Milwaukee sets example for flood risk mitigation

Milwaukee sets example for flood risk mitigation | Insurance Business America

Catastrophe & Flood

Milwaukee sets example for flood risk mitigation

Insights on nature-based solutions and their impact on community resilience

Catastrophe & Flood

By

Mika Pangilinan

Milwaukee has taken on a new approach to mitigating urban flood risks, employing nature-based solutions such as reforestation and wetlands restoration.

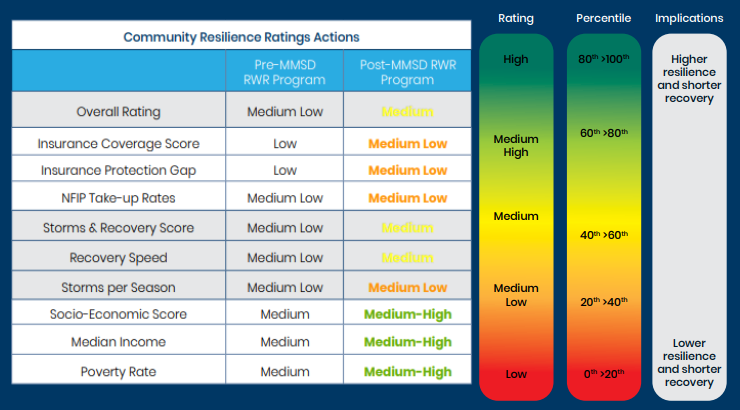

New analysis from the Insurance Information Institute (Triple-I) examined the Milwaukee Metropolitan Sewerage District’s (MMSD) Restoration and Wetland Restoration (RWR) program, which is set to implement various flood mitigation measures within the city over the next decade.

Key initiatives outlined in the program include the planting of 6 million trees, the restoration of 4,000 acres of wetlands, an estimated capture of 350 million gallons of stormwater through tree planting, and the potential storage of up to 1.5 million gallons of floodwater per acre of restored wetland.

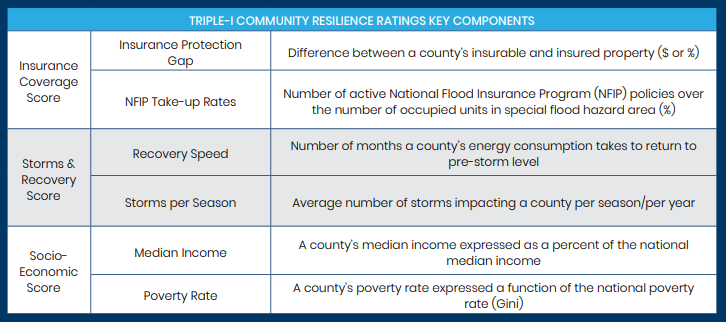

Utilizing the quantitative methodology of Triple-I’s Community Resilience Ratings, the report included components such as the insurance protection gap, socio-economic risk drivers, and speed of recovery after extreme weather events.

It also considered literature on nature-based solutions, resilience to extreme weather events, climate risk at the municipal level, and credit ratings methodology.

Based on these components, Triple-I used the following metrics to evaluate the RWR program’s impact on community resilience:

Triple-I’s analysis also highlighted the advantages of parametric insurance. It said community-based programs can incorporate a combination of parametric insurance and traditional indemnity coverage.

“Unlike indemnity insurance, parametric structures cover risks without the complications of sending adjusters to assess damage after an event,” the report stated. “Instead of paying for damage that has occurred, parametric insurance pays out if certain agreed-upon conditions are met. If coverage is triggered, a payment is made.”

What are your thoughts on this story? Feel free to comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!