Mental health and disability absence: the impact of employee motivation on return to work

Insurance companies in Canada paid out 75 per cent more in mental health claims in 2021 compared to 2019 (CLHIA), but disability claims with a mental health component have been on the rise for many years. Empire Life collaborated with The Claim Lab to create a tool that would enhance its predictive analytics and approach to the capture of mental health indicators. Empire Life was the first insurance company in Canada to work with the Claim Lab. In this blog, Michelle Cortes, our product manager for long-term disability, interviews Ian Bridgman, Executive Director of the Claim Lab, and Steve Higgins, who oversees the management of disability claims at Empire Life, to discuss how the Claim Lab is helping us manage mental health claims.

Michelle Cortes: Ian, you said recently that the duration of a claim has no correlation with the healing time of the human body. How is that possible?

Ian Bridgman: It may seem like an extraordinary thing to say, but managing a claim can be much more complicated than simply helping someone get over a medical condition. We see it time and time again: two claims, both with a similar diagnosis and both involving individuals who appear similar on the surface—same age, same occupation, same gender, same province. Yet when you start actually managing the claim, they go in very different directions. One might resolve quickly, the other one drags on and on. Why? Why could something like a lower back sprain be so different when you treat it in two individuals?

When you start digging around, you might find that the person who has remained on leave has a painkiller addiction. Maybe they hate their boss, hate their job, and the last thing they want to do is go back to work. Maybe they just got divorced or they have a sick child at home. All these maybes—these other issues—are what can complicate one person’s situation and make it so vastly different from another person’s situation. So when you look at what’s going on medically, as a claim goes on, the actual medical condition plays less and less of a part in that recovery.

The medical profession measures recovery over about a six-month span. If a claim goes from short-term to long-term disability, there may very well be other stuff going on that’s getting in the way of the person’s recovery. Yes, there are certainly serious conditions that require a longer claim period, but for simple conditions like a rotator cuff or a hernia, there’s got to be something else going on.

Michelle Cortes: The Claim Lab developed a questionnaire to measure this. How did you get started on that?

Ian Bridgman: When we started doing claim analytics many years ago, we were using existing historical data to understand how a new claim was going to behave. We initially thought that ‘because other claims behaved a certain way, this new claim would behave the same way.’ And that was really a little flawed because it relied too heavily on that previous experience. We realized that what we wanted was to control the source of data–tease out all the different possibilities of what could be affecting an individual—and so we built the questionnaire to capture all this other stuff that could be going on. In short, our goal was to get a more reliable view of what’s likely to happen to a claimant.

Michelle Cortes: We’ve been using the Claim Lab questionnaire for almost five years now. Can you explain how it works, for our readers?

Ian Bridgman: Empire Life sends the questionnaire before the claim manager and the person off work get together for their first telephone call. In this way, all the information in the questionnaire can be used in that first interview. This is where the claim manager gets to know the claimant, understands what’s going on, and tries to work out the most effective way of helping that person. They’re also trying to find out what issues in that person’s history might change the course of their recovery. Having that all upfront in the questionnaire is really, really valuable. It saves a lot of time and helps make sure that information is not missed.

Michelle Cortes: Does that mean everyone gets the same questionnaire?

Ian Bridgman: Yes—and the questionnaire is also responsive, so if a question is answered in a certain way, we drill down to find out more. The basic questions are the same, but the response profile may be very different from someone who’s got a serious mental health problem or a serious physical ailment. Another example is sleep. Sleep is a really fascinating area, because there’s a huge correlation between sleep deprivation and depression. In fact, it’s one of the deciding factors that determine major depression. And so, the first question is, “How many hours of sleep do you get a night?” If their answer reveals too little or too much sleep, we drill down and start to find out more information.

Michelle Cortes: How do we know the results are reliable?

Ian Bridgman: Well, that’s a really good question. When we were designing the questionnaire, we worked with behavioral psychologists who helped us apply the principles of survey science to structure the questions such that the answers would be reliable. And of course, we analyze claim outcomes—what eventually happens to the claim, how it resolves, duration etc. This lets us look back at the questionnaire that was completed at the start of the process to identify the questions that were most predictive. On all of our projects we receive this outcome data and it’s a vitally important part in closing the loop and validating our scoring algorithms. We know from this analysis that the questionnaire results are reliable. At the same time, it also helped us guide Empire Life on where they were doing well with their claims management processes and where there was opportunity to further refine their processes.

Michelle Cortes: Can you describe how the information in the questionnaire is used?

Ian Bridgman: Fundamentally, what we’re doing is trying to find better ways to design return-to-work plans for people—and having this 360 degree view of individuals helps us do just that. Claim managers do not have unlimited resources, and they want to make sure that they apply the right resources at the right time when they can make the most difference. And that’s the objective: to try and to have a scientific approach to claims management. Claim management is soft and empathetic but, at the same time, it should be based on consistent data and a consistent approach.

Steve Higgins: The response rate to our questionnaires is extremely high—over 80 per cent, which is terrific considering it’s not a mandatory questionnaire. Turnaround time for replies is also fast. It’s currently 1.4 days for employees and 3.5 days for employers, so it really gives us a quick view into a claim before we start working with the individual who is off work. We have found that the questionnaire does a great job of pinpointing psychosocial aspects that aren’t identified in the medical forms we receive when the claim is submitted. I’m talking about systematically exploring and scoring factors such as the individual’s motivation to return to work, financial situation, and domestic situation—social support is helpful; a lack of social support can be a red flag—mental health, and sleep. This data helps us see clearly which claims will resolve with little management from us and which individuals need a great deal of help to overcome barriers to return to work.

We’re also able to quickly identify any disconnect between the employer and the employee on the response rates, which is helpful. For example, if the employer questionnaire comes back and it’s a steady line—it’s all average responses, no concerns—we may decide not to have a telephone interview with the employer and focus all our energy on the employee. As Ian mentioned, our goal is to identify and address barriers. So we use the questionnaire responses to tailor our telephone interviews and help us better understand these barriers so that we can get the person the right type of help at the right time—and reduce the duration of the claim.

Michelle Cortes: Can you give us a real-life example of how this questionnaire has helped?

Steve Higgins: I managed a claim that involved a person who had been injured in a motor vehicle accident. At first, it seemed like this would be a straightforward claim, but the Claim Lab results revealed something unexpected. It turned out that the individual was struggling with long-standing mental health issues. This presented a major barrier to a sustainable return to work. To address these issues, we quickly implemented a variety of disability management strategies, including cognitive behavioral therapy. As you know, cognitive-behavioral therapy (or CBT) is a form of psychological treatment that focuses on changing negative patterns of thinking and behavior in order to improve mental health outcomes. CBT is based on the idea that negative thought patterns can contribute to mental health problems, such as anxiety and depression, and that by changing these patterns, individuals can improve their emotional well-being. CBT has been shown to be effective in treating a wide range of mental health conditions, including anxiety disorders, depression, post-traumatic stress disorder, and obsessive-compulsive disorder. By helping the person address their mental health issues while their body healed, they were able to make a full recovery—body and mind—and return to work in a sustainable way.

Ian Bridgman: That’s a great example of something which we see an awful lot of. This is what we refer to as “the undisclosed mental health issue.” We may think that there is less stigma today, but a lot of people feel very reluctant to talk about their mental health, particularly in a workplace setting. People wonder whether the disability insurance company is going to disclose information to the employer. It does not, but there’s always that underlying concern. More than that, people don’t like talking about the fact that they’re depressed or anxious because they feel it shows weakness. As a society, we still have a way to go in reducing stigma associated with mental health. So the data helps us see where there’s a mental health problem, even when it might be masked or secondary to the rotator cuff or the motor vehicle accident.

Michelle Cortes: Shifting gears a little, can you tell us what new things are you working on?

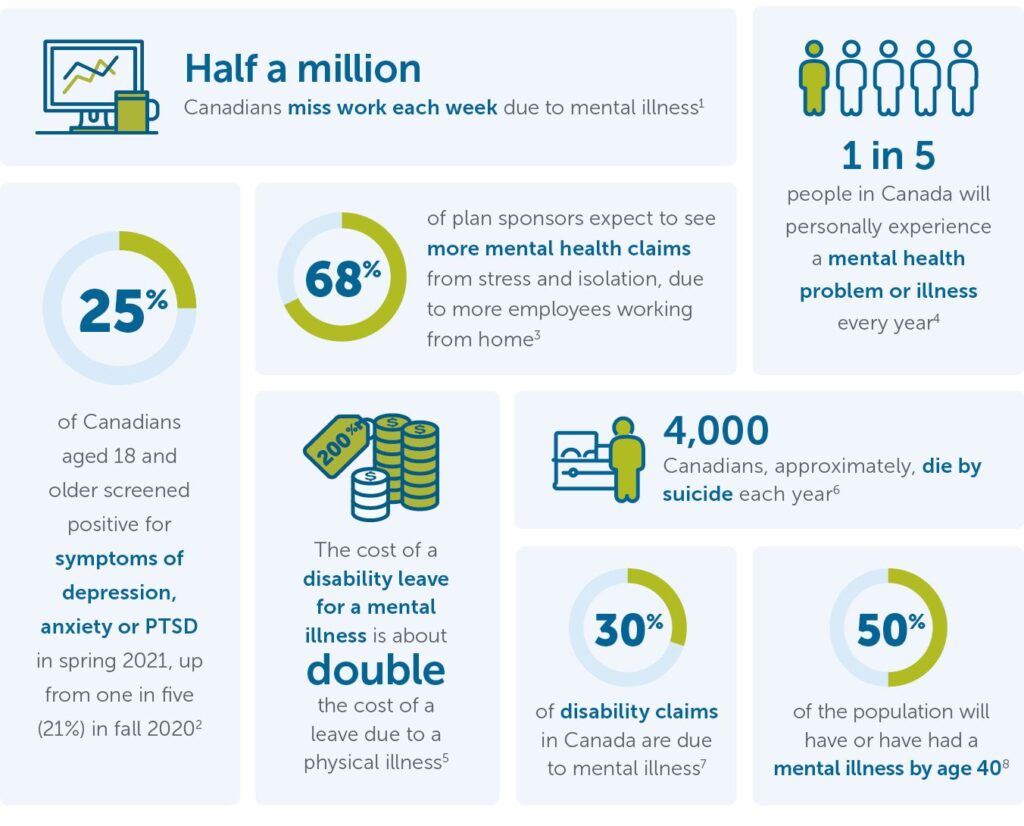

Ian Bridgman: Well, this is always exciting. When we started this project, it was all about psychosocial issues and wider and more consistent sources of data. But now, whether it’s post-pandemic or whatever, we’re getting very swung around to talk about mental health claims. It’s a significant problem in Canada. It’s a significant problem in the US. In Australia. Wherever we look, mental health rises to the top.

And for that reason, we’re about to embark on a major research project on mental health claims. We want to look at how we identify them in the first place. We want to look at the best process to put those claims through, and then look at the outcomes, so we can say what is the optimum way of handling a mental health claim. And it’s not just, “Oh, someone’s depressed, therefore we’ve got to handle it this way.” It may be the fact that there’s also a muscular-skeletal issue going on aside from that. It might be how to best handle depression with a cancer claim. So, it’s understanding the best process to put the claims through, and we need a lot of data for that. This is going to be a big, big project for us.

Michelle Cortes: Recently, the news has been filled with stories about the godfather of A.I., Geoffrey Hinton, leaving Google, with a warning of dangers ahead. How do you see artificial intelligence helping with disability management in the future?

Ian Bridgman: Well, yes, it’s interesting—and I think the whole topic is getting a little bit overhyped. The milk’s bubbling over a bit on AI. I remember many years ago it was about office automation, wasn’t it? And how the office is going to change because everything is going to get automated. And that has happened to a certain extent. But AI is fundamentally just a smarter tool for us to use in data science. There are some very sophisticated AI engines around, but really what we’ve got to focus on, in terms of our area, is getting better data. So, yes, AI might give us smarter tools to analyze the data, but what we’ve got to make sure is that we get the best data possible. So when a case manager looks at the doctor’s report and takes the diagnosis off the form and puts it into their system, if that’s wrong, it’s all for naught. It’s that fundamental. We’ve got to get the data straight, and then we can do great things once we start processing. It’s back to the power of the questionnaire itself.

Michelle Cortes: You just mentioned the spike in mental health claims. What do you see the trend line being for the future?

Ian Bridgman: I wish I could say it was going to all come down again, but I don’t think it is. We’ve got to become more sophisticated about the way we handle these things. We talk about complex claims. Well, I think claims are going to become more and more complex as life becomes more complex. And the strains and stresses of the post-pandemic period, will they decrease? I don’t know. Will it be just something else that gets thrown at us around the corner that further complicates life again? Employers can do more when it comes to building psychologically safe workplaces, and as individuals, we can also be more aware of our own mental health and the techniques that can help us be more stress-hardy.

In terms of how employers can manage their employees better, there needs to be some sort of a sea change there, because there’s interesting data about employers who offer work accommodations to employees and who create the right environment to support the employee coming back into the workplace. So it’s right across the whole of society. We’ve got to improve the way we think about supporting mental health. Steve, what’s your view on that? I’m sure you’re involved in this all the time.

Steve Higgins: I agree and would say that we no longer see any claims that are just one level of a diagnosis. Every claim has some type of mental health component to it. And it’s not specific to any gender, any area of the country. All of them have mental health components. I think that employers would do well to be proactive in identifying mental health issues and having resources available for their staff.

Ian Bridgman: That’s right. It’ll be nice to think that one day someone can talk about having recurring depression or anxiety in the same way that today someone feels OK to talk about having a recurring back sprain. People can’t do that yet. People don’t talk about depression like that. People talk about having a mental breakdown and the reaction is, “Oh my God.” But, yes, it happens, and it can repeat just in the same way as if you’ve got a back issue that you’re grappling with. Employers have a ways to go in creating a more supportive culture—beyond ‘wellness’ initiatives that sometimes feel bolted on.

Michelle Cortes: Are we at an inflection point in the way we structure work? Did COVID do something or accelerate something? I read recently that Microsoft in Japan moved to a four-day work week—not a compressed week—and they realized a 40 per cent gain in productivity. I wonder if this new generation is not buying past generations’ ways of work. Is something happening that you can see?

Ian Bridgman: That’s an interesting one. We quite often see claims coming in with some sort of minor depression, minor anxiety type issue, and that’s the main diagnosis. And then, you start digging around and, really, this person is not really disabled. Remember, depression and anxiety are fundamentally symptoms, not the problem. It’s not the diagnosis. So when you start digging around, you find other stuff that’s the real cause of it. And the most common one is the workplace—that people don’t like the job they’re doing and they think the way out is to raise a disability claim, when what they really should be doing is looking in the mirror and thinking, “Okay, I need a different job. I need a job that suits me better. I need to be happier in my employment.” And I think if people start to realize that, it can only be a good outcome all around, really.

Steve Higgins: The pandemic taught us a lot of good lessons. Here at Empire Life, we didn’t at first think it would be realistic to have our staff work remotely. But when the pandemic hit, I think we realized there are many benefits to remote work—and that we don’t require a traditional office set up to deliver our products and services. Some people really thrive at remote work and prior to the pandemic we never thought it’d be possible. So I would a hundred percent agree. This is a time of change, and the appropriate change is happening.

Michelle Cortes: As we draw to a close, what advice would you give to advisors and plan sponsors about keeping disability costs down?

Ian Bridgman: It’s elements of everything we’ve been talking about. It’s providing a more supportive environment for your employees and not just doing it so you tick the box, but actually doing it with sincerity. Just offering programs to tick the box on their employment packages is no longer good enough. You have to follow through and deliver the goods. I think that’s going to be a very important part in how we move forward. Authentic leadership and a healthy workplace culture; not just programs.

I also think we’ve got to understand more about what’s going on in the workplace. One of the things we’ve been thinking about is actually moving the questionnaire up into the workplace—so it’s not just administered at point of claim. So before Empire Life takes on a new customer, you might ask them to complete a questionnaire. “What’s going on there? What’s the level of workplace stress in that organization? How well’s it actually run?” Because that’s going to make a big impact on their loss ratios. Why shouldn’t you measure that before you take on the risk?

Michelle Cortes: What do you think?

Steve Higgins: It’d be a very useful tool. It’d be terrific. At the same time, going back to employers being proactive in their approaches, I think that having mental health awareness, having EAP programs that help individuals get help addressing mental health, and having early interventions before a claim is initiated will be key for disability management for employers. Prevention is key. We’ve got to move our efforts further upstream.

Michelle Cortes: Thank you to you both.

CAMH. Workplace Mental Health: A Review and Recommendations. 2020.

Statistics Canada. Survey on COVID-19 and Mental Health. 2021.

Benefits Canada. 2021 Benefits Canada Healthcare Survey. 2021.

CAMH. Mental Illness and Addiction: Facts and Statistics.

CAMH Op. Cit.

Government of Canada. Suicide in Canada: Key statistics.

Mental Health Commission of Canada. Workplace Mental Health.

CAMH Op. cit.