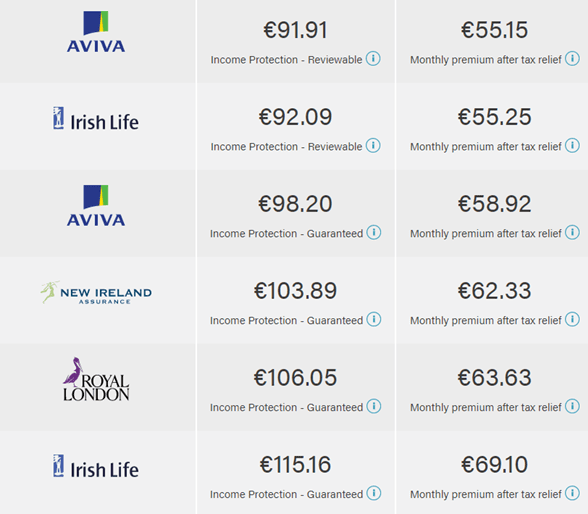

Her quote all in is:

But remember, serious illness cover doesn’t pay out for mental health.

She gets nothing.

And she’s out of work for five years.

Uh-oh.

Should have paid for Income Protection.

Because here’s the final note to leave you on: you don’t have to die to get the pay-out, and as your income pays for everything, it should be the first thing you protect. Whatever way you dice it, Maslow’s Hierarchy of Needs is verrrry empty without your money fuelling it.

Over to you…

You don’t know what the future will bring.

My advice:

Cover your bases with a little bit of everything.

Don’t blow the budget on Life Insurance only. Consider Income Protection too. If you genuinely can’t afford it, get a good deal on Life Insurance and Serious Illness Cover.

If you’re single, Income Protection is where it’s at.

Again: you pay for everything with your salary. Think about what would happen if you didn’t get your paycheque over Christmas, and in January, February. How long before the shit hits the fan?

If you’d like some help figuring it all out, you can get me on the phone on 05793 20836.

Alternatively, complete this short income protection questionnaire and I can send some quotes through over email for you to consider.

Chat you when you’re ready.

Nick