Minimal to no cat bond impact expected from hurricane Helene if track unchanged: Plenum

If hurricane Helene does not deviate from the currently forecasted path for the storm it is not expected to have significant implications for the catastrophe bond market, according to Swiss specialist asset manager Plenum Investments.

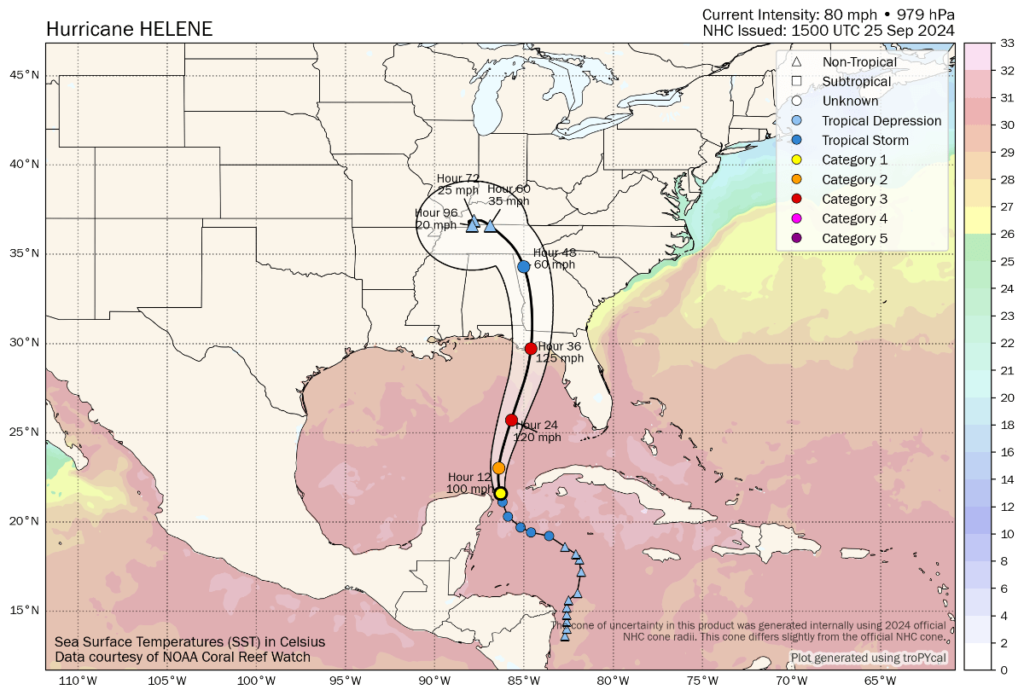

Commenting on the approaching hurricane Helene and the continued forecasts for a major strength landfall in the Big Bend region of the Florida Panhandle, Plenum Investments said that the lightly populated region would not be anticipated to drive much, if anything, in the way of losses for catastrophe bonds.

The investment manager says almost no impact for its own catastrophe bond funds are expected from hurricane Helene, based on the latest forecasts, citing the relatively lightly populated region where landfall as a major Category 3 storm is expected and the fact Helene is currently forecast to remain more distant from higher insured exposure areas such as Tampa Bay.

“To assess the consequences for CAT bond investors, it is worth comparing Helene to hurricane Idalia, which hit Florida’s Big Bend last year and caused damage across the southeastern parts of the United States,” Plenum said in its update.

“However, losses from Idalia were not significant enough to cause substantial losses for CAT bond investors – we estimate that if Idalia would occur today, nominal losses to the market would be below 0.5%,” the cat bond fund manager continued.

Plenum Investments went on to say, “Helene is forecast to be a weaker but larger storm than Idalia. Initial modelling indicates that industry losses will most likely stay in the single digit billion dollar range, which could erode some aggregate structures but is unlikely to cause any CAT bonds to pay out.

“We therefore expect only moderate market reactions from the storm, with minimal, if any, losses to a very limited number of catastrophe bonds held within our funds.”

As we reported this morning, if the track remains unchanged then a single digit billion dollar loss event appears to be the market’s current consensus and that has not changed with new forecast data as today has progressed. At this time the track guidance remains tightly focused on the Big Bend still.

While there are still some wildcards, such as Tallahassee as well as any wobbles further east bringing stronger winds and higher storm surge to Tampa Bay region to consider, at the moment the forecast still seems aligned with the thinking that Helene would be a loss event largely borne by primary insurers, with lower reinsurance impacts and minimal to no catastrophe bond implications.

That is, aside from the usual chances of further erosion of aggregate catastrophe bond deductibles.

On this Plenum notes, “As usual, also smaller events may lead to a further erosion of annual aggregate structures which have been eroded from previous events. We significantly underweight such aggregate CAT Bonds.”

Plenum also stated that, “There is still high uncertainty in the track and intensity forecast and we will follow up with updated information if warranted,” recognising that any deviation further east in the forward path of hurricane Helene could change the outlook for the catastrophe bond and insurance-linked securities (ILS) market.

At this time, the latest from the NHC is that hurricane Helene now has 80 mph sustained winds and is growing as well.

Helene is still expected to be at major hurricane strength, with sustained winds of around 125 mph, when it reaches the Florida Big Bend coast on Thursday evening local time, the NHC says.

It’s worth also pointing out that the NHC cautions that, “Helene’s fast forward speed will allow strong, damaging winds, especially in gusts, to penetrate well inland across the southeastern United States, including over the higher terrain of the southern Appalachians.”

Should hurricane Helene take a path towards population centers such as Tallahassee, that could have ramifications for a larger insurance market loss, although still this would not be expected to be anywhere near the scale of losses a track deviation further east towards Tampa might cause.

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.