Metallica, COVID insurance, and a Taylor Swift song

Metallica, COVID insurance, and a Taylor Swift song | Insurance Business New Zealand

Insurance News

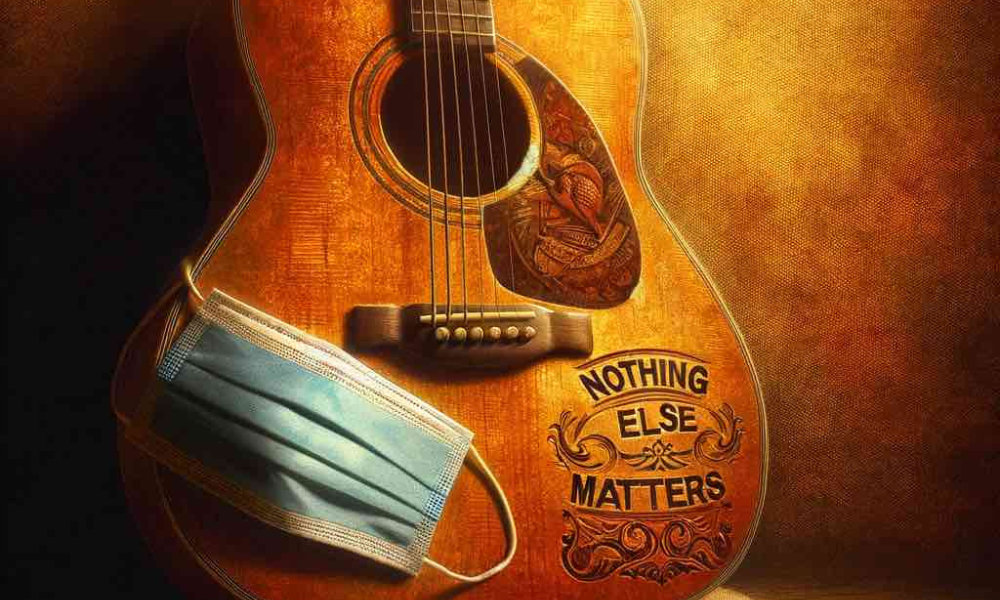

Metallica, COVID insurance, and a Taylor Swift song

What? In one headline? Surely not

Insurance News

By

Kenneth Araullo

A California court judge has channeled her inner “Swiftie” to deliver a judgment on rock legends seeking compensation from COVID.

Citing lyrics from Taylor Swift’s “All Too Well,” the California Court of Appeal has dismissed a lawsuit by iconic rock band Metallica that wanted over $3 million in damages for concerts in South America canceled due to the COVID-19 pandemic.

As per Billboard, the band argued that these losses should be covered by their insurance policy with Lloyd’s of London. However, the court ruled that the policy’s explicit exclusion of losses caused by “communicable diseases” meant the insurer was not liable for the claims.

Metallica contended that the matter warranted a trial, suggesting that factors unrelated to COVID-19 could have been responsible for the event cancelations. Nonetheless, Justice Maria Stratton dismissed this notion as unrealistic, considering the severe impact of COVID-19 at the time.

“To paraphrase Taylor Swift: ‘We were there. We remember it all too well,’” Stratton wrote. “There was no vaccine against COVID-19 in March 2020 and no drugs to treat it.”

The dispute stems from a series of six performances Metallica planned to hold in South America in 2020, which were canceled as countries like Argentina, Chile, and Brazil imposed strict measures to curb the spread of the virus. After the insurer refused to cover the losses claimed by the band in May 2020, citing the disease exclusion clause, Metallica initiated legal action against Lloyd’s in June 2021.

Metallica takes on Lloyd’s

The case is among numerous lawsuits filed across the music industry and beyond by entities seeking to recover financial losses due to the pandemic’s widespread disruptions. A significant portion of these claims have been unsuccessful, often due to specific exclusions for disease-related losses present in many insurance policies or the requirement of “physical damage” for coverage, a criterion hard to meet in pandemic-related shutdowns.

Metallica’s attempt to secure insurance compensation was challenged by Lloyd’s reference to the communicable disease exclusion upon denying the claim. The band had sought to recover expenses, including payroll for crew members, totaling $3,234,569 for the canceled shows.

However, both a Los Angeles judge in December 2022 and subsequently the appellate court found that the policy’s terms unambiguously excluded coverage for the cancelations, which were a direct response to the pandemic’s outbreak.

In rejecting Metallica’s appeal, Justice Stratton noted the significant changes by spring 2022, including vaccine availability, which influenced the lifting of restrictions, emphasizing that the situation during the pandemic’s onset differed markedly from conditions two years later.

The court also refuted the band’s argument that the policy did not explicitly cover COVID-19 cancelations due to the absence of the term “virus,” clarifying that the definition of communicable disease in the policy did not need to specify pathogens to enforce the exclusion.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!